- Saylor may announce the shopping for of $3 billion BTC after the newest trace.

- Will the announcement enhance BTC to hit the elusive $100K degree?

Michael Saylor, co-founder of MicroStrategy, has hinted at a probable Bitcoin [BTC] scoop from its newest bond sale proceeds.

In his twenty fourth November X put up, Saylor indicated that the agency wants to purchase extra BTC.

“We need more green dots on SaylorTracker.com.”

Supply: X

The final time he made the same put up, he introduced a 51.78K BTC bid afterward. Because of this, the market anticipated the same consequence, probably a $3 billion (about 30K BTC) shopping for spree from the newest bond (convertible notes) sale proceeds.

Will it push BTC to $100K?

As of this writing, the agency held 331,200 BTC, value over $32 billion. The agency had beforehand introduced a daring plan to amass $42 billion value of BTC via a 21/21 technique.

The primary half, $21 billion, can be purchased by debt (like convertible notes), whereas the remaining can be funded by issuing shares. Primarily based on the newest strikes, the plan’s execution has picked up momentum.

As a Bitcoin proxy, the agency’s inventory, MSTR, has loved huge progress, using on the cryptocurrency volatility and its huge BTC holding.

In keeping with choices analytics agency Amberdata, MSTR’s implied volatility (future expectations) has remained elevated. This urged that the agency may promote extra debt and shares to purchase extra BTC. The end result may enhance MSTR and BTC within the quick time period.

A part of the Amberdata report learn,

“The market exercise makes me assume MSTR can nonetheless do one thing utterly, COMPLETELY, insane (like rally to $1,500 by EOY as BTC breaks previous $100k and is FOMO purchased to $120-$140k)

As of this writing, BTC was valued at $98.3K after a 9% rally final week. Nonetheless, the much-anticipated $100K goal remained elusive within the spot market over the weekend.

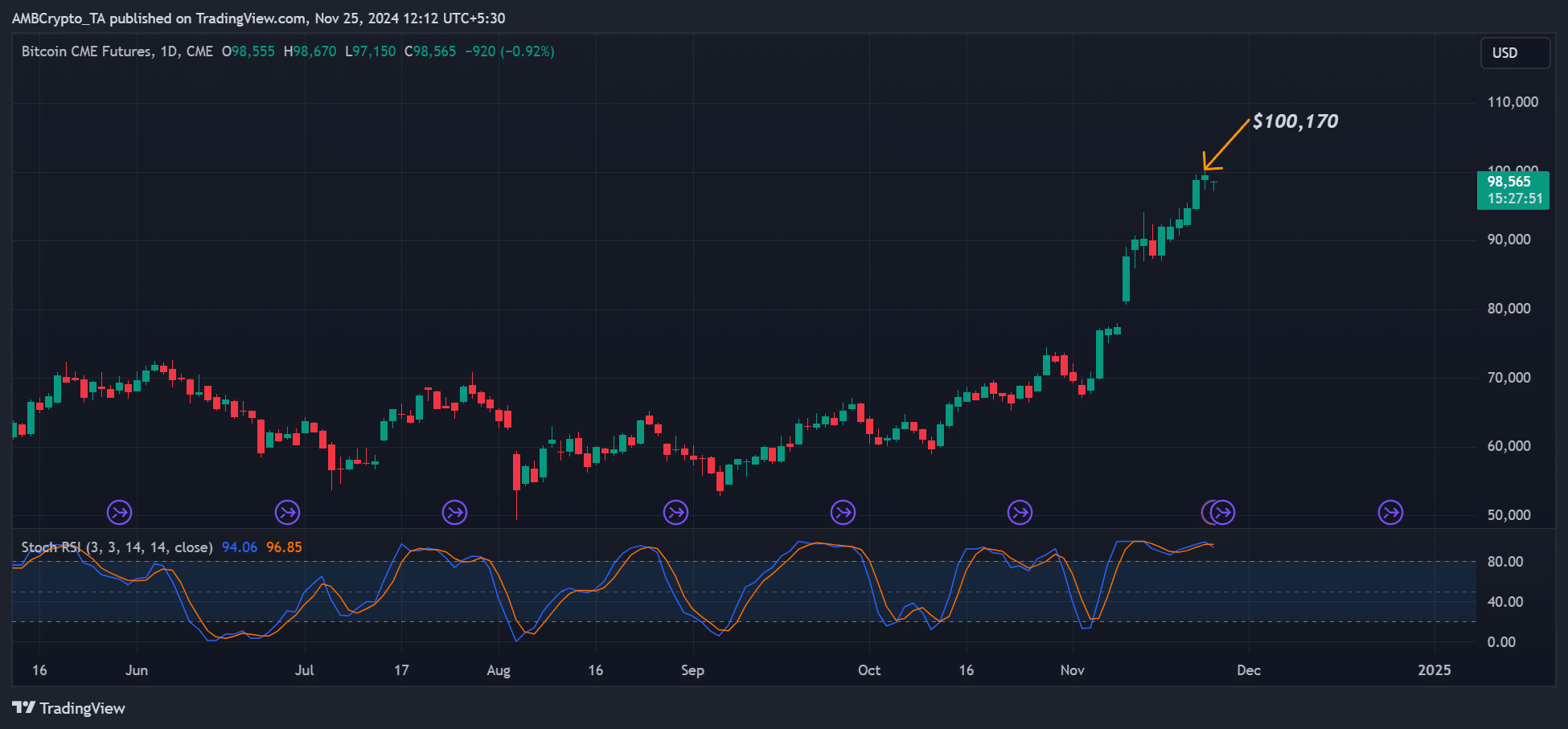

Curiously, CME Bitcoin Futures hit a brand new all-time excessive (ATH) of $100,170, elevating hopes that the spot market may quickly hit the $100K milestone. Whether or not Saylor’s announcement of BTC shopping for will speed up the goal stays to be seen.

Supply: Bitcoin CME Futures, TradingView

Then again, MSTR was valued at $421 at press time, up 6% earlier than the US market opened on November twenty fifth. Market pundits anticipated extra front-running for the inventory forward of its probably inclusion within the Nasdaq 100 earlier than December 2024.