- MicroStrategy boosted its Bitcoin holdings to 331,200 BTC, price $30 billion, resulting in a inventory surge.

- This coincided with MicroStrategy’s acquisitions below its bold “21/21 plan” and Bitcoin hitting $90K.

MicroStrategy Inc. has as soon as once more made headlines with its aggressive Bitcoin [BTC] acquisition technique. The agency bought $4.6 billion price of Bitcoin.

In alignment with its dedication to increasing BTC holdings, the enterprise software program large acquired roughly 51,780 Bitcoin between November eleventh and seventeenth, in accordance with a current SEC submitting.

This newest buy follows acquisitions in October and September, bringing the corporate’s complete BTC holdings to a powerful $30 billion.

MicroStrategy’s founder, Michael Saylor, additionally shared his ideas on X (previously Twitter), stating,

Supply: Michael Saylor/X

This led to MicroStrategy’s inventory (MSTR) surging by roughly 13% on 18th November, hitting a file closing excessive.

Influence on MicroStrategy’s inventory worth

This exceptional efficiency highlights the corporate’s 2024 success, with MSTR shares up over 500% year-to-date. This considerably outpaces Microsoft’s 11% development throughout the identical interval, in accordance with Yahoo Finance.

At present buying and selling at $384.79 per Google Finance, MicroStrategy’s aggressive BTC technique is yielding substantial returns. This contains inventory appreciation and the rising worth of its cryptocurrency holdings.

Moreover, the corporate plans to boost $1.75 billion by a non-public providing of zero-interest convertible senior notes. These notes will mature in December 2029, reinforcing its dedication to increasing its Bitcoin investments.

Supply: Michael Saylor/X

Group response

Observing the agency’s vital strides, an X person remarked,

“Big moves! MicroStrategy’s playing chess while others are stuck on checkers.”

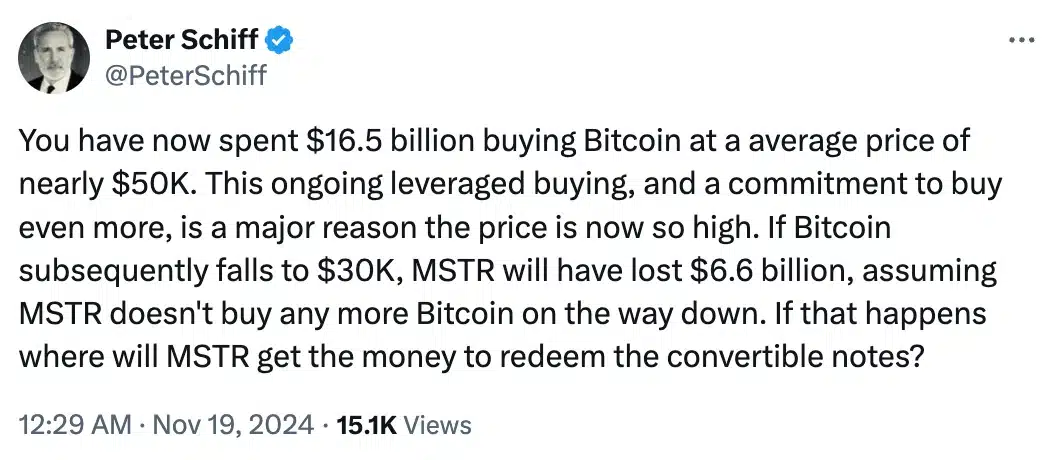

Nevertheless, critics like Peter Schiff seized the chance to weigh in, stating,

Supply: Peter Schiff/X

Regardless of dealing with criticism from figures like Schiff, MicroStrategy has solidified its place as the biggest institutional Bitcoin holder, with a powerful 331,200 BTC acquired at a cumulative value of $16.5 billion—considerably beneath the present market worth.

This milestone comes as Bitcoin trades at unprecedented highs, surpassing $90,000 following the U.S. election.

As of the newest replace, BTC was valued at $91,767.56, reflecting a minor 0.03% dip previously 24 hours however sustaining robust weekly and month-to-month good points of two.72% and 34.19%, respectively, as per CoinMarketCap.

MicroStrategy’s roadmap forward

MicroStrategy’s newest Bitcoin acquisition was funded by promoting roughly 13.6 million firm shares. This transfer aligned with its bold “21/21 plan.”

The technique goals to boost $42 billion by fairness and fixed-income choices over three years. This displays the corporate’s dedication to increasing its BTC holdings.

Since adopting Bitcoin as a core reserve asset in August 2020, MicroStrategy has used it to hedge in opposition to inflation and diversify its treasury.

Its open-source BTC reserve technique has impressed different public firms, resembling Marathon {Digital} Holdings and Semler Scientific, to undertake related approaches, signaling a rising pattern in company Bitcoin funding.