- Bitcoin addresses with some BTC steadiness continued to develop, as patrons took benefit of the dips.

- Assessing the danger of Bitcoin’s worth doubtlessly dipping beneath key ranges.

Two main Bitcoin [BTC] narratives have been dominant for the previous couple of months.

One is the prospect of a significant rally, and the opposite is the potential of Bitcoin’s rally being cancelled and worth doubtlessly falling beneath $50,000.

The 2 Bitcoin prospects have supplied an opportunity for whales and establishments to benefit from emotionally charged worth swings, At the least this has been the case within the final 5 months.

Bitcoin dipped beneath $50,000 as soon as courtesy of a significant panic promoting occasion in August.

The promote stress incident was adopted by speedy capitalization as merchants moved in to purchase at a reduction. The newest incident of downward stress final week noticed the bears failing to push beneath $52,000.

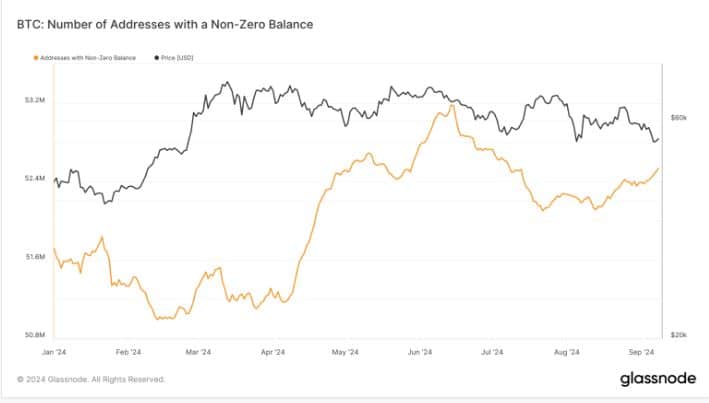

Glassnode’s knowledge confirmed a resurgence of accumulation.

Supply: Glassnode

In accordance with Glassnode, the extent of accumulation by addresses with zero balances was near 53 million addresses at press time, a wholesome restoration from August lows.

Nonetheless, this was nonetheless considerably beneath the heights noticed in the beginning of July, signaling that there was nonetheless some degree of uncertainty out there.

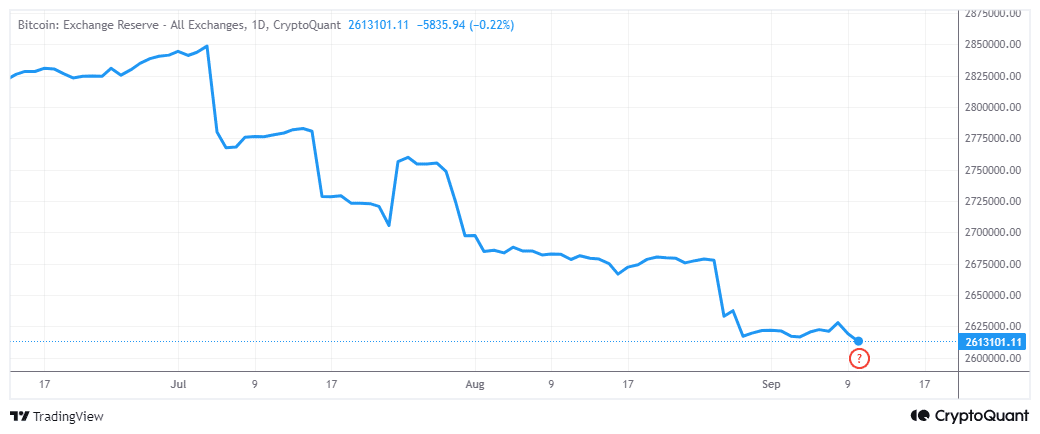

Additionally value noting is that Bitcoin’s alternate reserves have been again on the downtrend. This confirmed that fewer cash have been obtainable on exchanges, opposite to the slight uptick noticed in the beginning of September.

Supply: CryptoQuant

Decrease alternate reserves are excellent news for the bulls, and it aligns with the rising non-zero addresses. Nonetheless, it’s not a transparent indicator of what whales and establishments have been doing.

