- MicroStrategy outperformed different main shares when it comes to value efficiency.

- The worth of BTC retained the $65,000 stage on the time of writing.

Bitcoin’s [BTC] current rally has generated a way of optimism available in the market over the previous couple of days. Other than altcoins, firms associated to cryptocurrencies have additionally gained.

MicroStrategy inventory outshines everybody

MicroStrategy inventory, specifically, has skilled a big uptick. The corporate’s strategic resolution to build up Bitcoin as a core element of its reserves has confirmed exceptionally profitable.

Consequently, MicroStrategy’s inventory (MSTR) has outperformed tech titans reminiscent of Nvidia, Tesla, and Microsoft. The world’s largest company Bitcoin holder witnessed a exceptional 15% surge in its share value on Monday, closing at $1,611.

This spectacular rally coincided with Bitcoin’s value climb to $65,000.

MicroStrategy has considerably outperformed Bitcoin over the previous 12 months, showcasing a exceptional progress trajectory. Whereas Bitcoin skilled a modest 13% enhance in value on a weekly chart, MSTR shares surged by over 22% throughout the identical interval.

The disparity in efficiency turns into much more pronounced when contemplating the broader timeframe. Because the starting of 2024, MSTR’s share value has skyrocketed by an astonishing 135%, eclipsing Bitcoin’s 44% acquire inside the similar interval.

Furthermore, on a yearly chart, MSTR inventory boasts a formidable 258% enhance.

A major catalyst for MicroStrategy’s distinctive efficiency is its substantial Bitcoin holdings. The corporate’s strategic funding in Bitcoin has confirmed to be extremely profitable, driving vital shareholder worth.

To boost accessibility and broaden its investor base, MicroStrategy just lately introduced a 10-for-1 inventory break up. This company motion is designed to make MSTR shares extra inexpensive for each current and potential traders, together with workers.

The inventory break up is scheduled to take impact on August 1, with shares distributed after market shut on August 7.

Michael Saylor boasts

Michael Saylor just lately touted MicroStrategy’s distinctive efficiency in a tweet, showcasing a chart that exposed a staggering 1,203% share value surge since tenth August, 2020.

Its surge outpaced tech giants like Nvidia (1,050%), Tesla (167%), Amazon (22%), and Apple (108%).

Attributing MicroStrategy’s success to its Bitcoin technique, Saylor inspired companies aiming to rival Nvidia to undertake the same method. The corporate has amassed a Bitcoin hoard value $7.538 billion by aggressively buying the cryptocurrency since 2020.

To gasoline these purchases, MicroStrategy has raised vital funds by debt choices. In a bid to increase its Bitcoin holdings, the corporate efficiently elevated a June debt providing from $500 million to $700 million.

Supply: X

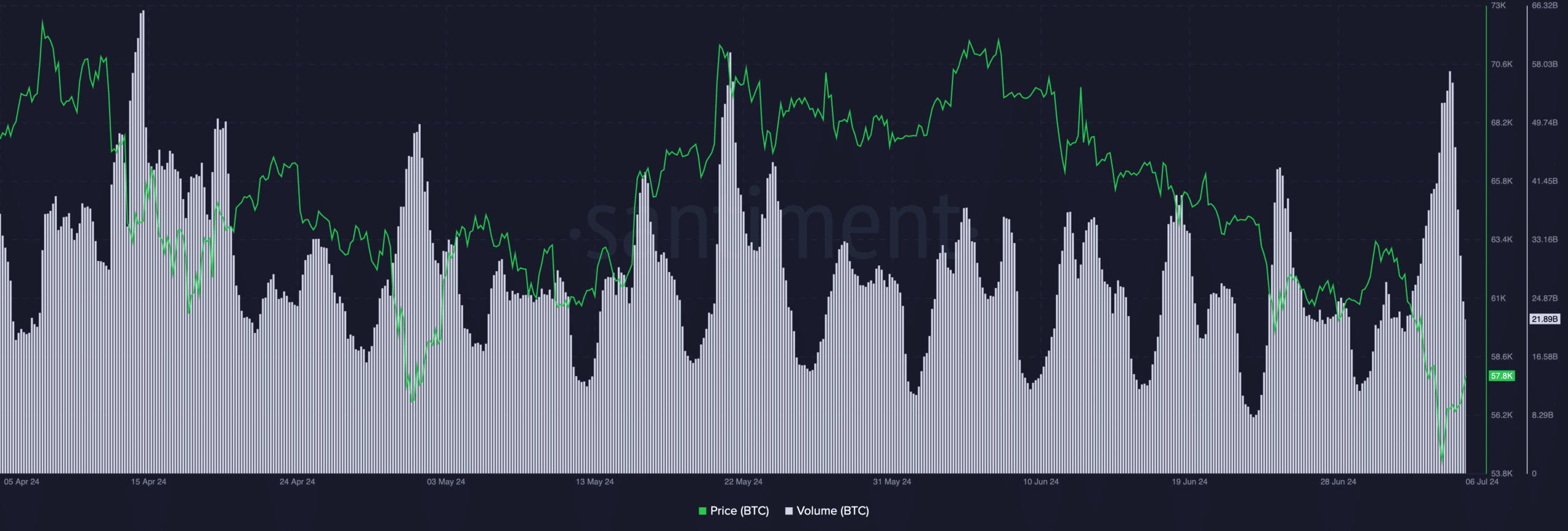

At press time, BTC was buying and selling at $65,321.79 and the amount at which it was buying and selling at had fallen by 0.91% within the final 24 hours.

Supply: Santiment