- The BTC CDD advised that the pattern was nonetheless beneath vital ranges

- Lengthy-term holders have amassed round 1 million BTC since July

In March 2024, Bitcoin hit a brand new all-time excessive. It has since sparked debates amongst buyers about whether or not this marked the height of the bull market or not. Now, whereas some argue this could possibly be the ultimate prime, on-chain information suggests in any other case.

In truth, metrics like Coin Days Destroyed (CDD) appeared to point that the market should still have room for additional upside.

Bitcoin’s prime in but?

In March 2024, Bitcoin noticed a notable spike within the Coin Days Destroyed (CDD) metric, signaling that some long-term holders took earnings across the all-time excessive. Nevertheless, additional evaluation revealed that the CDD has not but reached the vital “red zone.” This zone usually indicators the ultimate market prime.

What this implies is that whereas the March peak represented a big interim excessive, it possible wasn’t the last word peak of the present cycle. By extension, the pattern within the CDD metric indicated that there’s nonetheless potential for additional worth hikes within the coming months.

Supply: CryptoQuant

CDD is a vital on-chain metric that tracks the motion of older, long-held Bitcoin. It offers insights into when long-term holders are promoting, giving a clearer image of the market’s maturity and doable future traits.

The truth that the CDD is but to achieve its peak implies that the bull market should still have room to develop. Particularly with long-term holders displaying warning however not totally exiting.

Lengthy-term holders proceed to build up Bitcoin

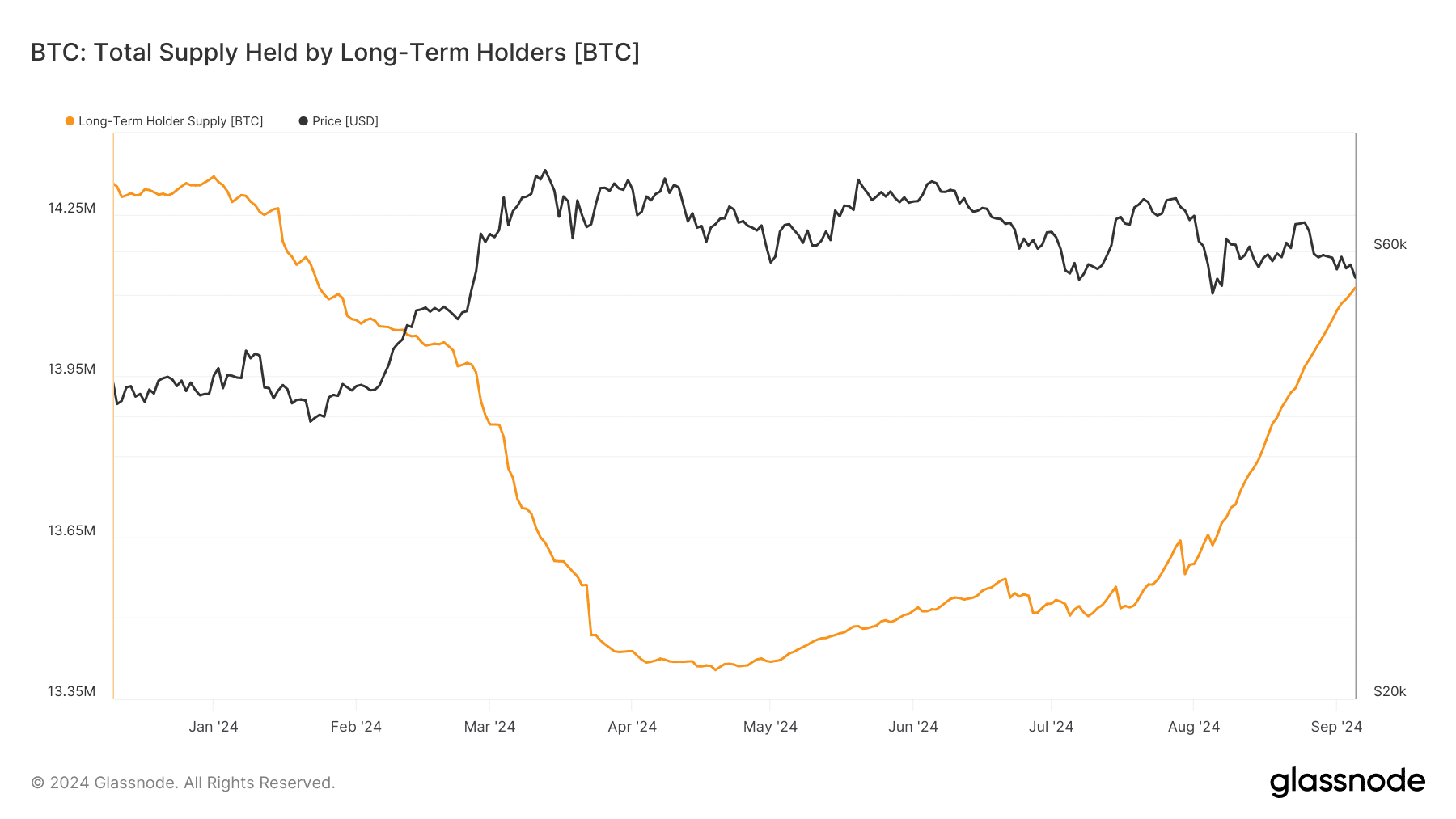

An evaluation of Bitcoin Lengthy-term Holders (LTH) provide information from Glassnode additionally revealed a optimistic sentiment that aligns with the pattern noticed within the Coin Days Destroyed (CDD) metric.

