- Bitcoin dropped 3.89% amid Mt. Gox repayments and the German authorities’s sell-off.

- 75.48% of BTC holders have been “in the money,” indicating potential bullish sentiment.

The crypto market noticed yet one more difficult day as the worldwide market cap dropped to $2.04 trillion, marking a 3.33% lower prior to now 24 hours.

Bitcoin takes successful!

Bitcoin [BTC], particularly, has garnered vital consideration attributable to a steep decline over the previous week, fueled by rumors surrounding the Mt. Gox reimbursement course of.

In actual fact, on the fifth of July, as Mt. Gox commenced repayments, BTC fell to its lowest stage since February.

Supply: www.mtgox.com

Compounding the problem, the German authorities additionally selected this second to unload their Bitcoin holdings, amplifying concern, uncertainty, and doubt (FUD) throughout the neighborhood.

Remarking on the identical, Devchart, Co-Founder ChartAlerts famous,

“The awkward moment where you want to refill on this dump but you also realize that Mt Gox and the German govt have $10 billion worth of #BTC ready to go on the market in the near future.”

As of the newest replace, BTC was buying and selling at $55,459.62, reflecting a 3.89% decline over the previous 24 hours.

This downward pattern was additional confirmed by the Relative Energy Index (RSI), which has dipped properly under the impartial stage and was nearing the oversold zone at press time.

Supply: TradingView

Traditionally, oversold and overbought situations have typically signaled a possible pullback. Due to this fact, there stays hope that BTC would possibly get better as soon as the Mt. Gox reimbursement course of concludes.

Affect on Bitcoin Money can’t be ignored

Bitcoin Money [BCH] was additionally down by 6.79%, altering arms at $311.35 at press time.

