- Japanese agency Metaplanet added $10.4 million in Bitcoin, bringing its holdings to over 1,000 BTC.

- Market indicators, together with rising open curiosity and MVRV ratio, sign potential for Bitcoin’s continued bullish momentum.

Following a dip in Bitcoin [BTC] value late final week, the cryptocurrency is displaying indicators of a rebound, with costs returning above $68,000 as the brand new week begins.

As of Monday morning, Bitcoin was buying and selling at roughly $67,953, marking a 1.3% enhance over the previous 24 hours and peaking at $68,210 in early hours of right this moment.

Metaplanet provides to its Bitcoin holdings

This restoration coincides with a major improvement: Japanese funding agency Metaplanet Inc has introduced one other giant Bitcoin buy, including $10.4 million value of BTC to its holdings.

This latest acquisition brings the agency’s Bitcoin reserves to over 1,000 BTC, positioning Metaplanet among the many high company Bitcoin holders in Asia.

Metaplanet’s renewed dedication to BTC displays a broader development of firms adopting cryptocurrency as a strategic treasury asset.

Following its preliminary announcement in Could, Metaplanet has steadily accrued BTC, rising its reserves from 141.07 BTC on the finish of June to a considerable 1,018.17 BTC right this moment.

Supply: Simon Gerovich on X

This dedication is bolstered by the agency’s capital market actions, together with a latest $66 million increase by way of its eleventh inventory acquisition program.

CEO Simon Gerovich shared that Metaplanet’s purpose to keep up BTC as a major reserve aligns with its long-term outlook on digital property. Nonetheless, the agency clarified that holding shares doesn’t present shareholders with any direct declare to the BTC in reserve.

BTC’s rising market indicators sign attainable value stability

Along with optimistic momentum from company shopping for, Bitcoin’s technical indicators are pointing to elevated investor curiosity.

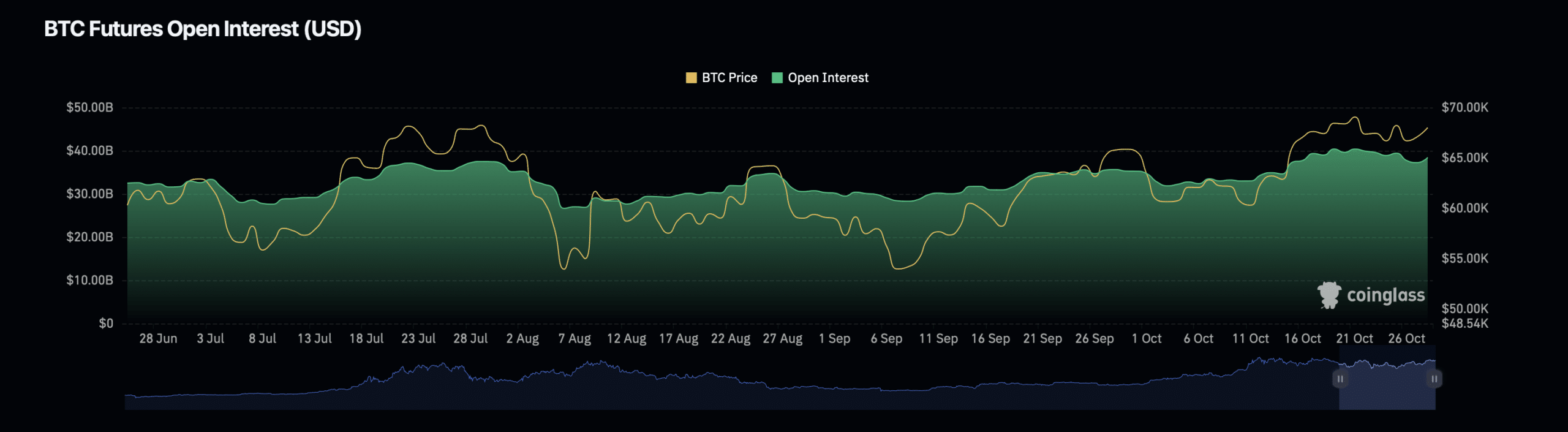

Information from Coinglass reveals that Bitcoin’s open curiosity has grown by 4.26%, reaching $38.89 billion, with open curiosity quantity seeing a considerable 61.13% enhance, at the moment valued at $33.77 billion.

Supply: Coinglass

Open curiosity refers back to the complete variety of excellent spinoff contracts, corresponding to futures and choices, that haven’t but been settled.

An uptick in open curiosity can point out larger market exercise, suggesting that traders anticipate additional motion in Bitcoin’s value. When open curiosity rises in tandem with a value enhance, it might sign a buildup of bullish sentiment.

