Picture supply: Getty Pictures

I’m hoping to have money in my pocket to put money into the approaching days. So immediately, I’m constructing a listing of one of the best low-cost FTSE 250 shares so as to add to my portfolio.

Right here’s one among my favourites.

Going for gold

Buyers have been piling into gold shares in 2024 to capitalise on the booming valuable metallic value. African mining enterprise Centamin (LSE:CEY), consequently, has risen a formidable 29% within the 12 months thus far.

Gold’s moved from report excessive to report excessive, reaching an all-time peak above $2,500 per ounce in current weeks. Some analysts are tipping bullion costs to maintain going too, as central banks start slicing rates of interest, and worries over conflicts within the Center East and Jap Europe mount.

All which means that the likes of Centamin may stay engaging shares within the close to time period. Nonetheless, we’d be fallacious to assume that getting publicity to gold is simply a shrewd short-term play.

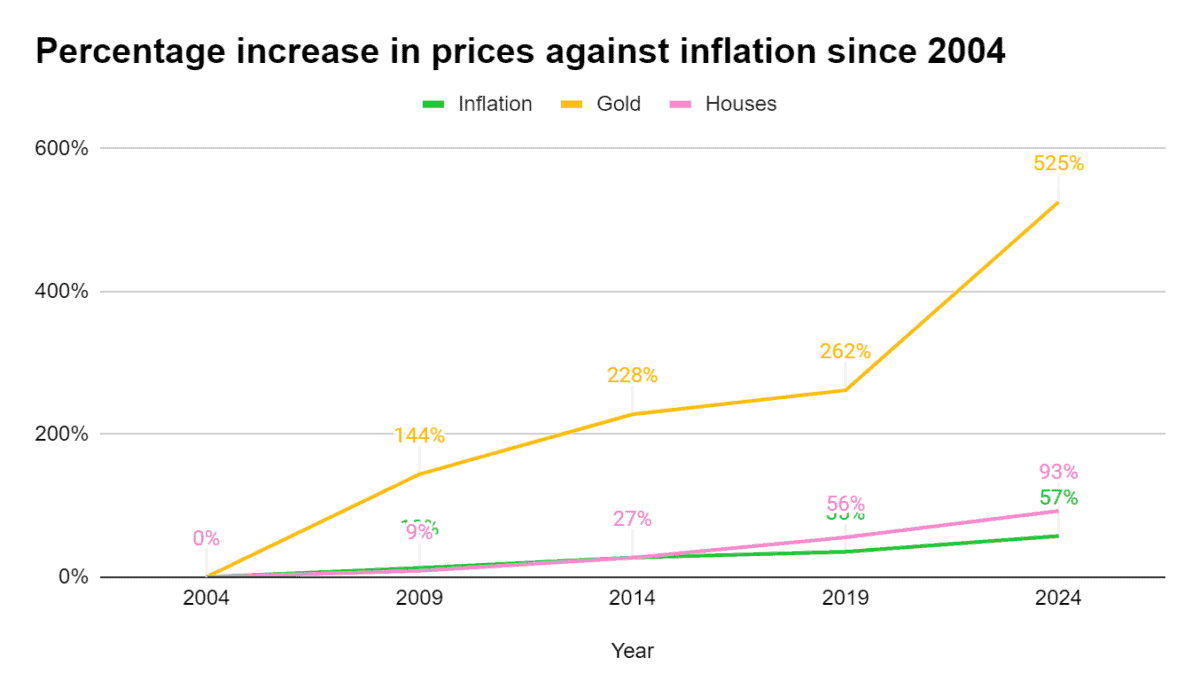

Firstly, as we are able to see above, the gold value has soared greater than 500% in worth over the previous 20 years. It has, as an example, elevated much more sharply than UK shopper value inflation (CPI) and the common British home value.

It’s additionally traditionally been a good suggestion for traders to have publicity to gold to handle threat. Protected-haven property like this have a tendency to carry out strongly throughout financial downturns, offsetting weak point elsewhere in a dealer’s portfolio and due to this fact offering a smoother return over time.

Up 1,600%!

However what are some great benefits of shopping for gold shares like Centamin over bodily metallic, or a metallic backed exchange-traded fund (ETF)?

In any case, shopping for gold or a gold-tracking monetary instrument protects traders from the perils of commodities mining.

Centamin may encounter issues at its Sukari or Doropo tasks — on the exploration, mine growth or manufacturing levels — that affect revenues and drive up prices.

Nonetheless, if the mining inventory performs nicely operationally, an investor has an opportunity to make higher returns than by merely aiming to trace the bullion value.

That is the place Centamin’s actually impressed. Whereas the gold value has risen 525% since 2004, this FTSE 250 inventory — which operates the large Sukari mine in Egypt — has recorded a near-1,600% share value achieve over that point.

All-round worth

On high of this, traders can obtain an revenue in the event that they purchase a dividend-paying mining inventory. This may present them with a constructive return even when the gold value fails to rise and even drops.

Centamin’s been a dependable dividend payer for the reason that early 2010s. And, pleasingly, Metropolis analysts count on the miner to boost dividends over the subsequent two years, helped by the rising gold value and manufacturing will increase at Sukari.

This implies dividend yields for 2024 and 2025 stand at a wholesome 3.7% and 4.8% respectively.

Regardless of its share value explosion, Centamin shares nonetheless look dust low-cost on paper. On high of these market-beating dividend yields, the commodities big additionally trades on a price-to-earnings (P/E) ratio of 9.3 occasions.

All issues thought-about, I feel it’s an distinctive inventory to think about shopping for proper now.