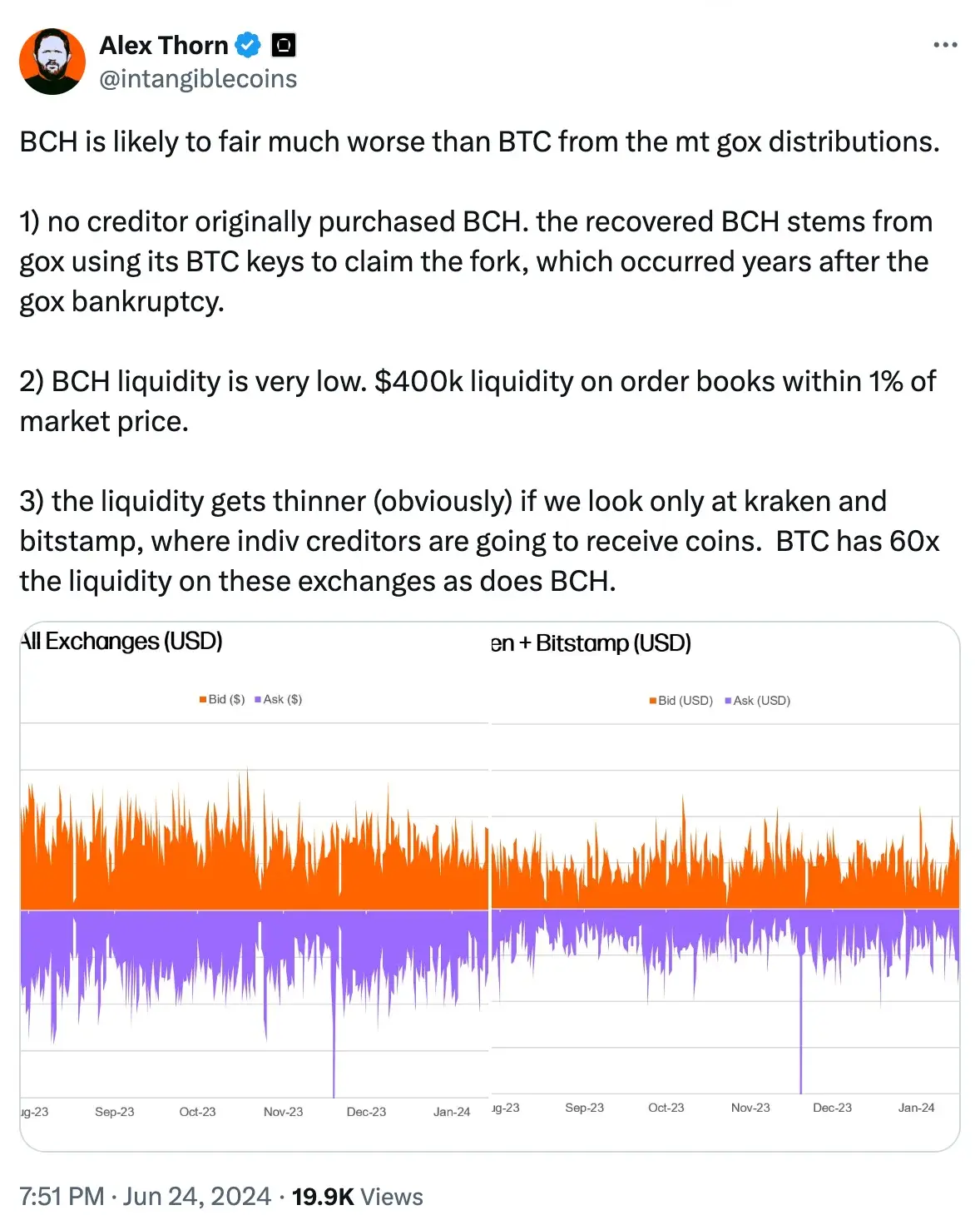

The distinction within the decline means that BCH suffered a considerably larger loss in comparison with BTC. This was earlier highlighted by Alex Thorn, Head of Firmwide Analysis at Galaxy {Digital}, when he famous,

Supply: Alex Thorn/X

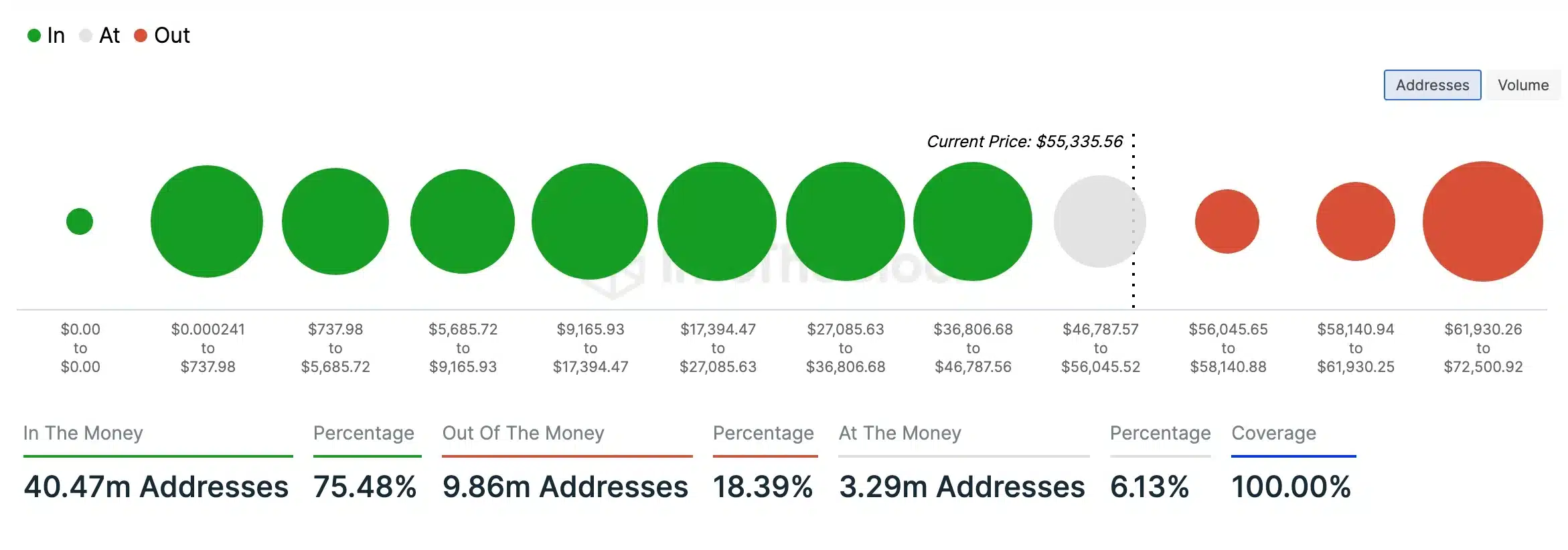

Nonetheless, AMBCrypto’s evaluation of IntoTheBlock knowledge revealed {that a} vital majority (75.48%) of BTC holders held tokens valued larger than their buy value at press time, indicating that they have been “in the money.”

Supply: IntoTheBlock

In distinction, a smaller section (18.39%) held BTC tokens which can be price lower than their buy value, putting them “out of the money.” This instructed a bullish sentiment or potential upcoming value surge for Bitcoin.

CEX HTX summed it up properly after they famous,

Supply: HTX/X