- Bitcoin’s rebound post-drop mirrors 2016 bull run patterns.

- RSI and Bollinger Bands counsel potential worth correction or shift to the bullish development.

On fifth August, Bitcoin [BTC] skilled its most vital every day drop for the reason that FTX collapse, plummeting over 16%.

This steep decline was a part of a broader crypto rout, with almost 90% of altcoins additionally struggling double-digit losses, signaling a extreme downturn throughout the sector.

Bitcoin bounces again after the dip

Regardless of this dramatic droop, BTC has rebounded strongly, exhibiting a outstanding restoration with an 8% acquire previously 24 hours and buying and selling at $54,791 as per CoinMarketCap.

Whereas many stay cautious amid Bitcoin’s heightened volatility, veteran dealer Peter Brandt notes that BTC’s latest decline for the reason that April 2024 halving resembles market patterns noticed earlier than the 2016 bull run.

Taking to X he famous,

“Please note that $BTC decline since halving is now similar to that of the 2015-2017 Halving Bull market cycle.”

Supply: Peter Brandt/X

For perspective, in 2016, Bitcoin dropped 27% from its halving worth earlier than hovering to new highs.

With the same 26% drop from its latest halving worth, this sample may point out a possible for vital positive factors sooner or later, mirroring the earlier bull run.

What are the technical indicators making an attempt to inform us?

Nonetheless, regardless of BTC’s latest worth enhance, issues stay because the Relative Power Index (RSI) sits at a low 29, indicating that sellers nonetheless dominate over consumers.

Following a dramatic 16% drop, Bitcoin entered the oversold zone. Traditionally, such oversold or overbought situations typically sign worth corrections.

This view is strengthened by the widening Bollinger Bands, which counsel elevated volatility and a possible shift from a bearish to a bullish development.

Supply: Buying and selling View

Bitcoin’s on-chain metric evaluation

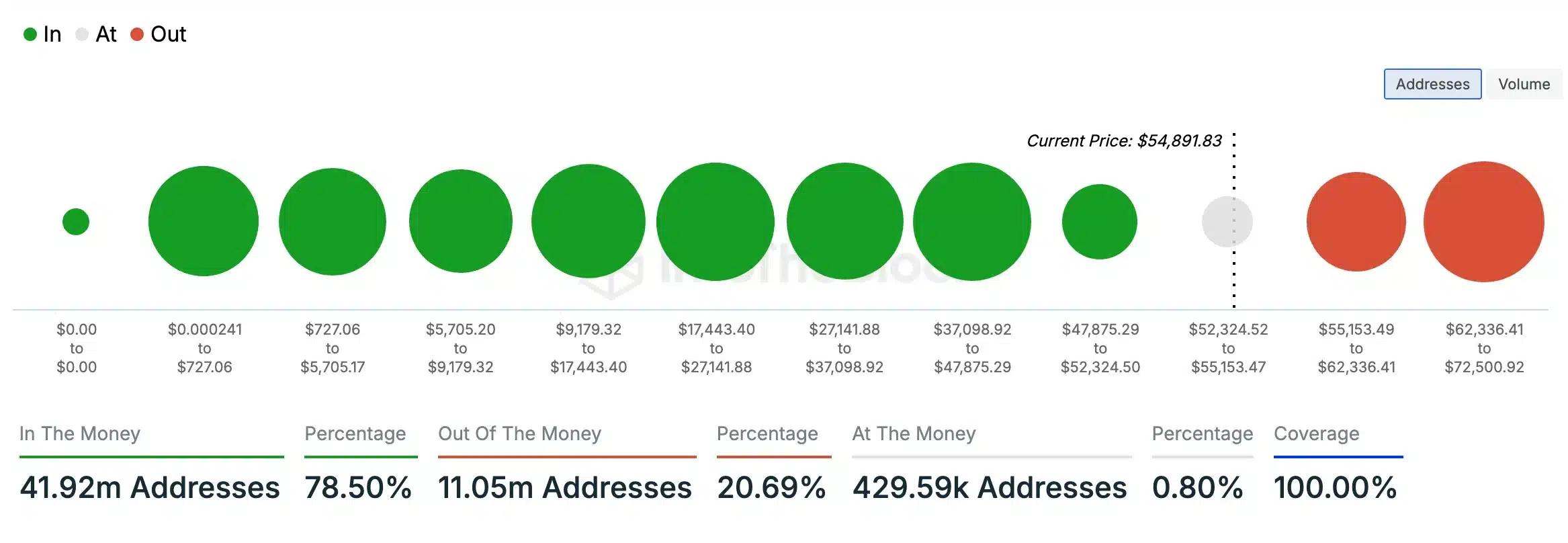

To additional solidify the upcoming bullish development, AMBCrypto analyzed IntoTheBlock’s knowledge and located {that a} vital majority (78.50%) of BTC holders held tokens valued increased than their buy worth at press time, indicating that they have been “in the money.”

In distinction, a smaller phase (20.69%) held BTC tokens that have been value lower than their buy worth, putting them “out of the money.”

Supply: IntoTheBlock

This instructed a bullish sentiment or potential upcoming worth surge for BTC. ‘The Bitcoin Therapist’ put it greatest when he mentioned,

Supply: The Bitcoin Therapist/X