In line with the identical, these long-term holders started growing their accumulation in July, when Bitcoin’s worth began to say no.

Supply: Glassnode

Between 19 July and 06 September, the availability of Bitcoin held by long-term holders has grown considerably, rising from roughly 13.5 million BTC to over 14.1 million BTC. This accumulation pattern means that long-term holders keep confidence in Bitcoin’s long-term prospects, regardless of the current worth drop, and will not be exiting their positions.

This rising provide is an indication that long-term holders are capitalizing on the decrease costs, reinforcing the idea that the market nonetheless has room for additional upside. Particularly as these key buyers proceed to carry and accumulate, somewhat than promote.

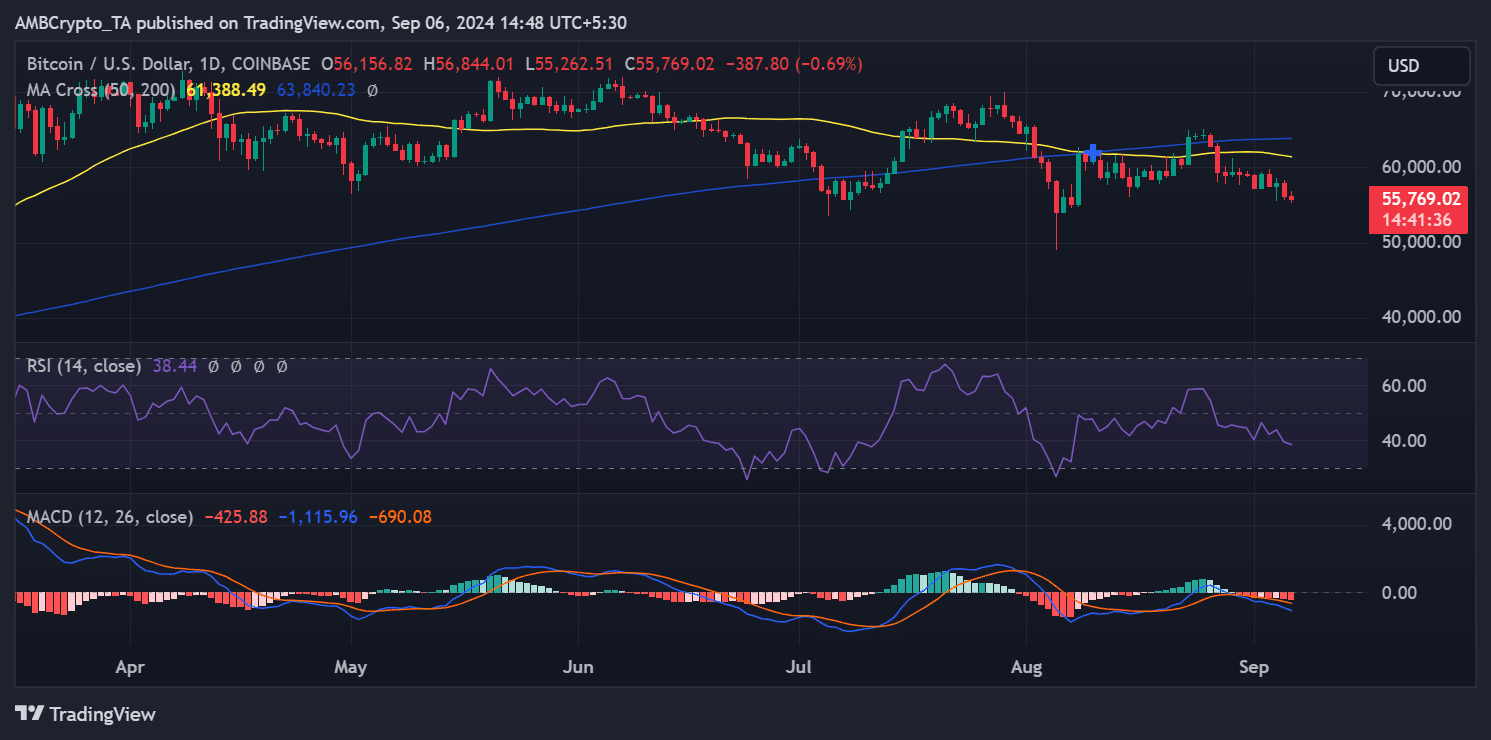

BTC falls additional down the charts

Bitcoin’s worth wrestle has persevered, with AMBCrypto’s evaluation of its every day chart displaying a decline of over 3% within the final buying and selling session. The decline introduced its worth all the way down to round $56,000. On the time of writing, the decline appeared to proceed with an extra 0.7% drop, pushing the value to roughly $55,700.

Supply: TradingView

The Relative Energy Index (RSI) for Bitcoin had dropped barely beneath 40, indicating that it entered the oversold zone. Merely put, promoting stress might have peaked, which might sign a possible worth rebound shortly.

– Learn Bitcoin (BTC) Value Prediction 2024-25

Nevertheless, regardless of the continuing worth decline, the optimistic pattern in Bitcoin’s Lengthy-Time period Holder (LTH) provide might encourage additional accumulation at this worth degree.

As long-term holders proceed to construct their positions, it might present assist for the value. This may doubtlessly result in stabilization and even restoration, because the market digests the downtrend.