- Analyst believes altcoins would possibly proceed to underperform in opposition to Bitcoin because the market deviates from earlier patterns

- Solana is likely to be the explanation why the altcoin market cap has not shaped decrease lows

Altcoins have underperformed in opposition to Bitcoin (BTC) this yr with many of the high ten altcoins, in addition to Binance Coin (BNB) and Toncoin (TON), failing to reclaim their earlier highs.

The truth is, in line with Andrew Kang, Accomplice at Mechanism Capital, the market has not been following its earlier patterns. Historically, at any time when Bitcoin kinds a brand new all-time excessive, altcoins comply with go well with. Nevertheless, this didn’t occur for many altcoins earlier this yr when BTC hit an ATH of $73k on the charts.

“Altcoin market caps (and ETH) should be making new highs in new cycles. It’s increasingly clear that this is not the case… Even if Bitcoin goes to new highs this doesn’t mean altcoins will keep up.”

A take a look at knowledge from Blockchain Heart revealed that solely 11 out of the highest 50 altcoins outperformed Bitcoin during the last 90 days.

Supply: Blockchain Heart

ETH kinds yearly lows in opposition to Bitcoin

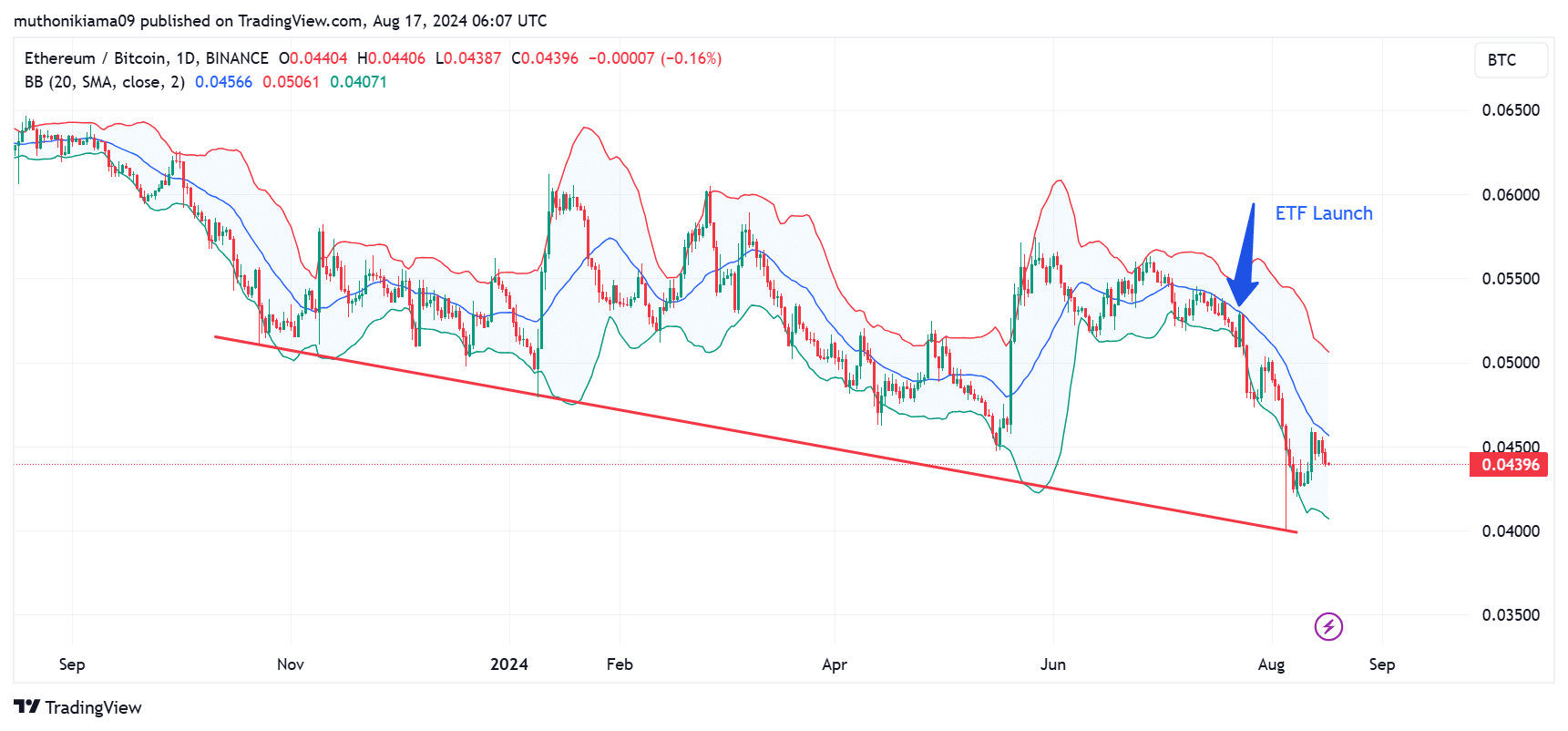

Kang’s evaluation comes on the again of Ethereum forming a yearly low in opposition to Bitcoin on 9 August. The ETH/BTC every day chart additionally revealed that the biggest altcoin has been forming decrease lows in opposition to BTC since October final yr.

Furthermore, since spot Ether exchange-traded funds (ETFs) began buying and selling in July, ETH has didn’t bounce from the center Bollinger band (20-day Easy Transferring Common). That is simply one other signal of underperformance.

Supply: ETH/BTC, TradingView

In response to Kang although, altcoins will doubtless discover a backside in 2025, earlier than making a bullish rebound.

Solana is the security internet?

That’s not all although as Kang believes that Solana (SOL) is the only real motive why altcoins’ market cap, at the moment at round $1 trillion, has not shaped a decrease low on the charts.

