Picture supply: Getty Photos

Rolls-Royce‘s (LSE:RR.) earnings have rocketed since the depths of the pandemic, driving the value of its shares skywards. At 526p, the FTSE 100 engineer’s share worth has grown nearly 290% previously three years alone.

If Metropolis forecasts are appropriate, income are tipped to proceed rising strongly over the following few years no less than, too. This might lay the foundations for additional vital share worth progress.

The massive query, in fact, is how reasonable these income estimates are. It’s commonplace for company earnings to considerably beat or fall wanting what analysts are predicting.

So what are the expansion prospects for the Footsie agency? And may I purchase Rolls-Royce shares for my portfolio?

The case for

Rolls’s income restoration has been pushed by the post-pandemic rebound within the civil aviation sector. Pent-up demand for journey has continued to gas aircraft ticket gross sales lengthy after the top of Covid-19-related fleet groundings.

That is vital given the agency’s function as one of many world’s greatest aviation engine suppliers. The corporate makes round half of its revenues from actions like servicing the ability models on massive planes.

However Rolls’ rebound can also be thanks partly to energy elsewhere. Whereas Civil Aerospace gross sales rose 27% within the first half of 2024, Defence revenues improved 18%, reflecting energy at its air fight and submarines segments.

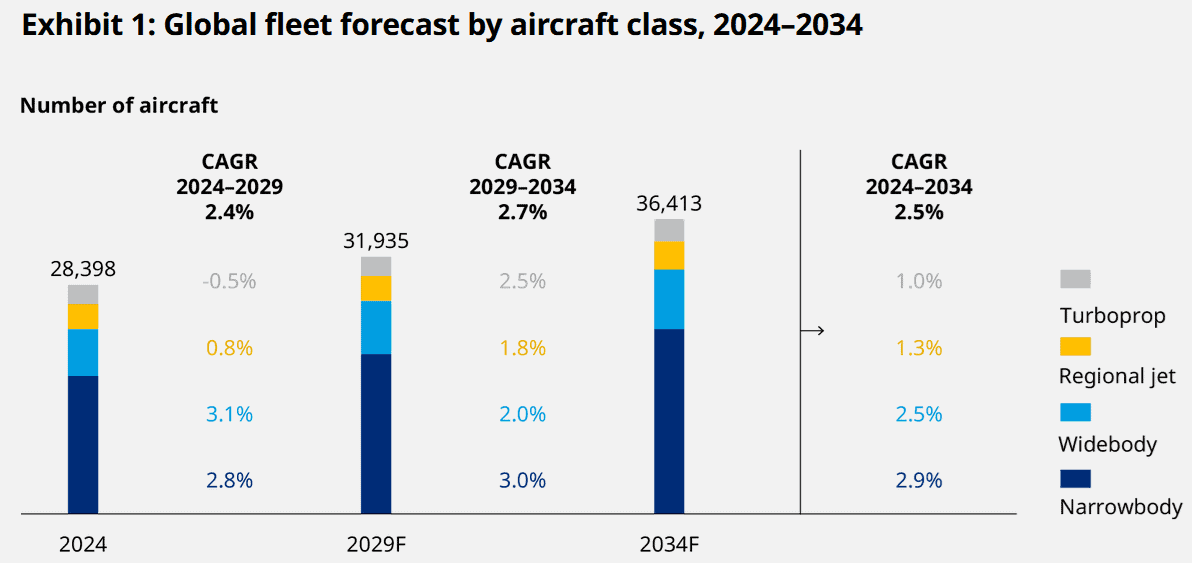

Encouragingly, the outlook for each civil and defence markets stays sturdy over the close to time period and past. Right here you’ll be able to see forecasts for civilian plane numbers as the worldwide tourism increase continues.

Earnings may additionally balloon as Rolls’s profitable transformation programme rolls on. Margins have improved significantly (they hit 18.6% within the first half) because of measures like job reductions and contract renegotiations.

The case in opposition to

Having mentioned that, there are threats to Rolls-Royce and its shares within the quick time period and past.

One is the specter of declining or stagnating gross sales if the worldwide financial system weakens. Given a comparatively regular raft of weak knowledge coming from the US, this situation can’t be discounted.

There’s additionally the issue of ongoing provide chain points within the aerospace trade. Rolls warned of a “challenging supply chain environment” in its half-year outcomes, and cautioned that this might final for as much as 24 months.

I’m additionally involved a few main {hardware} fault that would end in misplaced gross sales and huge monetary penalties. In latest weeks, Cathay Pacific has grounded various its plane because of a gas nozzle challenge contained in the Trent XWB-97 engine.

The decision

There are definitely causes to stay optimistic about Rolls-Royce and its share worth outlook. However there are additionally appreciable risks that would blow the engine builder off beam.

With a ahead P/E ratio of practically 30 occasions, I feel that — all issues thought of — a lot of the excellent news is baked into the corporate’s share worth. In actual fact, I concern this lofty valuation may trigger its shares to plummet if information movement across the enterprise begins to weaken.

Because of this, regardless of its vibrant progress forecasts, I’d slightly purchase different FTSE 100 shares at this time.