- NDB now working in direction of increasing the usage of native currencies to “de-dollarize”

- Bitcoin might be the following large reserve forex

120 international international locations attended the Worldwide Municipal Discussion board of the BRICS international locations just a few days in the past. On the heels of the identical, nonetheless, the New Growth Financial institution hosted its ninth Annual Assembly. The latter is within the information at the moment after its President Dilma Rousseff claimed that the NDB is working in direction of increasing the usage of native currencies. In different phrases, the NDB is working in direction of de-dollarization.

Therefore, the query – What does this imply for Bitcoin?

Based on Rousseff,

“One of the main focuses of the NDB is to increase the use of local currencies. We have decided that up to 30 per cent of the bank’s total funding will take place in local currencies”

A world motion?

BRICS has been entrance and heart of this de-dollarization motion over the previous few years. In actual fact, in the course of the fifteenth Annual Summit of the BRICS international locations final 12 months, there was a lot help for a singular “BRICS currency.” On the time, Brazil’s President Lula Da Silva mentioned,

“It increases our payment options and reduces our vulnerabilities.”

Right here, it’s value declaring that a lot of the world continues to be removed from de-dollarization. Based on the Atlantic Council’s Greenback Dominance Monitor, for example, the US Greenback nonetheless accounts for a 58% share of all world foreign exchange reserves. Equally, it has a share of 88% throughout all international alternate transactions.

Supply: Atlantic Council

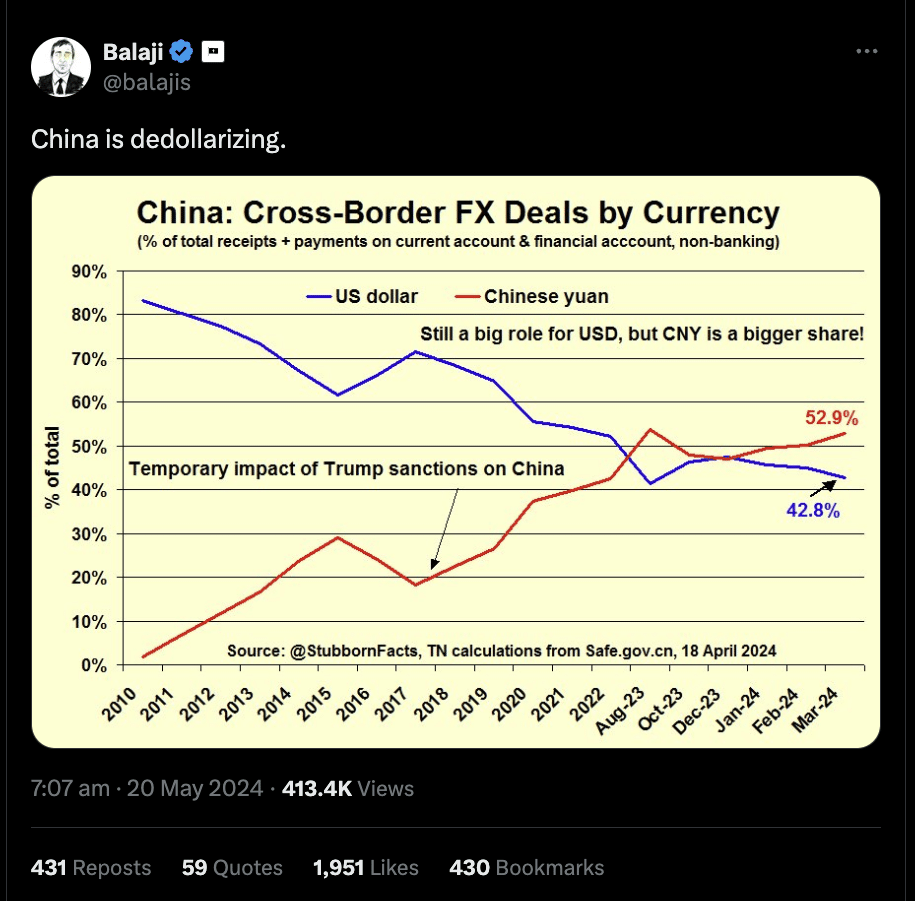

Merely put, de-dollarization gained’t occur within the brief time period or the medium time period. This, even supposing to China’s credit score, it has steadily been de-dollarizing itself.

