- Constant stablecoin inflows into exchanges are fueling Bitcoin’s worth stability above $96,000.

- Bitcoin’s MVRV ratio at 2.69 and rising open curiosity counsel a bullish pattern with minimal dangers.

Bitcoin’s [BTC] journey towards breaching the $100,000 mark stays intently watched because the cryptocurrency maintains worth stability above $96,000.

Regardless of attaining an all-time excessive (ATH) of $99,645 on twenty second November, Bitcoin has resisted important corrections, buying and selling at $98,083 on the time of writing. This resilience suggests a sturdy basis, with market members awaiting its subsequent transfer.

One key statement behind this worth stability has been the regular influx of stablecoins into exchanges. In response to SignalQuant, a CryptoQuant analyst, the pattern of stablecoin web inflows has boosted Bitcoin’s capacity to maintain increased lows.

SignalQuant famous,

“This has allowed the price to continue to make higher lows. Its price will break the $100,000 mark at any moment without a significant correction based on the net inflows trend.”

Supply: CryptoQuant

In response to the analyst, this regular influx has minimized the potential for main sell-offs, reinforcing the bullish momentum seen in Bitcoin’s latest efficiency.

Market fundamentals and Bitcoin’s future path

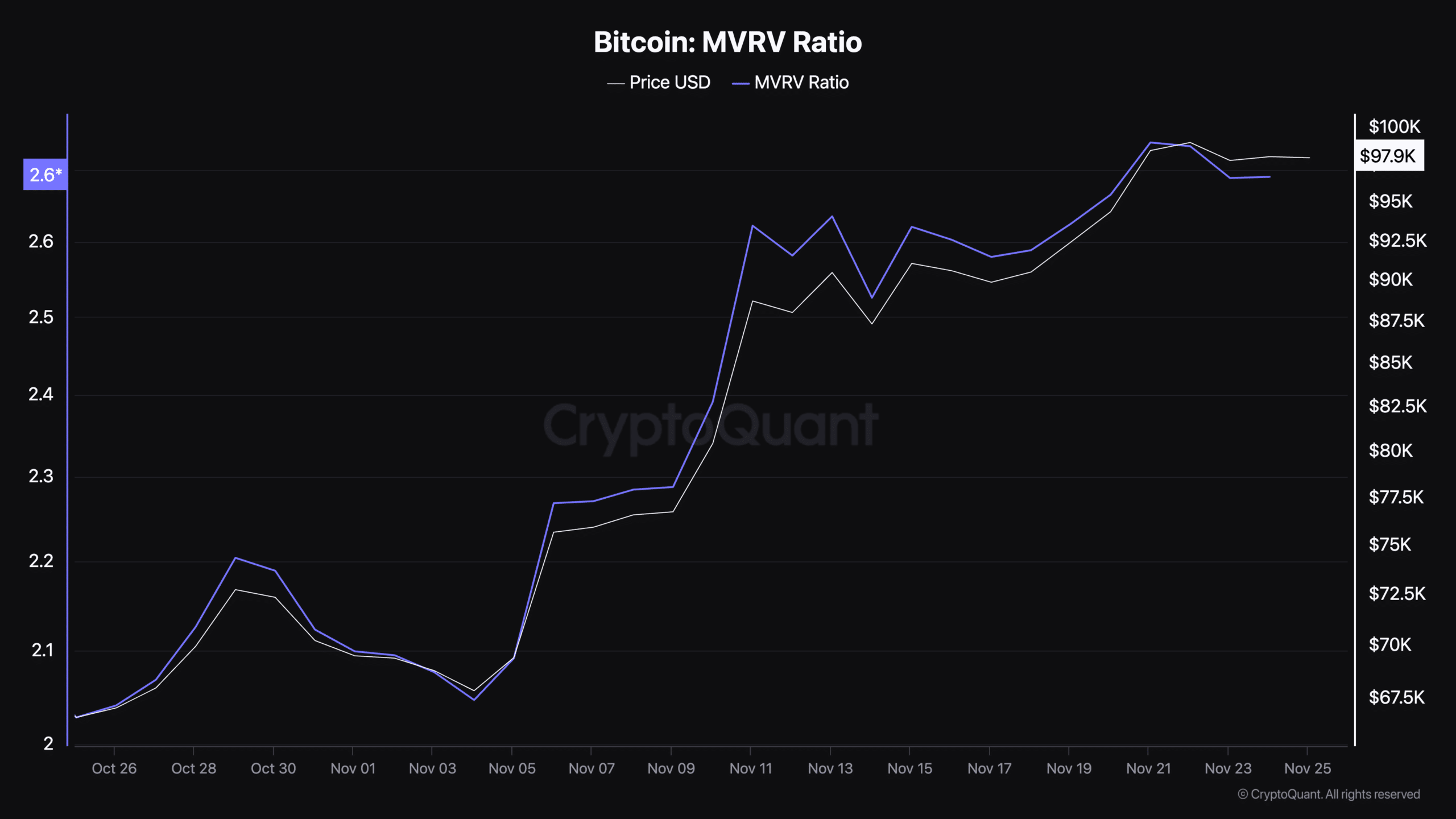

To raised perceive BTC’s potential trajectory, it’s essential to research key market fundamentals. The MVRV ratio, a preferred on-chain metric, offers beneficial insights.

The MVRV ratio is calculated by dividing Bitcoin’s market cap by its realized cap, reflecting whether or not the asset is overvalued or undervalued.

Supply: CryptoQuant

Traditionally, an MVRV ratio beneath 1 alerts a market backside, whereas values above 3.7 counsel a possible market peak. With Bitcoin’s MVRV ratio at the moment at 2.69, the metric signifies that the market is leaning towards optimism however stays beneath vital overvaluation ranges.

This implies room for additional worth development whereas sustaining a cautious stance on overextension.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

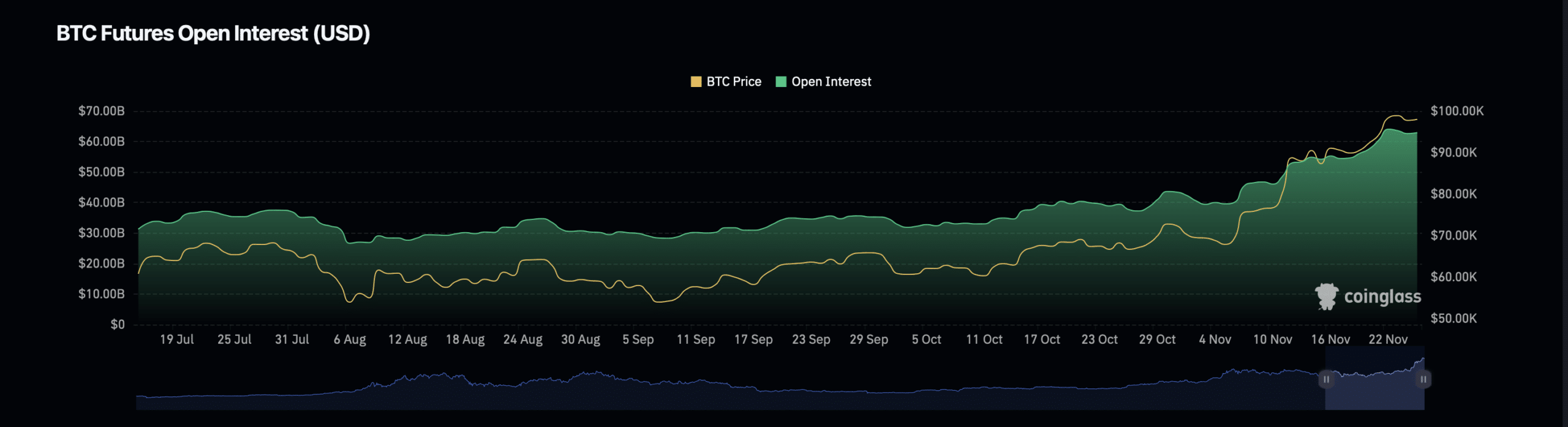

Along with the MVRV ratio, Bitcoin’s open curiosity and quantity metrics present a snapshot of dealer exercise. Information from Coinglass reveals a 0.86% enhance in Bitcoin’s open curiosity, bringing it to $63.16 billion.

Supply: Coinglass

Equally, the open curiosity quantity has surged by 47.13%, reaching $81.33 billion. These figures spotlight a robust market urge for food for Bitcoin, with merchants positioning themselves in anticipation of additional worth motion.