- Bitcoin struggles to remain above the bull market assist band as This autumn approaches.

- Evaluation of historic tendencies suggests a doable rally or additional decline in This autumn 2024.

Bitcoin [BTC] value skilled a notable dip final week, dropping to the $53,000 degree for the primary time since February. This downward development has continued into the beginning of this week.

Nevertheless, the cryptocurrency has managed a slight restoration, presently buying and selling above $55,000. Regardless of this rebound, Bitcoin stays down 2.4% over the previous 24 hours, with a buying and selling value of $55,704 and a 24-hour low of $54,320.

Amid this, distinguished crypto analyst Benjamin Cowen has just lately taken to social media platform X to debate the implications of Bitcoin’s present value actions and its potential trajectory by the top of the 12 months.

Based on Cowen, Bitcoin’s current efficiency may very well be indicative of a “summer lull,” a sample noticed in earlier cycles. His evaluation means that the cryptocurrency’s future in This autumn hinges on its skill to regain and keep key value ranges over the approaching weeks.

Bitcoin’s probably efficiency in This autumn

Earlier than delving deeper into the projections for This autumn, it’s important to know what a Bull Market Assist Band (BMSB) is.

This technical indicator combines the 20-week transferring common and the 21-week exponential transferring common, serving as a important assist area in bull markets.

A sustained place above this band is often considered as bullish, whereas dropping beneath it might probably sign bearish circumstances.

Cowen factors out that Bitcoin is presently testing this assist band. If historic patterns maintain true, Bitcoin’s habits in relation to the BMSB in the course of the summer season may set the stage for its This autumn efficiency.

As an illustration, in 2023, after a short dip beneath the BMSB, Bitcoin skilled a major rally within the fourth quarter. Equally, in 2013 and 2016, durations following a dip beneath this band noticed substantial upward actions.

Exploring additional, Cowen attracts parallels with previous years the place Bitcoin confronted comparable downturns in the course of the summer season months. He notes that in years like 2019, when Bitcoin remained beneath the BMSB post-summer, the fourth quarter tended to be bearish.

Conversely, years that noticed a restoration above the BMSB usually skilled sturdy This autumn rallies.

The present market dynamics present Bitcoin’s wrestle to climb again above the BMSB. Cowen speculates that the result of this wrestle may both result in a repeat of the robust recoveries seen in 2013 and 2016 or mimic the quieter This autumn of 2019.

This uncertainty makes the approaching weeks essential for setting the tone for the rest of the 12 months.

Present market fundamentals

Turning to Bitcoin’s fundamentals, there’s a noticeable decline in whale transactions, with a vital drop from 17,000 to beneath 12,000 in only one week.

This lower may point out a cooling curiosity from bigger buyers or a possible consolidation part.

Supply: IntoTheBlock

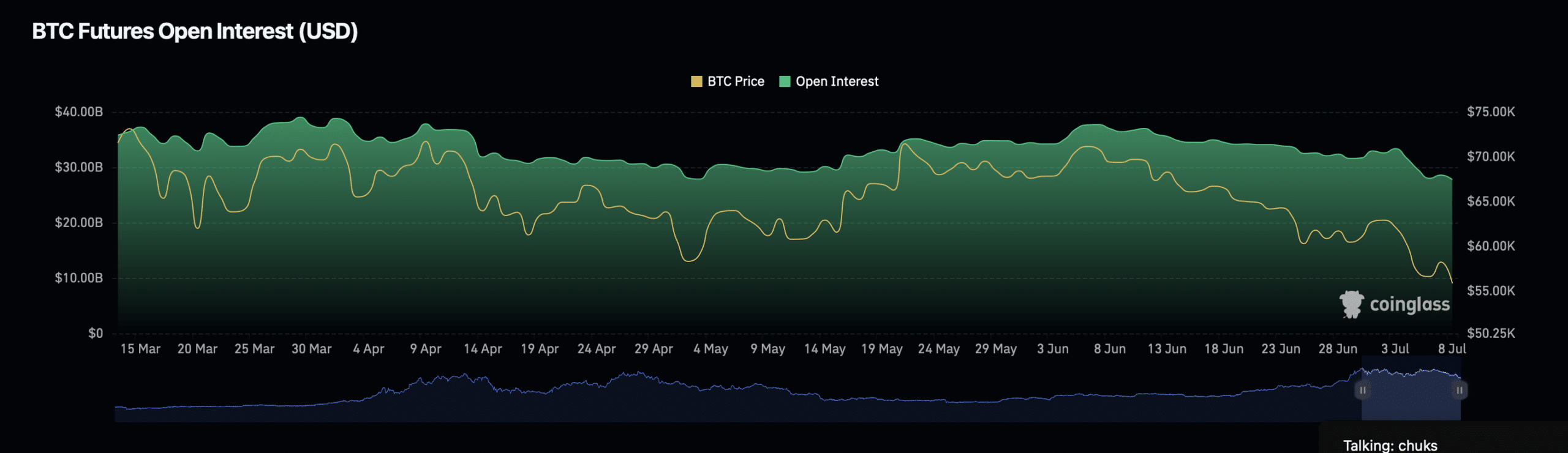

Moreover, Bitcoin’s open curiosity has barely decreased by 2%, now standing at $27.62 billion. Nevertheless, there’s been a stark improve in open curiosity quantity, which surged by 32.91% to $57 billion.

