- About 64M SUI tokens (2.13% of whole provide) shall be unlocked on the first of February.

- SUI has dropped to an inflection level, which might set off a reversal or prolonged plunge.

The layer 1 contender Sui [SUI] leads the record of token unlocks scheduled within the subsequent seven days.

About 64M tokens (price over $250M) or 2.1% of the circulating provide will hit the market on the first of February, simply days after the Fed’s first rate of interest resolution in 2025.

Supply: Tokenomist.ai

Relying on the broader market sentiment post-Fed steering on the twenty ninth of January, SUI might tank or rally after the token unlock.

SUI lags behind SOL

That stated, since final August, SUI has eclipsed SOL in worth efficiency by 550%. Nonetheless, the run peaked in early January and has shed practically 40% in opposition to SOL up to now two weeks.

Whereas SUI has retreated to a possible inflection level, the unlock occasion and post-Fed sentiment may decide whether or not it can regain floor in opposition to SOL.

Supply: SUI/SOL, TradingView

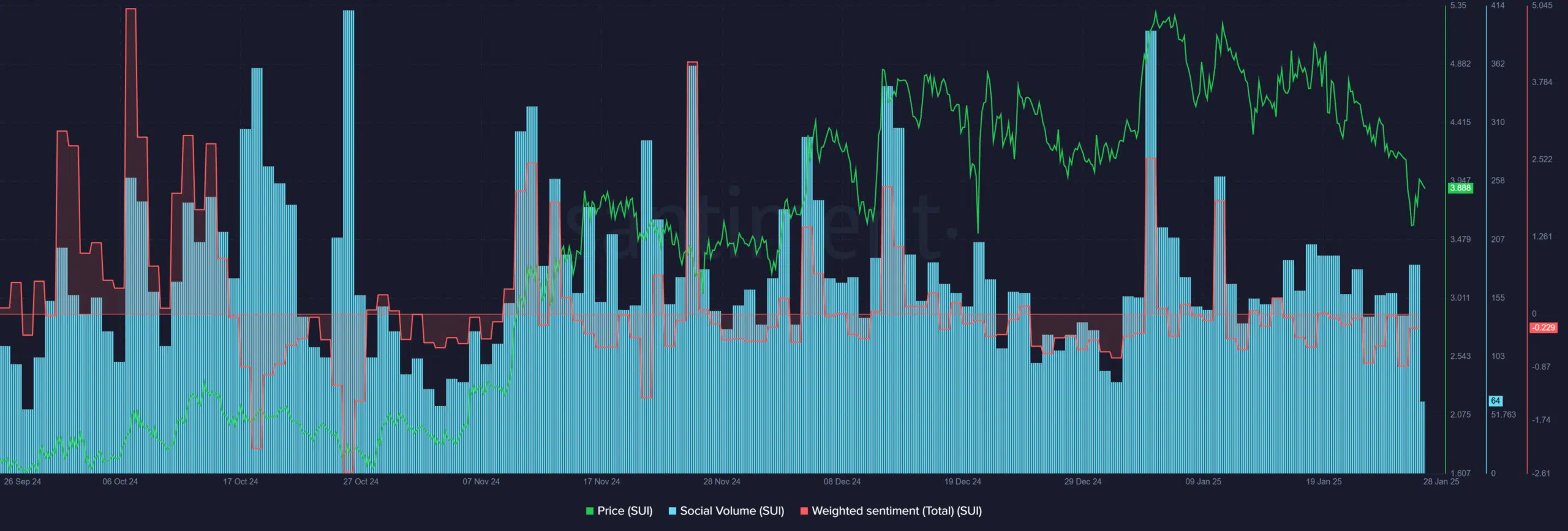

Moreover, sentiment and market curiosity had been beneath par, at the very least as of this writing. The drop in social quantity and detrimental weighted sentiment illustrated this.

For context, a current optimistic spike in social quantity and sentiment noticed SUI high an all-time of $5.3.

Merely put, the present muted social quantity and weak sentiment might cap SUI’s upside potential forward of its unlock.

Supply: Santiment

That stated, the co-founder of the Sui community, Abiodun Adeniyi, teased an SMS transaction function that might permit even these with non-smartphones to ship cash and crypto over the blockchain.

This might be disruptive and drive mass adoption.

Adeniyi stated,

“Coming soon: #Sui will enable transactions through SMS, bringing payments, DeFi, rewards, and more to everyone, everywhere.”

Within the meantime, SUI’s pullback was again to the $3.5 help, a key demand zone since final December.

Ought to the short-term help maintain, SUI might reverse current losses, with the rapid goal of $4.5. Nonetheless, a crack beneath it might lengthen the plunge to $3.0.

Supply: SUI/USDT, TradingView