Picture supply: Getty Photos

Some say the FTSE 100 lacks good development inventory alternatives, however a look on the Rolls-Royce (LSE:RR.) share worth chart tells a distinct story. Returns for traders within the aerospace and defence pioneer over current years have been distinctive.

Underneath Tufan Erginbilgiç’s management, the jet engine maker has roared into motion with a exceptional turnaround from its pandemic woes. As the corporate upgrades its mid-term outlook, Rolls-Royce shares proceed to smash by new highs in 2025. Consequently, I’m a really completely happy shareholder.

Let’s discover the explanations underpinning the stellar efficiency and the place the share worth may go subsequent.

Beating market expectations

Rolls-Royce’s FY23 outcomes have been distinctive, however its FY24 earnings is likely to be even higher. Working revenue soared 55% to hit £2.5bn, and free money circulate practically doubled to £2.4bn. The stability sheet has additionally totally recovered. The agency now enjoys a web money place of £0.5bn in comparison with a web debt burden of £2bn the 12 months earlier than.

Moreover, shareholders have been handled to a shock £1bn share buyback plan for 2025 and the resumption of dividend funds for the primary time since Covid-19 nearly wrecked the enterprise. Taking a look at these numbers collectively, it’s little surprise the Rolls-Royce share worth is booming.

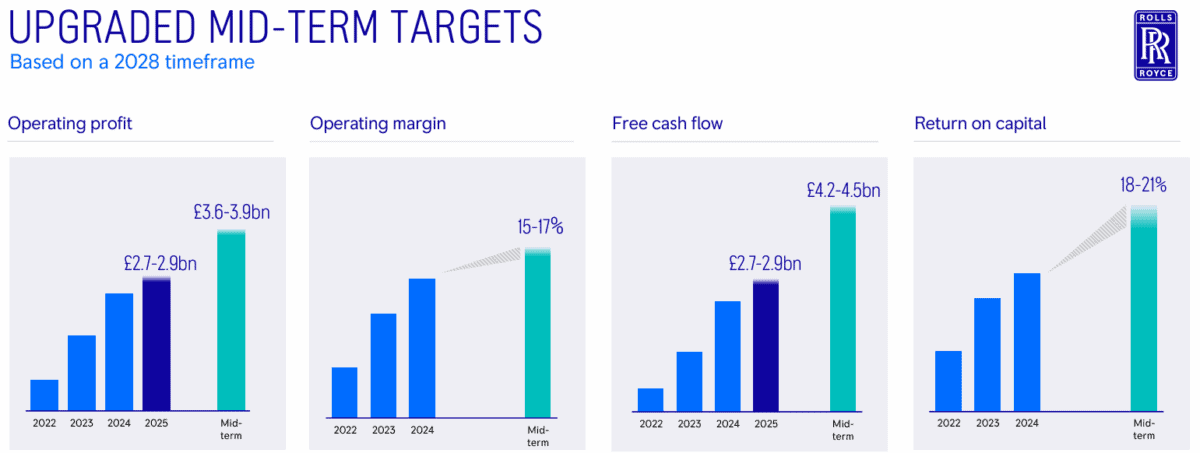

Having achieved a few of its 2027 targets two years upfront, the board has additionally raised its ambitions throughout a wide range of key metrics.

Can the expansion proceed?

A surging share worth has pushed Rolls-Royce’s valuation greater. The blue-chip inventory’s at present buying and selling at a price-to-earnings (P/E) ratio of 26.5 and a ahead P/E of 36.8. These aren’t low cost multiples, which raises questions in regards to the future development trajectory.

Nevertheless, the corporate’s ahead steerage suggests these issues is likely to be unfounded. Giant engine flying hours are anticipated to achieve 115% of 2019 ranges this 12 months, pushed by sturdy worldwide journey demand. That’s essential contemplating over 50% of the agency’s revenues comes from the civil aerospace division.

The outlook for the defence arm is equally rosy. Prime Minister Sir Keir Starmer’s dedicated to boosting UK defence spending to 2.5% of GDP by 2027. As one of many authorities’s most well-liked army contractors, this bodes nicely for Rolls-Royce shares.

Hopefully, we’ll see additional excellent news following the agency’s largest ever MoD contract win earlier this 12 months. The eight-year deal is valued at £9bn. Rolls-Royce will present design, manufacturing, and assist companies for nuclear reactors to energy Britain’s submarine fleet.

Technological advances for the facility methods unit present additional encouragement. Rolls-Royce has established itself as a market chief in small modular nuclear reactors. Potential development alternatives for functions in house missions and energy-hungry information centres add one other string to the corporate’s bow.

These causes for optimism must be balanced towards provide chain disruption for Trent 1000 engine components, which may forestall the enterprise from attaining its objectives. As well as, current technical faults for the agency’s engines elevate security issues and reputational dangers.

What I’m doing

Additional development within the Rolls-Royce share worth isn’t assured, however I see few causes to promote my shares simply but. I’ve loved some spectacular good points from my funding so far, and I’m hopeful there can be extra to come back sooner or later. For traders who don’t personal the inventory, I feel it deserves critical consideration.