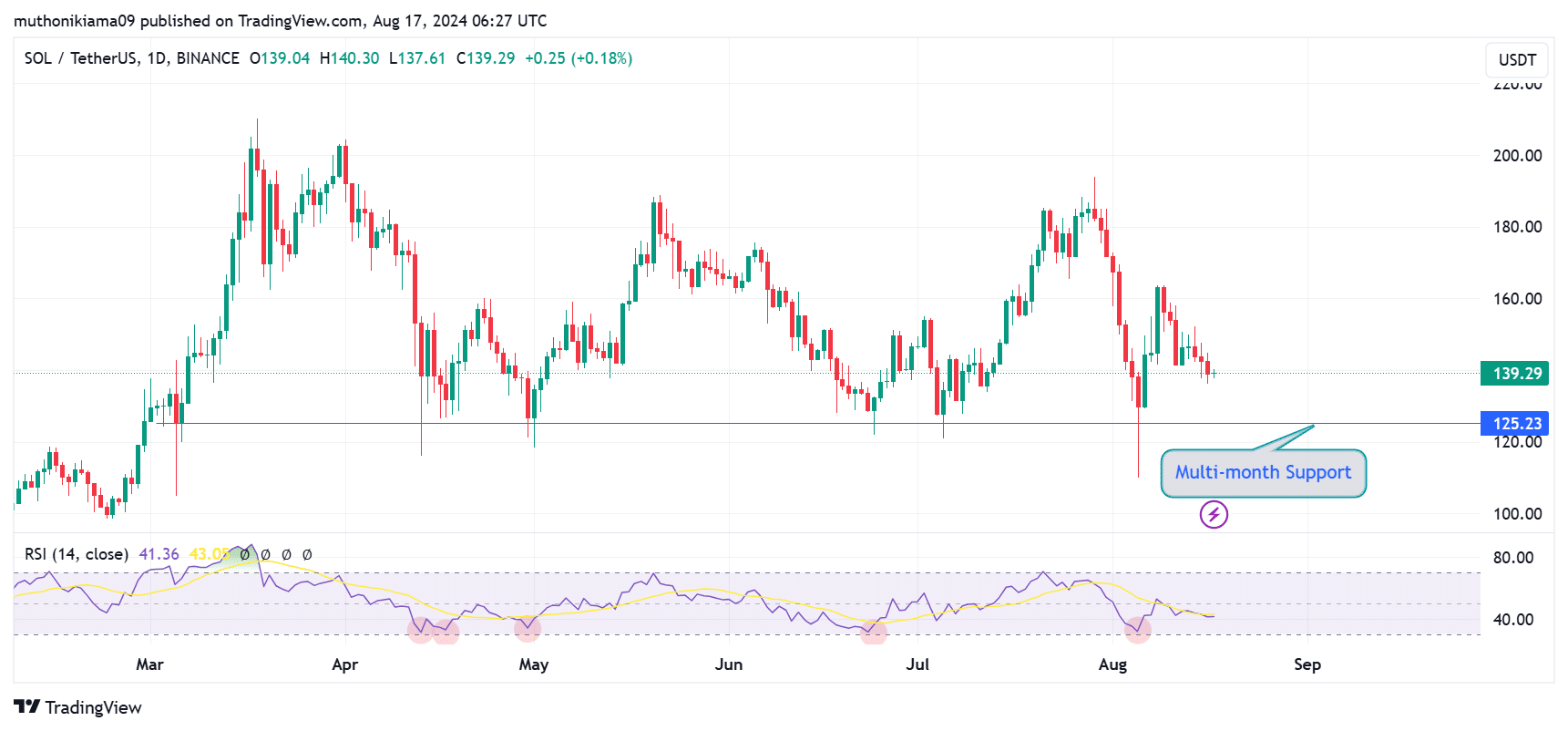

The truth is, Solana has defended a multi-month help degree at $125 since March 2024.

Supply: SOL/USDT, TradingView

The $125 psychological degree is a vital worth to look at because it confirmed that regardless of downward stress, SOL has established a steady base stopping steep declines.

The Relative Energy Index (RSI) has additionally sustained ranges above 30 since March – An indication that SOL has not been oversold for an prolonged interval.

This development indicated that consumers have prevented vital draw back threat. This robust help for SOL helps Kang’s thesis that Solana’s worth is much less prone to kind a decrease low.