Supply: X

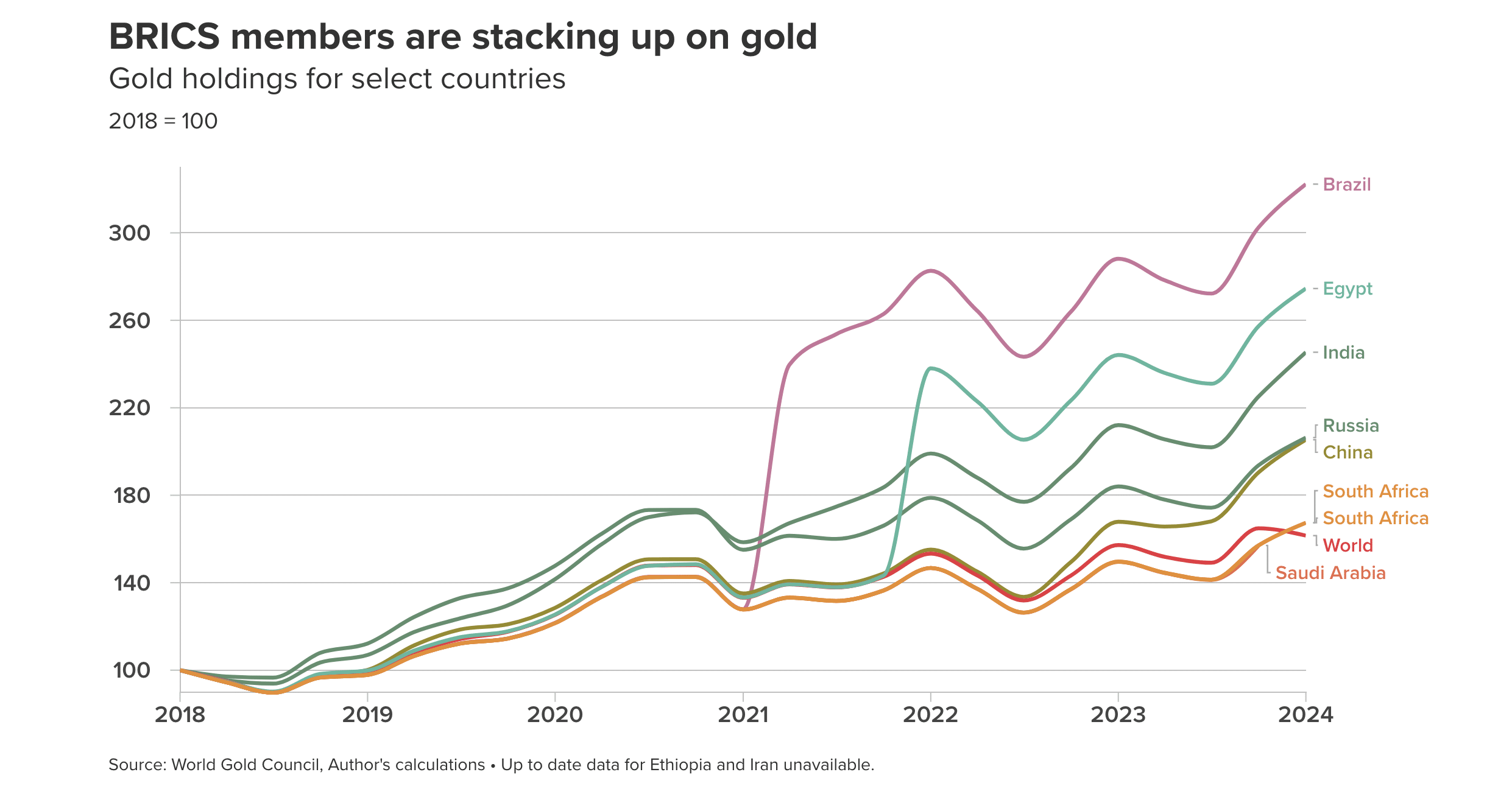

Quite the opposite, it might occur in the long run. Particularly for the reason that USD’s share of all world international reserves has fallen from 65.3% to 58.8% within the final 8 years alone. Equally, many international locations, particularly these related to BRICS, have been accumulating gold regardless of rising costs.

Supply: Atlantic Council

Gold’s standing as a reserve and as a retailer of worth has risen since 2019, particularly for the reason that COVID-19 pandemic. Subsequently, there was nice curiosity in different asset courses which have retailer of worth traits too. Bitcoin and cryptocurrencies typically, at the moment are seen as one such asset class.

Bitcoin to the rescue?

Russia and Iran, for example, are already utilizing Bitcoin and Bitcoin mining to mitigate the consequences of worldwide sanctions imposed towards them. In actual fact, the previous can also be beta testing cryptocurrency exchanges to evaluate how cross-border crypto transactions will work.

As a corporation too, BRICS has been eager on launching a gold-backed stablecoin, particularly on the again of its earlier discussions a few “BRICS currency.”

Exterior of those pursuits, there’s additionally nice curiosity amongst many international locations to go El Salvador’s manner and accumulate Bitcoin as a treasury asset. President Bukele, when he introduced this step again in 2021, additionally supposed to “de-dollarize” the financial system, regardless of criticism from the World Financial institution and IMF.

2024 is a special world, nonetheless, with main establishments like MicroStrategy and Metaplanet additionally diving into cryptocurrencies. That’s not all both, as Bitcoin and Ethereum ETFs at the moment are among the many hottest on Wall Road – An indication of institutional curiosity on this asset class.

All these developments, collectively, imply that crypto is awaiting the following large leg up. If BRICS international locations are profitable of their effort to de-dollarize and if even a minor share of the USD’s liquidity is directed in direction of cryptos, the market would possibly change eternally.