- MicroStrategy sees $22m in quantity on launch day as Bitcoin’s historic sample is about for repetition.

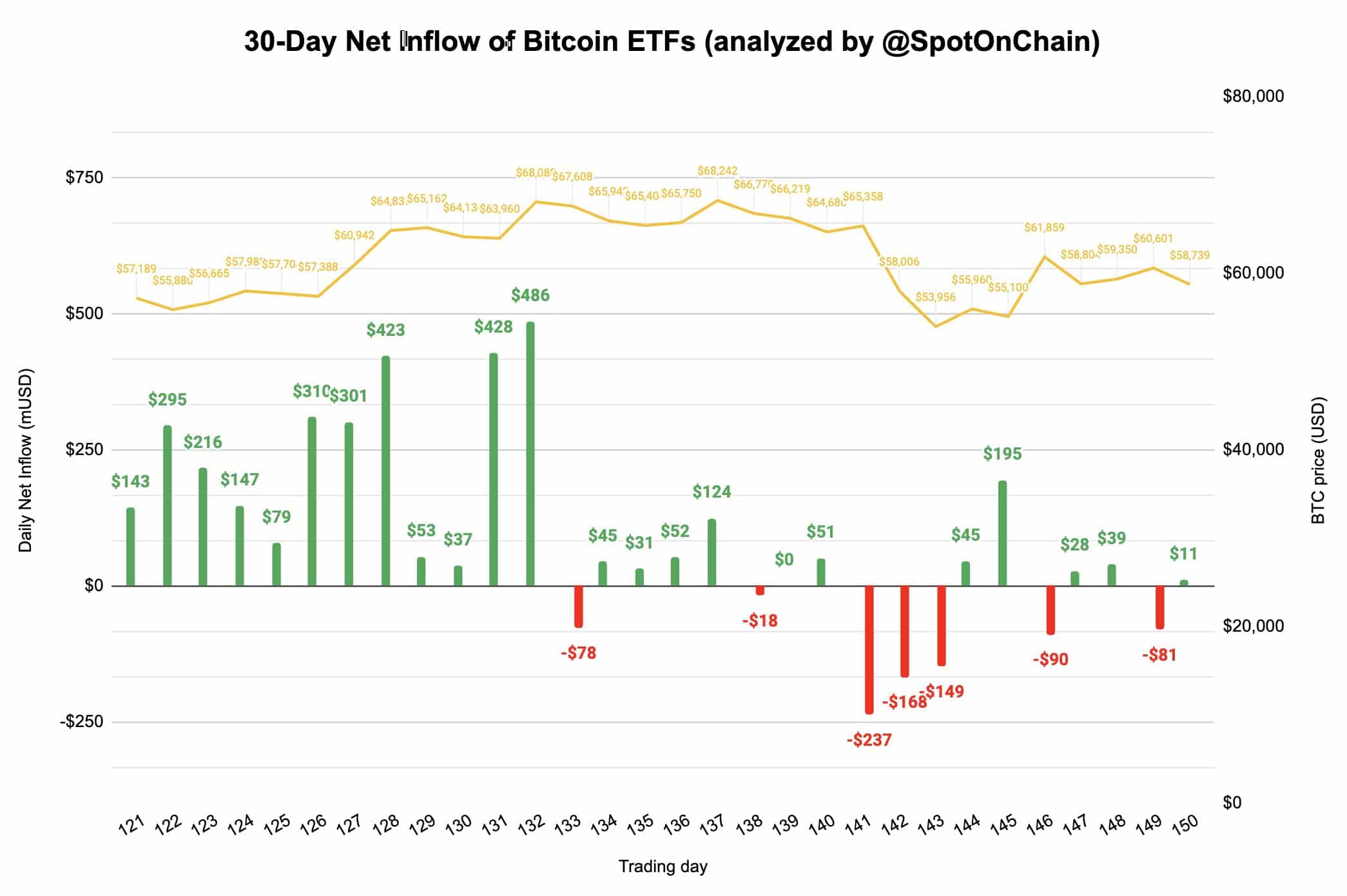

- Bitcoin ETFs web stream turned constructive once more after at some point of outflows regardless of market sentiment being fearful.

