- New Bitcoin buying and selling merchandise on the verge of launch.

- Bitcoin index and futures to extend Bitcoin buying and selling liquidity.

Nasdaq and CME Group are making vital strides in increasing Bitcoin buying and selling choices, a transfer that would have profound implications for the way forward for Bitcoin [BTC]. Nasdaq is main the hassle with its first-ever BTC index.

The corporate has filed with the US SEC to checklist and facilitate buying and selling of Nasdaq Bitcoin Index Choices (XBTX). If accepted, this can present a safe and controlled platform for buying and selling Bitcoin choices as John Black, Head of Index Choices at Nasdaq said:

“We’re creating a place for investors to confidently put their money into this innovative asset class.”

CME Group, the world’s largest futures change, additionally launched a smaller Bitcoin futures contract aimed toward retail traders. This initiative is a part of the market’s evolution to draw a broader viewers.

By making futures contracts extra accessible, CME Group is anticipated to deliver new liquidity and elevated consideration to Bitcoin buying and selling, probably driving BTC costs increased in future.

Supporting the long-term bullish outlook for Bitcoin, the availability held by long-term holders has elevated by 262,000 BTC up to now 30 days, now controlling 14.82 million BTC, which is 75% of the whole provide.

Supply: CryptoQuant

Regardless of latest market downturns, this sturdy long-term holding signifies continued confidence in Bitcoin’s future.

Bitcoin ETFs day by day & weekly net-flow

Furthermore, the Bitcoin ETF market has seen optimistic internet flows not too long ago, with day by day BTC ETF internet flows reaching +3,179 BTC (roughly $195.65 million) and weekly internet flows at +9,909 BTC.

This development means that the introduction of Nasdaq’s Bitcoin index and CME Group’s Bitcoin futures might additional improve these inflows, supporting a better BTC worth in the long run.

Supply: Lookonchain

What does the worldwide bid ask ratio say?

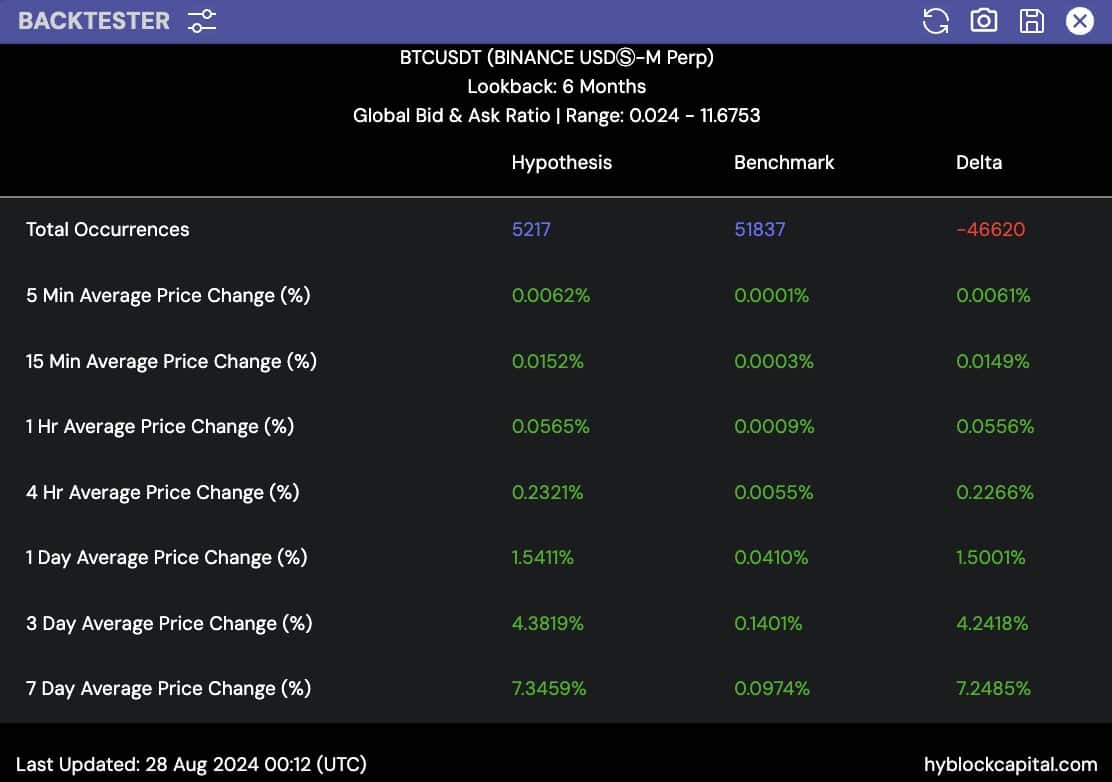

One other optimistic indicator is the International Bid-Ask Ratio (GBAR), which has flipped optimistic, outperforming common BTC worth motion throughout a number of timeframes.

This development, mixed with the upcoming Nasdaq Bitcoin index and CME Group futures, means that Bitcoin buying and selling liquidity is on an upward trajectory.

Supply: Hyblock Capital

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Stablecoin provide

Lastly, the quantity of stablecoin provide has been steadily rising, reaching an all-time excessive in 2024.

This inflow of funds, notably into Binance, correlates with an increase within the Taker Purchase/Promote Ratio for stablecoins on the platform, which might drive BTC costs increased as buying and selling actions enhance with the launch of those new Bitcoin merchandise.

Supply: TradingView