Picture supply: Getty Photographs

All of us love an enormous dividend yield. However many traders make the error of attaching an excessive amount of significance to this when selecting which passive earnings shares to purchase.

Excessive yields can generally be a crimson flag, indicating that the corporate’s inventory worth has dropped attributable to underlying points.

Choosing dividend shares

Moreover, whereas giant yields can recommend huge dividend earnings as we speak, it’s vital to seek out corporations that improve dividends over the long run. This normally signifies a secure and rising enterprise, and can assist traders construct their wealth forward of inflation over a protracted interval.

It’s additionally vital to have a look at a inventory’s dividend payout ratio. An organization that distributes most of its earnings as dividends could have little capital left over for reinvestment to develop, and subsequently to pay a sustainable dividend additional down the road.

With all this in thoughts, which FTSE 100 shares do I believe traders ought to take into account for a second earnings? Right here is one in every of my favourites.

A FTSE 100 star

Bunzl (LSE:BNZL) is brilliantly boring. It makes all the important merchandise that make the world go spherical, from meals packaging and medical gloves, to cleansing merchandise and security helmets.

The enterprise sells into a number of sectors, too, like healthcare, retail, foodservice, and cleansing and upkeep. And whereas it sources simply over half (54%) of revenues from North America, it has important operations throughout the globe.

These qualities are what makes it such a superb dividend inventory. Massively various operations and appreciable gross sales to non-cyclical industries imply earnings stay secure in any respect factors of the financial cycle.

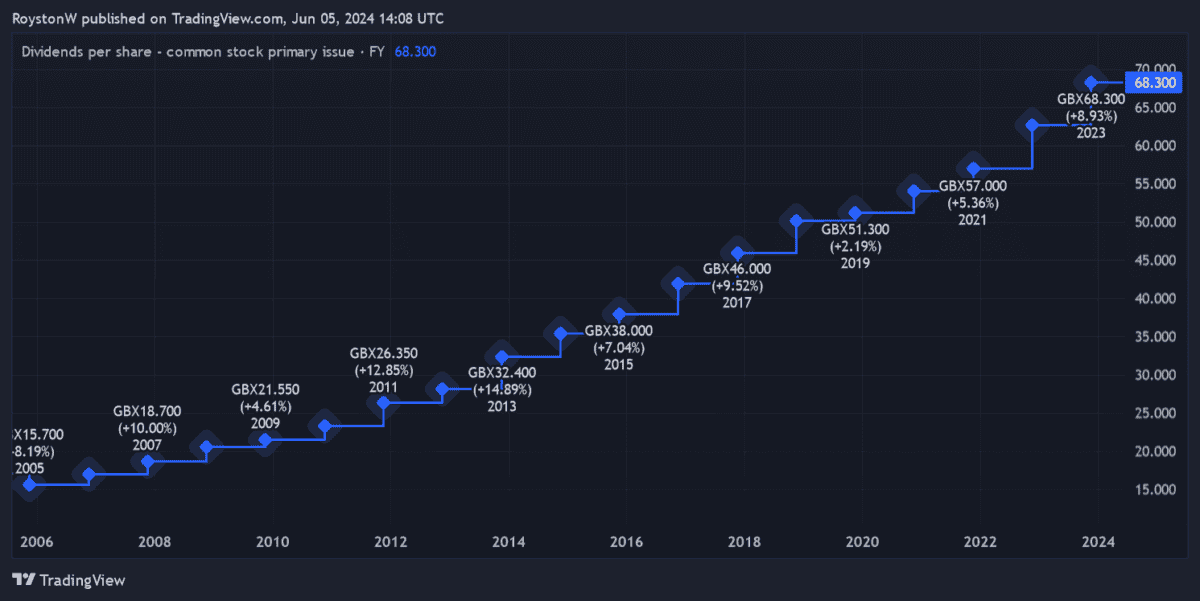

This in flip has led it to lift annual payouts for 31 straight years. A snapshot of its terrific payout report might be seen under.

With a payout ratio of round 40%, Bunzl is ready to steadily elevate dividends whereas additionally investing closely to develop. The enhance this has given to its long-running acquisition-based development technique — and by extension, to earnings — has additionally pushed Bunzl’s share worth 539% increased over the previous twenty years.

Extra payout development

Encouragingly for traders, Metropolis analysts anticipate dividends to maintain rising by way of to 2026, too, as proven within the desk under.

| 12 months | Whole dividend per share | Ahead dividend yield |

|---|---|---|

| 2023 | 68.3p | – |

| 2024 | 72p (f) | 2.4% |

| 2025 | 76p (f) | 2.6% |

| 2026 | 79.8p (f) | 2.7% |

Based mostly on earnings, Bunzl appears to be like in good condition to fulfill these forecasts too. Predicted payouts for the following three years are lined between 2.5 occasions and a couple of.6 occasions by anticipated earnings.

A reminder that any studying above two occasions offers a large margin in case earnings disappoint.

After all there’s extra to contemplate than simply dividends when shopping for shares. A sinking share worth can greater than offset the good thing about a steadily rising dividend to an investor’s wealth.

Within the case of Bunzl, a sudden spike in prices may hamper future efficiency. So may a scarcity of enticing acquisition targets. However on stability, I believe the potential advantages of proudly owning its shares outweigh these dangers.