This rise in buying and selling quantity amidst reducing open curiosity means that whereas fewer positions are open, the transactions which can be occurring are extra vital.

Supply: Coinglass

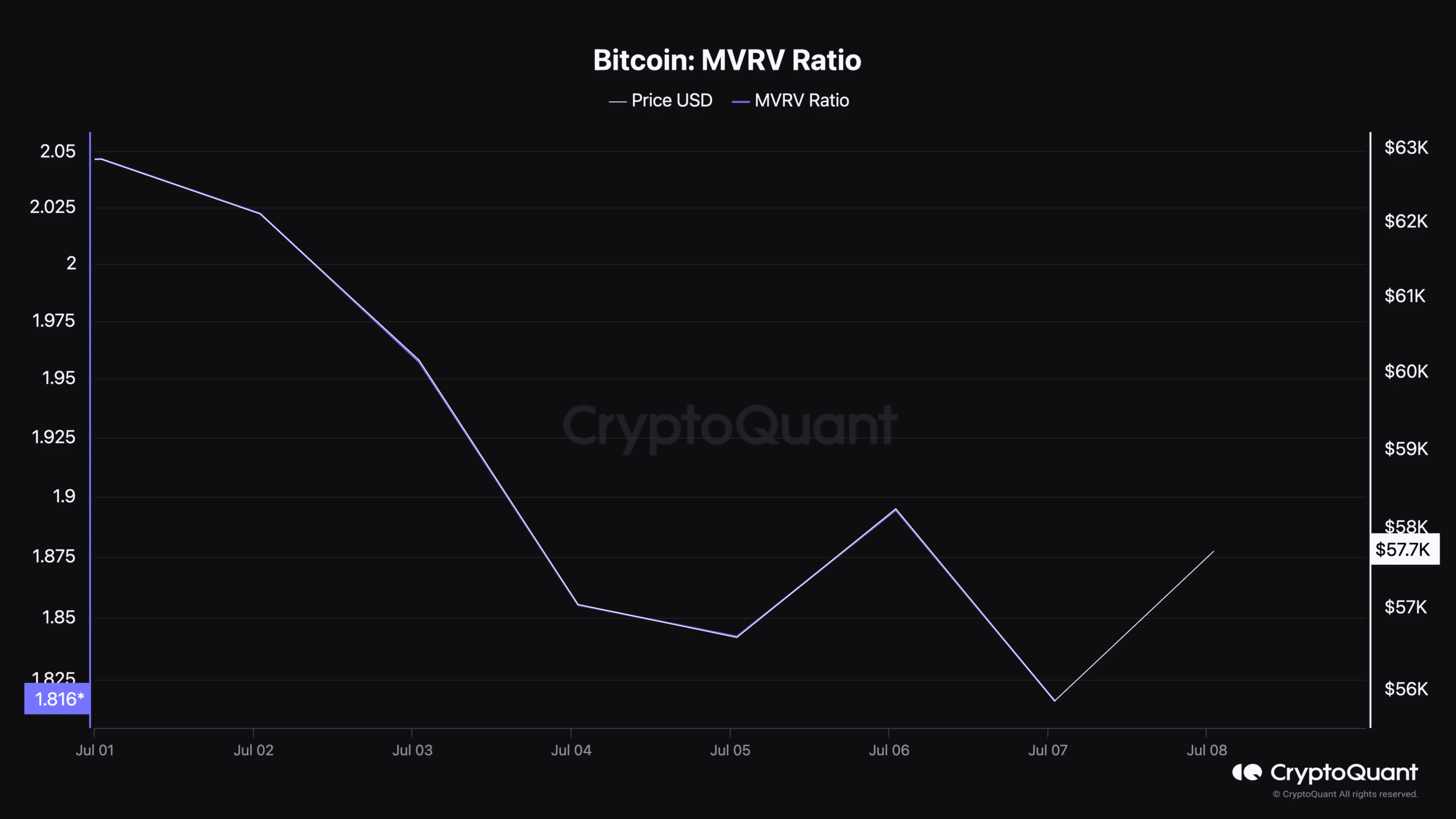

Moreover, Bitcoin’s Market Worth to Realized Worth (MVRV) ratio, a measure of the market’s profitability, stands at 1.816.

A ratio above one usually signifies that the common holder is in revenue, which may counsel that regardless of current value drops, the general market sentiment stays considerably optimistic.

Supply: CryptoQuant

As This autumn approaches, the market stays at a important juncture.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Whether or not Bitcoin can rebound above important technical ranges will probably dictate the market’s path within the coming months, probably setting the stage for the following main rally or a continued consolidation.

Alternatively, AMBCrypto has just lately reported that Bitcoin backside may be in as the rise in realized losses on-chain signifies that one other BTC rally was shut.