- The Nakamoto improve will assist enhance transaction velocity.

- Market sentiment, nonetheless, remained bearish on the token.

Bitcoin’s [BTC] layer 2, Stacks [STX], has been making ready for a serious improve for a number of months.

Nonetheless, whereas the L2 was preparing for this improve, the token’s value motion turned bearish. Will this improve fire up sufficient bullish sentiment to push the token as much as $2?

All about Stacks improve

Named for Satoshi Nakamoto, the nameless developer of Bitcoin, the Nakamoto improve will separate Stacks’ block manufacturing schedule from Bitcoin.

The upcoming Stacks improve will probably be pushed on the twenty ninth of October.

As per the official doc,

“The Nakamoto Release is an upcoming hard fork on the Stacks network designed to bring several benefits, chief among them are increased transaction throughput and 100% Bitcoin finality.”

Manufacturing of Stacks blocks would now not be depending on miner elections underneath Nakamoto.

Somewhat, miners generate blocks at a predetermined fee, and the set of PoX Stackers is determined by miner elections to resolve when to modify from one miner to a different.

Will STX cross $2?

Although the blockchain was making ready for a serious improve, its token, STX, didn’t see a lot profit. CoinMarketCap’s knowledge revealed that STX’s value dropped by greater than 5% within the final 24 hours.

At press time, Stacks was buying and selling at $1.84 with a market capitalization of over $2.75 billion. The unhealthy information was that the token’s buying and selling quantity elevated whereas its value dropped, which legitimized the worth drop.

AMBCrypto selected to dig deeper into STX’s present state to search out out whether or not it’s viable to count on the token to the touch $2 within the coming days.

As per our evaluation of Santiment’s knowledge, STX’s Weighted Sentiment dropped considerably final week. This meant that bearish sentiment across the token was rising, hinting at a insecurity amongst traders.

Supply: Santiment

Additionally, as per Coinglass’ knowledge, STX’s Lengthy/Quick Ratio noticed a dip. At any time when the metric drops, it implies that there are extra brief positions out there than lengthy positions, which could be thought-about a bearish signal.

Lastly, Stacks’ Open Curiosity noticed a decline. This indicated that the continued bearish value pattern would possibly change within the coming days.

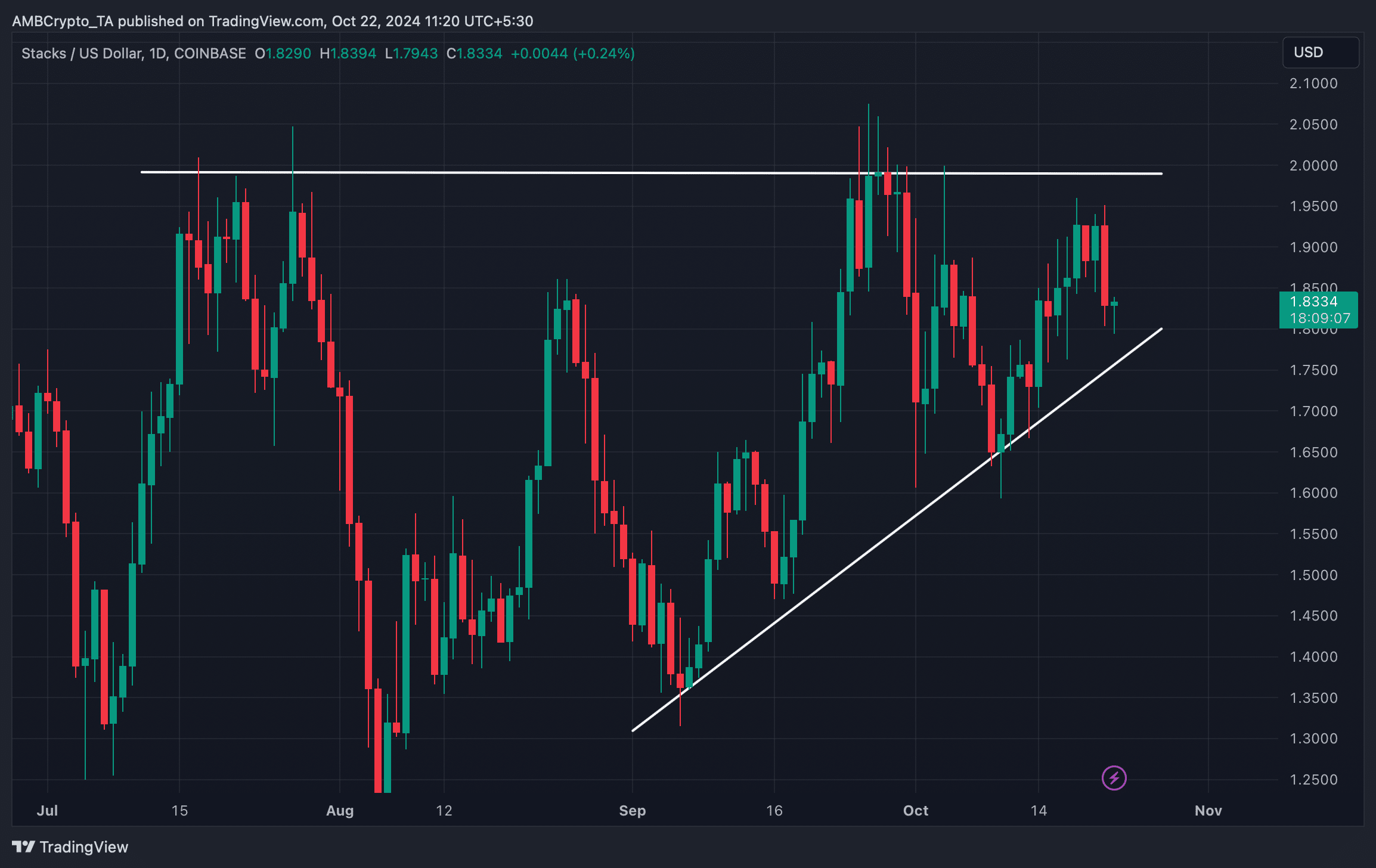

AMBCrypto took a take a look at STX’s every day chart to raised perceive what to anticipate.

Learn Stacks [STX] Worth Prediction 2024-25

As per our evaluation, STX’s value was transferring inside a rising triangle sample. The most recent value decline might have been as a result of the token was consolidating contained in the sample.

A breakout above the rising triangle might push the token properly above $2 within the coming days.

Supply: TradingView