Bitcoin’s different excessive

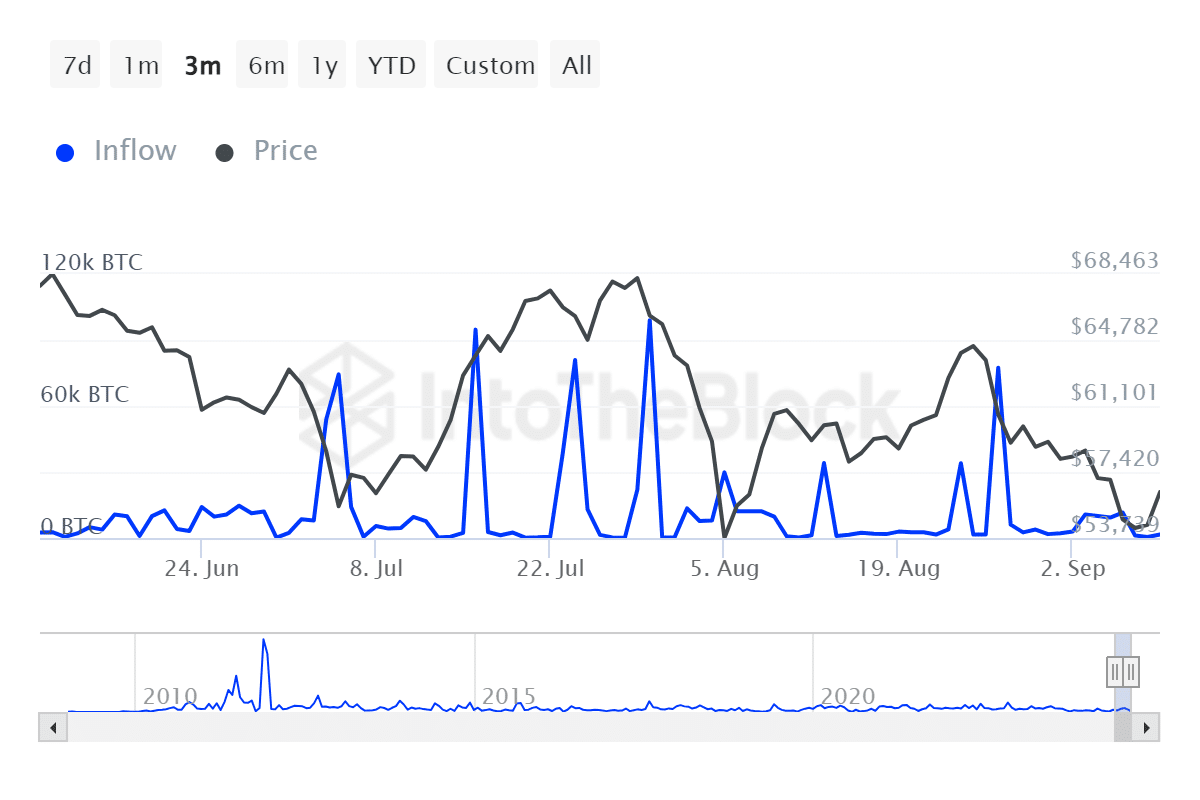

So far as whales are involved, we discovered that whales are much less lively in September up to now, than they have been between June and August. Whale influx knowledge indicated a slowdown within the final two weeks.

Supply: IntoTheBlock

The low whale participation coincided with the low Bitcoin ETFs demand, judging by the dominant outflows. This additional aligned with the statement that Bitcoin’s pattern seemed to be falling within the final 5 months.

BTC has been attaining decrease highs every time the bulls made an try, thus confirming decrease bullish confidence.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

In different phrases, there’s nonetheless a major threat of Bitcoin doubtlessly sliding in the direction of $50,000 and probably decrease. Alternatively, many whales at present on the sidelines would doubtless capitalize at a reduced degree.

Additionally it is attainable that many savvy merchants are ready for clearer market knowledge from the FED subsequent week earlier than any huge strikes.