MicroStrategy, a significant Bitcoin [BTC] participant, achieved $22 million in quantity on the primary day of the ETF, presumably setting a report for leveraged ETFs, as first shared by Bloomberg’s ETF Analyst Eric Balchunas on X (previously Twitter).

This ETF is predicted to guide in volatility among the many U.S. ETFs, based mostly on the 90-day volatility indicator. Nonetheless, its volatility might enhance additional as issuers push the boundaries to draw buyers.

Regardless of $MSTX’s excessive volatility within the US, it’ll nonetheless be much less excessive in comparison with Europe’s $3LMI LN, which has a 90-day volatility of over 350%.

Supply: Eric Balchunas/X

The volatility and buying and selling quantity of $MSTX recommend it may turn out to be a significant participant within the ETF market, thus impacting the longer term value of Bitcoin.

This has presumably led to Bitcoin ETFs seeing a constructive shift, with $11 million deposited, reversing a quick outflow as Spot On Chain shared on X.

Supply: Spot On Chain

Among the many prime U.S. Bitcoin ETFs, solely BlackRock’s IBIT didn’t see a big enhance in web stream, whereas Constancy, Grayscale, and Bitwise skilled notable inflows.

The ETF market is poised for continued development, bolstered by the MicroStrategy ETF’s report buying and selling quantity.

Given MicroStrategy’s substantial Bitcoin holdings, its affect means that Bitcoin costs are more likely to rise.

BTC present cycle mirrors ‘Blue Years’

Bitcoin’s present cycle mirrors previous “Blue Years,” marked by constant patterns of two main highs and two sideways durations.

This cycle has seen a strong transfer from January to March, adopted by a chronic correction. Not like earlier cycles, this one hasn’t but reached new all-time highs, extending the correction.

Supply: CryptoCon, TradingView

Traditionally, related cycles have discovered each second early prime (mild blue circle) bottoms round August, suggesting the latest drop is typical earlier than a push into new highs the next yr.

Regardless of some variations, the Halving Cycles Idea signifies {that a} prime in late 2025 stays on observe. New highs seem possible because the cycle progresses.

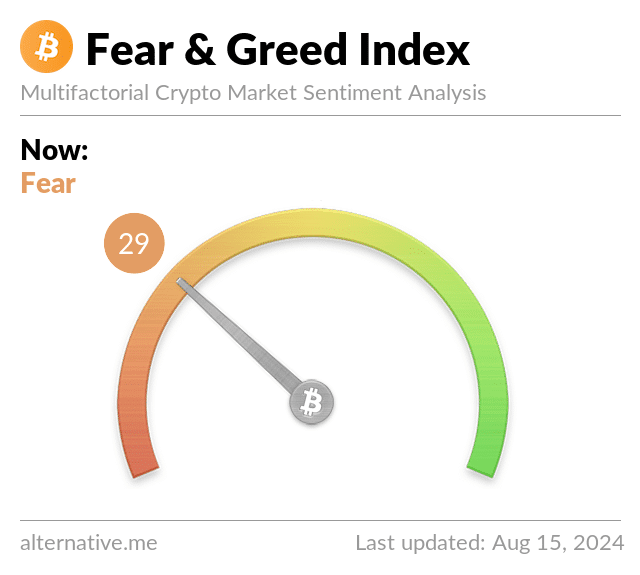

Moreover, main banks and huge monetary establishments globally are growing their Bitcoin holdings, regardless of the present fearful market sentiment.

Supply: Different.me

It’s smart to observe the lead of those influential buyers. With robust shopping for exercise and constructive market metrics, merchants and buyers can anticipate a possible upward motion in Bitcoin’s value.