Picture supply: Getty Photos

The most well liked investing development to have come alongside in a few years is undoubtedly synthetic intelligence (AI). Most specialists predict this revolutionary know-how will remodel a number of industries. Naturally then, many buyers beginning out at present could have been questioning which is the perfect inventory to purchase within the house.

Thus far, Nvidia (NASDAQ: NVDA) has been the standout winner. Shares of the AI chipmaker have risen by a stonking 2,473% over 5 years — even after a 16% drop in July!

Whereas Nvidia’s chips maintain a dominant place in AI-accelerated knowledge centres, competitors is mounting. Not simply from previous rivals like Superior Micro Gadgets, but additionally its personal prospects, together with Alphabet and Amazon. Each are growing their very own customized AI chips to scale back reliance on outdoors suppliers.

Will Nvidia nonetheless be on the prime of the AI pile in 5 years time? Maybe, however we don’t know for positive, particularly given how quickly the business is growing.

My technique right here then is to spend money on the agency doing a lot of the chipmaking on behalf of all these prospects. That’s Taiwan Semiconductor Manufacturing (NYSE: TSM), the world’s largest chip foundry.

As I write, the inventory has dropped 19% inside a month. Right here’s why I plan to purchase extra shares in August.

Deep moat and eye-popping margins

TSMC, because the agency is understood, has delivered a 17.7% compound annual development fee (CAGR) in income since 1994. Its earnings CAGR? 17.2%!

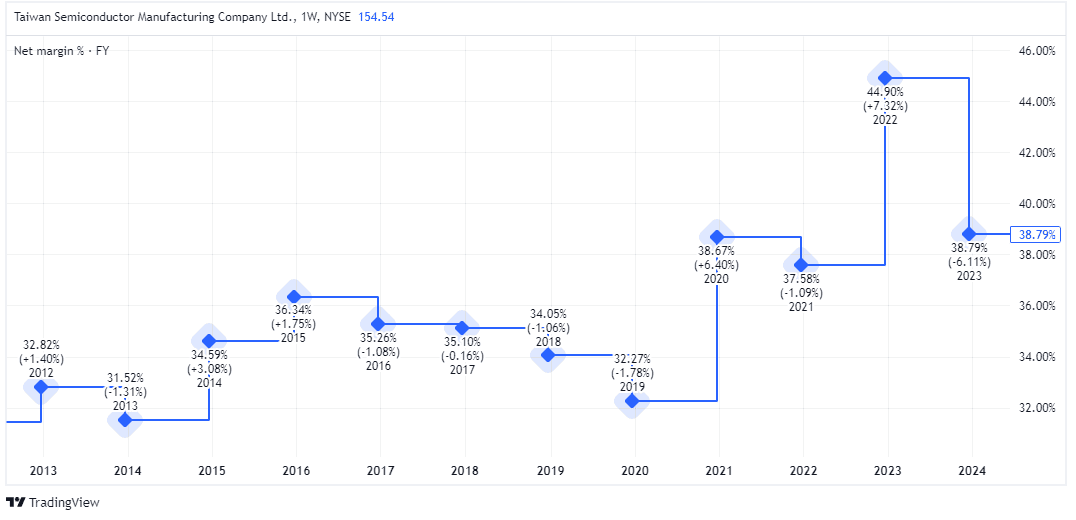

This means that the corporate has a strong aggressive benefit (or moat). Certainly, its web revenue margin is an unbelievable 38%.

I doubt a $100bn struggle chest would compete with TSMC. I imply, a single trendy foundry prices $10bn-$20bn or extra. Earlier than that, you’d should construct the provision chain, appeal to prime expertise, then match TSMC’s economies of scale and big annual capital expenditure and R&D price range. Good luck with that!

That’s to not say it has no competitors. It does, primarily within the form of Intel and Samsung Foundry, a division of Samsung Electronics. However it stays the worldwide chief, with a 60% market share and a fortress steadiness sheet.

Robust AI demand

In Q2, income surged 32.8% 12 months on 12 months to succeed in $20.8bn. Internet earnings and diluted earnings per share each elevated 36.3%.

As talked about, most prime tech corporations use TSMC. Apple and Nvidia are amongst its largest prospects. And chief government C.C. Wei just lately instructed analysts: “AI is so hot; right now everybody, all my customers, want to put AI functionality into their devices.”

Given this, you may anticipate TSMC to be buying and selling at some loopy AI-fueled a number of. However the inventory’s ahead price-to-earnings (P/E) ratio is presently underneath 20, primarily based on 2025’s analyst estimates.

That’s far cheaper than Nvidia and most different AI-related tech shares.

As with all investments although, there’s danger. The primary one is China invading Taiwan, the place most of TSMC’s manufacturing capability is situated. One other can be a slowdown in AI spending, which might damage development.

Nonetheless, TSMC has round a 90% share in making probably the most superior chips. So it’s completely positioned to profit from the AI revolution, no matter which particular person corporations find yourself reigning supreme.

With the inventory wanting nice worth once more, I intend to purchase the dip in August.