- Mt. Gox’s current switch has left it with a $3B BTC steadiness.

- BTC continued its sell-off forward of the U.S. July jobs report set for the 2nd of August.

The current Mt. Gox switch of $3.1 billion Bitcoin [BTC] to BitGo has lowered the defunct change’s steadiness much more, signaling that its provide overhang may finish quickly.

In keeping with Arkham information, the BitGo switch, made on the thirtieth of July, has introduced the Trustee property’s steadiness to $3.06 billion.

“Last night Mt. Gox addresses moved 33.96K BTC ($2.25B) to addresses we believe are most likely BitGo:..After these transfers, Mt. Gox now holds 46.16K BTC ($3.06B), including the new Mt. Gox address.”

Mt. Gox provide stress is nearly over

The above appreciable discount within the trustee property holdings meant that, like German authorities stress, the Mt Gox perceived risk would finish quickly.

Curiously, the current distribution from the defunct change didn’t exert stress in the marketplace as beforehand assumed.

In keeping with Glassnode information, there weren’t notable sell-side results amongst main exchanges, Kraken and Bitstamp, that the trustee property used for repayments.

In reality, the Spot Cumulative Quantity Delta (CVD) metric on Kraken surged marginally after the distribution, denoting that there wasn’t any promoting stress after the change obtained the reimbursement.

CVD tracks the web promote or purchase quantity on the change, with a constructive worth indicating extra purchase quantity on market orders aspect.

Supply: Glassnode

Glassnode established the same situation on Bitstamp. Therefore, the reimbursement didn’t drag the market just like the German authorities’s sell-off. In brief, the remaining $3 billion BTC could possibly be moved with out affecting the market.

Nevertheless, the important thing promote stress in the intervening time was the U.S. authorities. It at the moment has about $13 billion BTC after shifting $2 billion BTC final week and spooking the market.

Since June, the German and US sell-off fears have supplied bears extra edge out there.

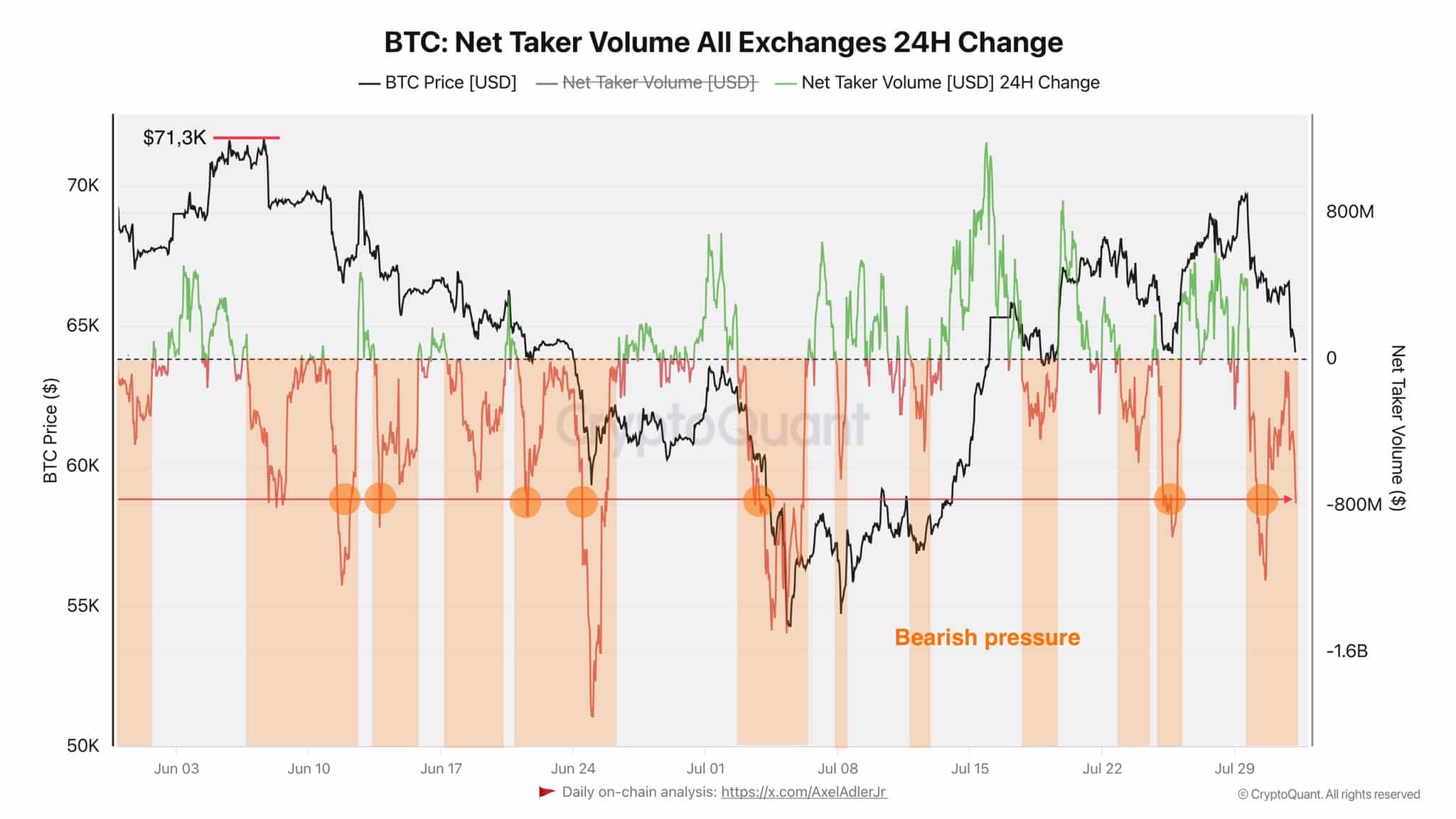

In keeping with CryptoQuant analyst Axel Adler, the promoting stress has emboldened bears all through the summer season, as proven by the Internet Taker Quantity.

“It must be acknowledged that the bears’ pressure since the beginning of summer has been impressive. Until the metric becomes greater than zero, the bulls will have to worry.”

Supply: CryptoQuant

The unfavorable Internet Taker Quantity meant the market had been predominantly promoting, as purchase volumes outweighed the purchase aspect.

As of press time, BTC had hit $63.0k and threatened to weaken additional forward of the U.S. July Jobs reviews, that are set to be launched on the 2nd of August.

It stays to be seen whether or not the roles report will ease the accelerated sell-off regardless of the dovish FOMC assembly.