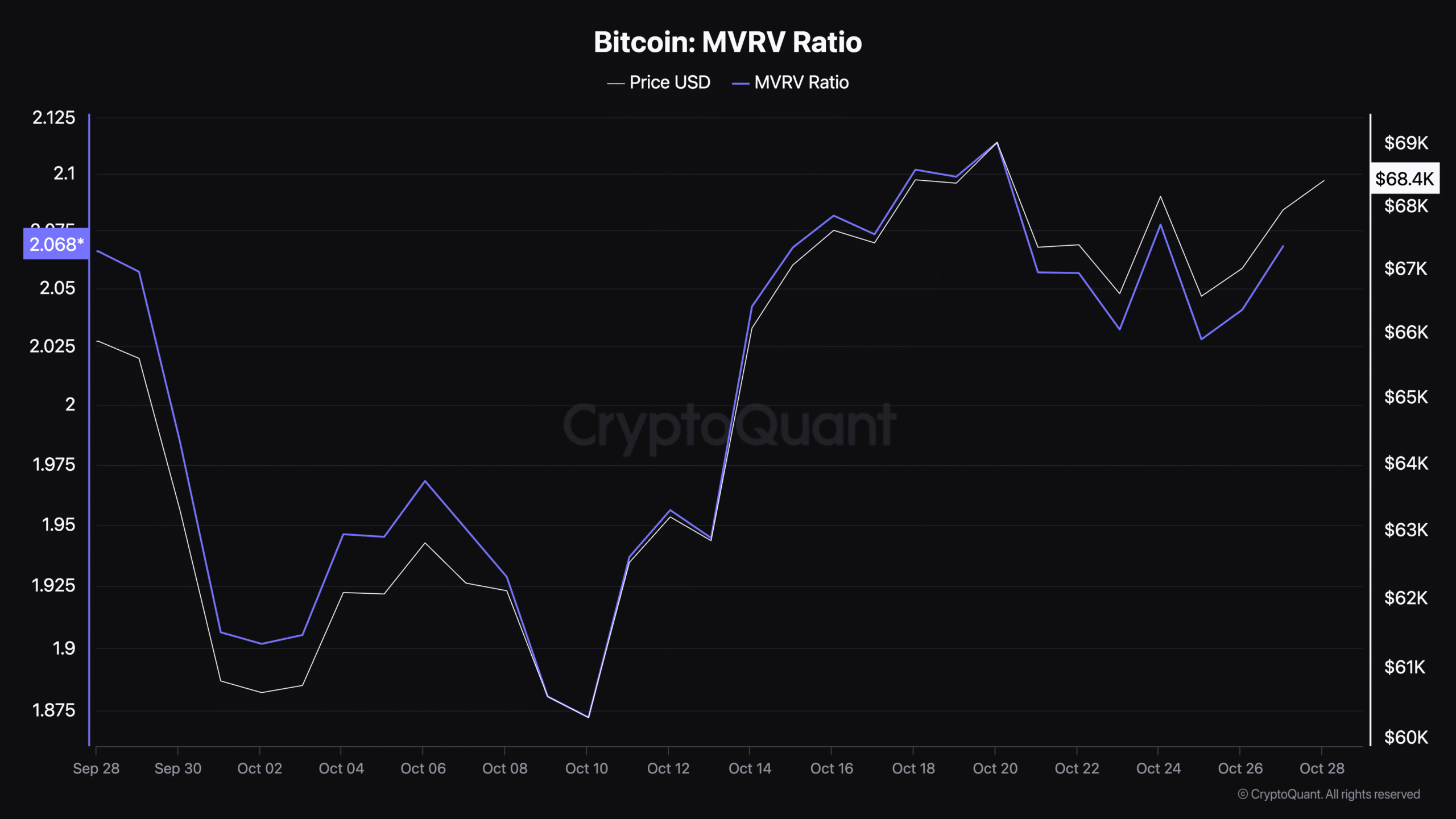

Moreover, Bitcoin’s Market Worth to Realized Worth (MVRV) ratio has just lately climbed to 2.06, as per CryptoQuant information. This metric compares Bitcoin’s present market worth to its common realized worth, offering perception into whether or not it’s overvalued or undervalued relative to its historic efficiency.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

An MVRV ratio above 1 typically alerts that BTC is valued larger than its buy price, suggesting the potential for investor profit-taking.

Nonetheless, an increase within the MVRV ratio, particularly throughout a interval of value stability or enhance, can mirror optimistic sentiment out there, because it implies traders are keen to carry onto their beneficial properties reasonably than promote.