- Bitcoin’s volatility hit a 3-month excessive on the charts

- Shopping for stress on the coin elevated, hinting at a value hike quickly

As Election Day in america attracts nearer, a number of sectors have responded otherwise. And, crypto wasn’t insulated from all of it both.

The truth is, owing to the identical, Bitcoin’s [BTC] value volatility hit a 3-month excessive. Therefore, the query – Will this have a broader impression on the crypto market?

U.S elections affecting crypto?

The crypto market’s volatility began to rise forward of the U.S election end result date. AMBCrypto discovered that the general crypto market’s volatility shot up and hit 66.7, on the time of writing. As anticipated, Bitcoin led this altering development, with BTC’s volatility touching a 3-month-high.

Right here, the attention-grabbing half was {that a} sample appeared on the volatility chart. To be exact, the sample appeared in July and since then, the volatility chart has been consolidating inside it.

On the time of writing, BTC’s volatility was testing the resistance of the sample because it had a price of 63.72. If the chart jumps above the resistance, then traders would possibly see extra volatility put up the election outcomes.

Supply: TradingView

Other than this, AMBCrypto additionally discovered that liquidations within the crypto market rose.

The excellent news was that within the case of Bitcoin, most of this liquidations got here from lengthy positions – A bullish signal. This was the case as extra lengthy positions hinted at better bullish sentiment throughout the market.

Supply: Cryptometer

Will BTC’s rising volatility push it up?

Since BTC’s volatility has been on the rise, AMBCrypto checked the king coin’s on-chain information to search out out whether or not the result of this growth will earn traders revenue or push them into loss. Our evaluation of CryptoQuant’s information revealed that BTC’s alternate reserves have been dropping, which means that purchasing stress on the coin was excessive.

A hike in shopping for stress usually interprets into value hikes. The truth is, over the past 24 hours alone, BTC witnessed a marginal value hike and was buying and selling at $68.75k.

Nonetheless, not all the things was working within the king coin’s favor. BTC’s aSORP revealed that extra traders have been promoting at a revenue. In the midst of a bull market, it might probably point out a market high.

Moreover, amidst the continuing buzz across the U.S elections, traders usually are not contemplating shopping for BTC, with the identical evidenced by the crimson Coinbase premium.

Supply: CryptoQuant

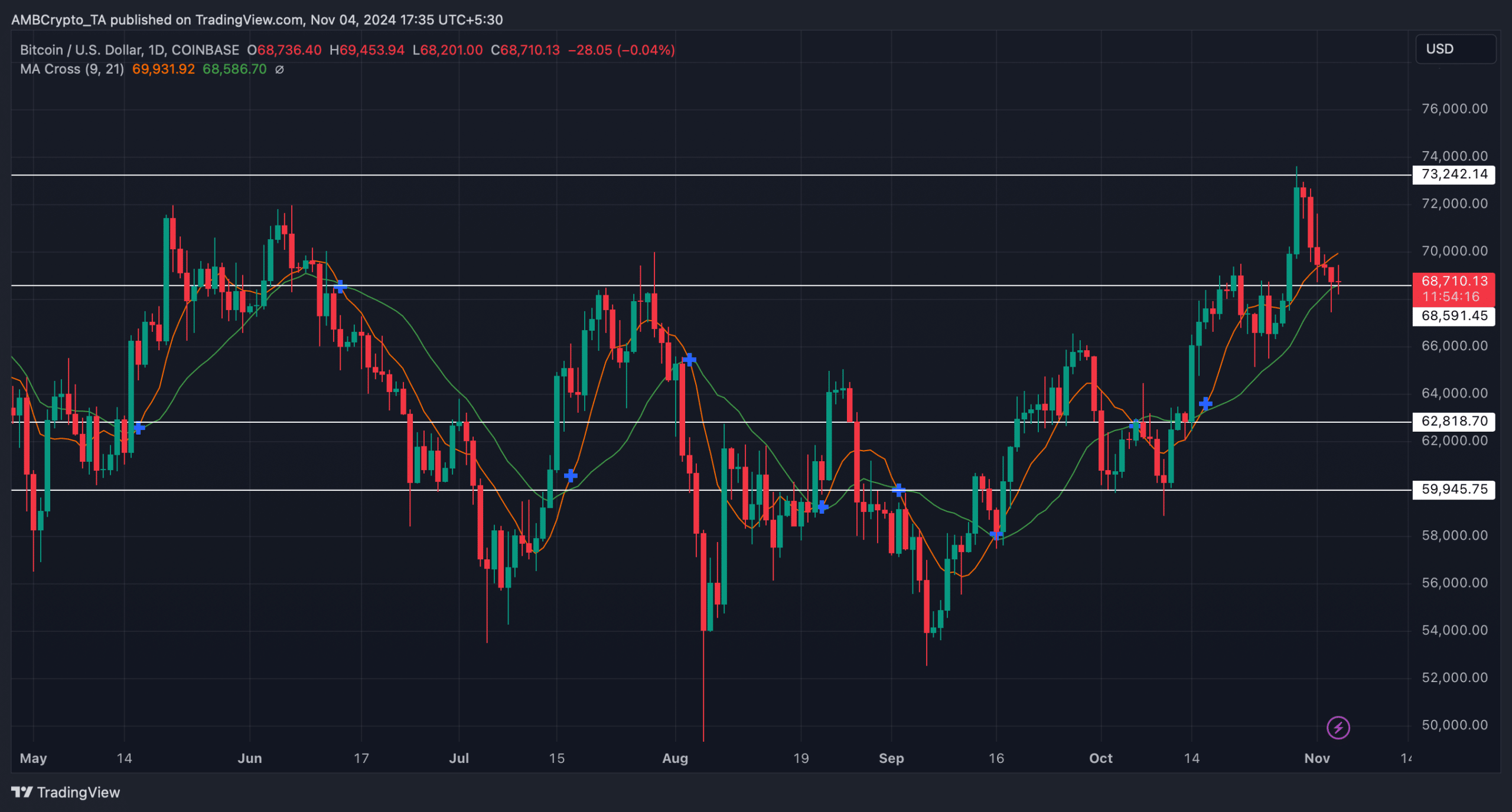

Lastly, we checked BTC’s day by day chart to raised perceive what to anticipate. As per our evaluation, BTC appeared to be testing a help degree.

Learn Bitcoin (BTC) Worth Prediction 2024-25

The technical indicator MA Cross urged that the bulls had been main, indicating a profitable check. Due to this fact, if BTC’s volatility will increase much more, its value would possibly transfer in direction of $73k once more.

Supply: TradingView