- ETH’s Lengthy/Quick Ratio elevated, suggesting an increase in bullish sentiment.

- Nevertheless, market indicators remained bearish.

Ethereum [ETH], like most different cryptos, has been exhibiting much less volatility in the previous couple of days. Nevertheless, a key metric registered an enormous uptick within the final 24 hours, hinting at a development reversal within the coming days.

Is Ethereum prepared for a comeback?

After a 2% weekly rise, ETH’s value volatility dropped. On the time of writing, the token was buying and selling at $3.38k, with a market capitalization of over $407 billion.

Although this seemed bearish, the continued development may change quickly.

Coinglass’ knowledge revealed that Ethereum’s Lengthy/Quick Ratio shot up sharply within the final 24 hours. Because of this there are extra lengthy positions out there than brief positions, which can lead to a bullish development reversal.

Supply: Coinglass

Ali Martinez, a preferred crypto analyst, posted a tweet revealing how traders had been optimistic about ETH’s value rise within the coming days.

The tweet talked about that 78.30% of merchants on BitMEX with open Ethereum Futures trades had been betting on the worth going up!

Aside from this, EtherNasyonal, one more well-known analyst, posted a tweet suggesting that Ethereum may transfer in the direction of $4.7k quickly.

Odds of Ethereum recovering

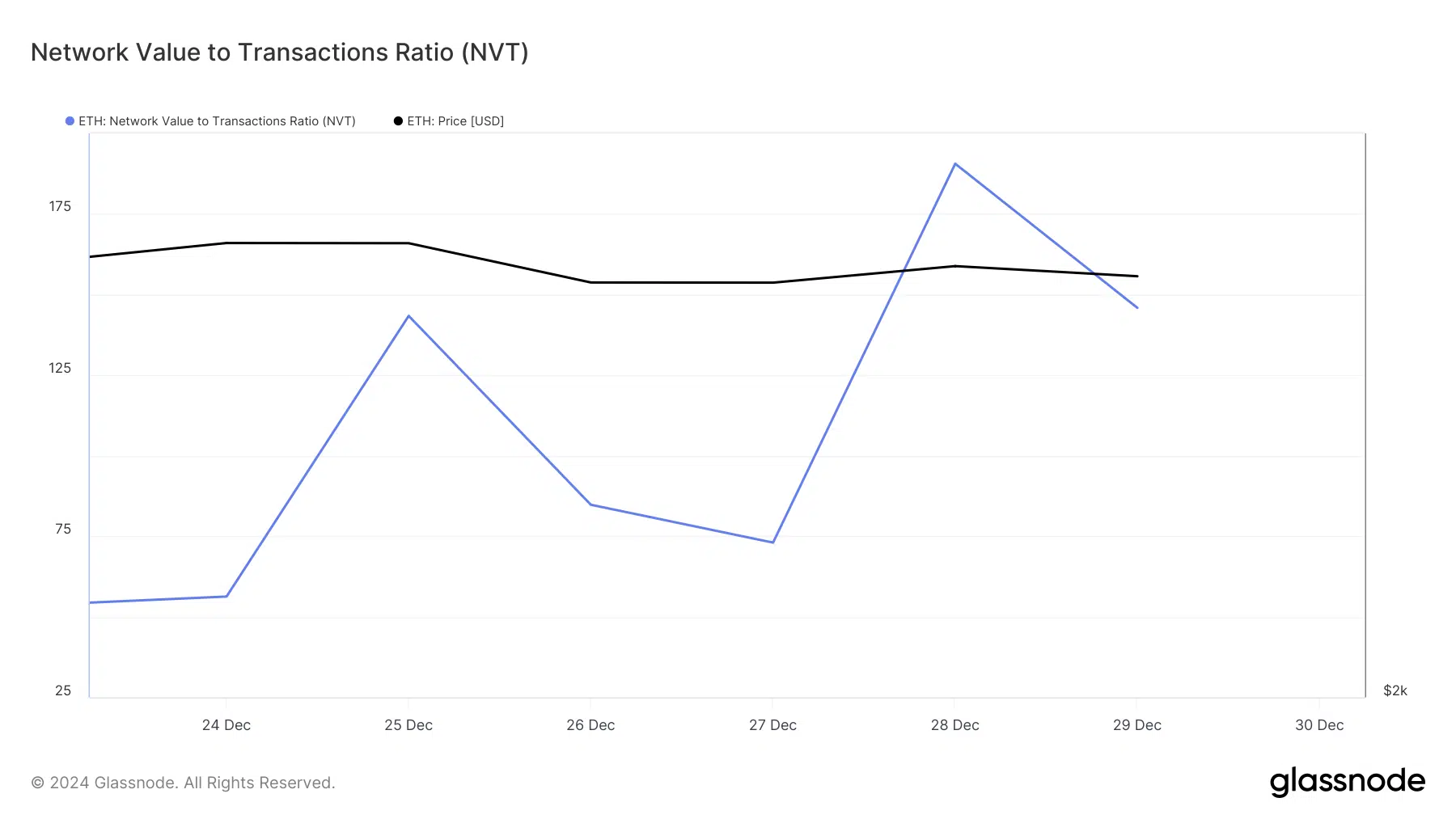

The opportunity of Ethereum as soon as once more gaining bullish momentum was excessive, because the token’s NVT ratio declined after a pointy uptick.

Each time the metric drops, it signifies that an asset is getting undervalued, which ends up in value hikes.

Supply: Glassnode

The king of altcoins’ alternate reserve was additionally dropping, which meant that purchasing stress on the token was rising. Issues within the derivatives market additionally seemed fairly optimistic.

This was evident from Ethereum’s rising Funding Charge — an indication that the market is optimistic, and merchants count on costs to rise.

Supply: CryptoQuant

Although these aforementioned metrics instructed a development reversal, technical indicators remained bearish. The MA Cross displayed a bearish benefit out there, because the 9-day EMA was properly beneath the 21-day MA.

The MACD additionally painted the same image of a bullish higher hand out there.

Supply: TradingView

Learn Ethereum’s [ETH] Value Prediction 2025–2026

In case of a continued bearish development, traders may first count on the token drop to $33.7 within the close to time period, as per Coinglass’ liquidation heatmap.

Nevertheless, if bulls take cost, Ethereum may first goal $34.56 earlier than it eyes $4.7k within the coming weeks or months.