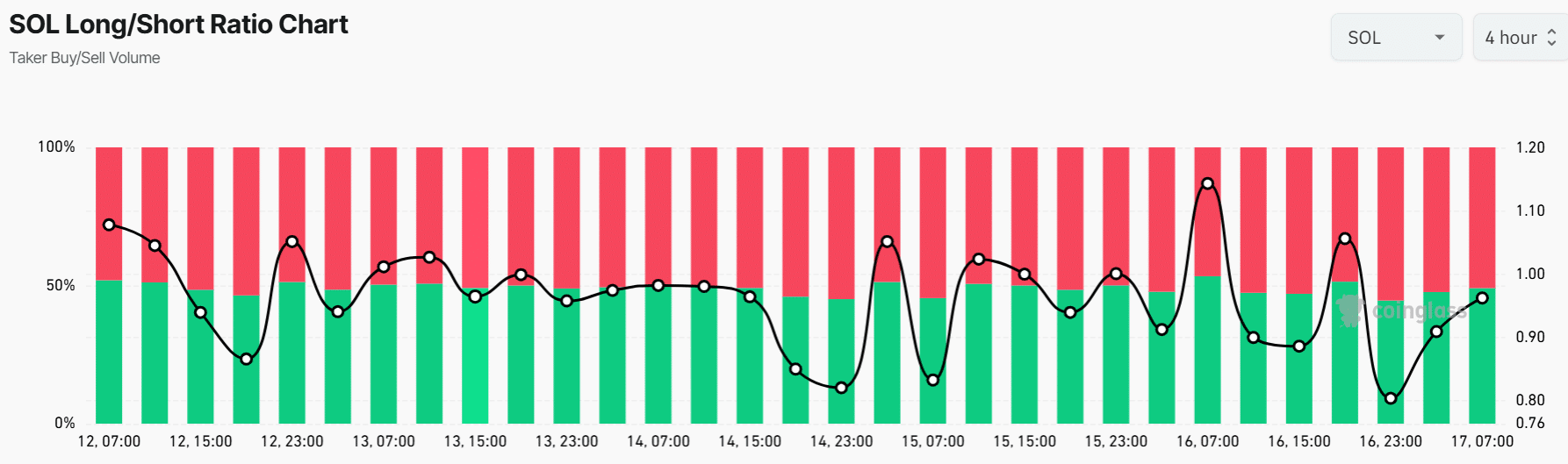

Moreover, the Futures market demonstrated an almost balanced sentiment round SOL by merchants. The lengthy/quick ratio for SOL, at press time, was at 0.97, indicating quick positions are barely larger than lengthy positions.

Supply: Coinglass

However, Solana’s energy has not been sufficient to help the altcoin market. On the time of writing, the Altcoin Season Index had a price of twenty-two, suggesting that the market is favoring Bitcoin over altcoins proper now.