- Metaplanet elevated Bitcoin holdings to 398.8 BTC amid the worth decline, boosting its share value.

- Institutional traders, resembling Metaplanet and MicroStrategy, maintained their Bitcoin investments regardless of market volatility.

Metaplanet, a publicly-listed funding and consulting agency based mostly in Japan, is sticking to its technique of “buy the dip” amidst Bitcoin [BTC]’s latest struggles.

As BTC battles to interrupt the $60,000 mark, its value not too long ago fell to $56,497.76, reflecting a 0.915% drop over the previous 24 hours, in keeping with CoinMarketCap.

Metaplanet will increase its Bitcoin holdings

Regardless of this downturn, Metaplanet has seized the chance to extend its Bitcoin holdings to just about 400 BTC.

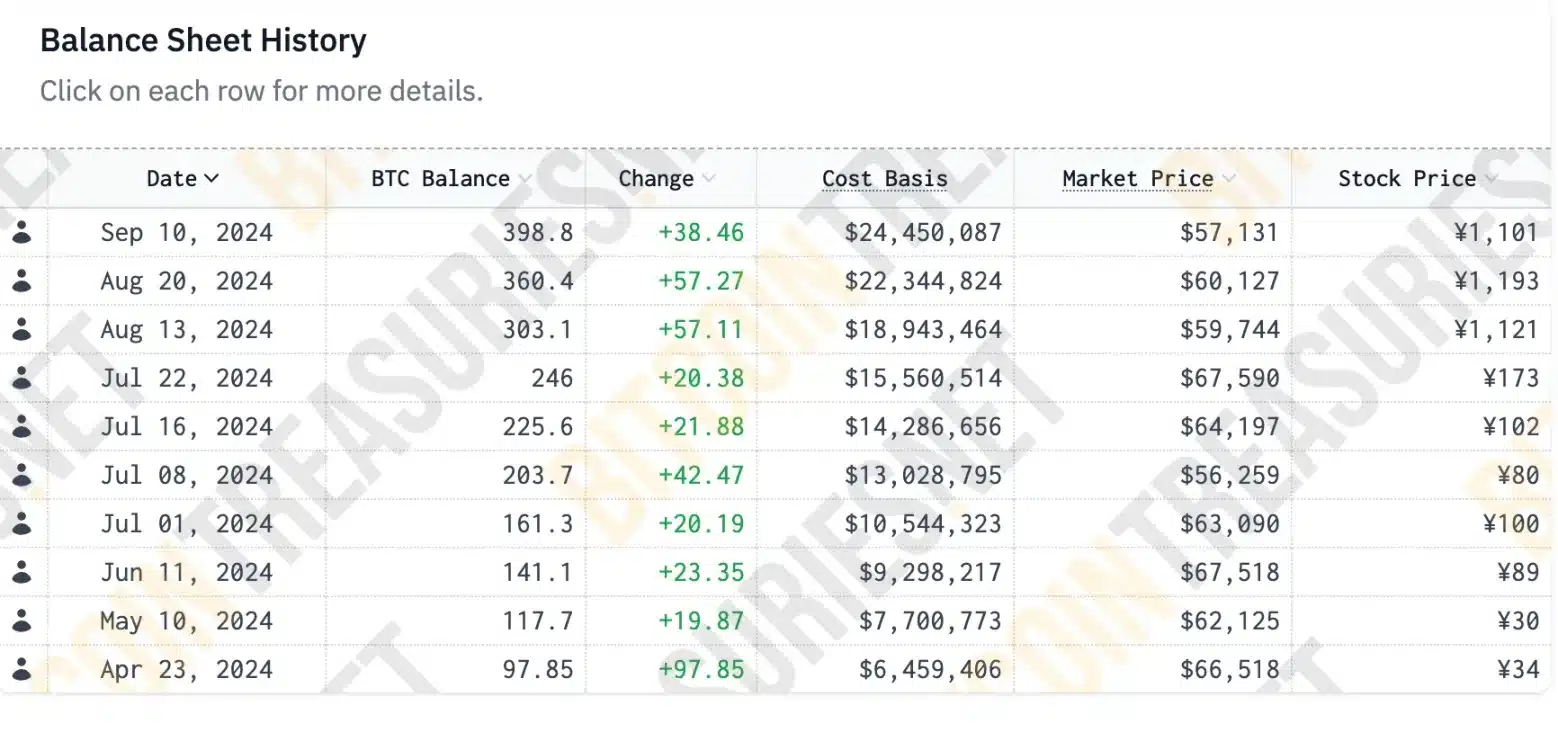

Supply: bitcointreasuries.web

This transfer has positively impacted its share value, which surged by 5.9% on the Tokyo Inventory Trade.

Metaplanet’s latest BTC acquisition highlights the funding technique generally known as “buying the dip.”

This method includes buying property when their costs drop, with the expectation that their worth will rise sooner or later.

By capitalizing on Bitcoin’s latest decline and including to its holdings, Metaplanet demonstrates confidence within the cryptocurrency’s long-term potential, regardless of present market volatility.

This technique reveals confidence in BTC’s long-term worth and displays a pattern of shopping for property throughout value drops to learn later.

What does the info spotlight?

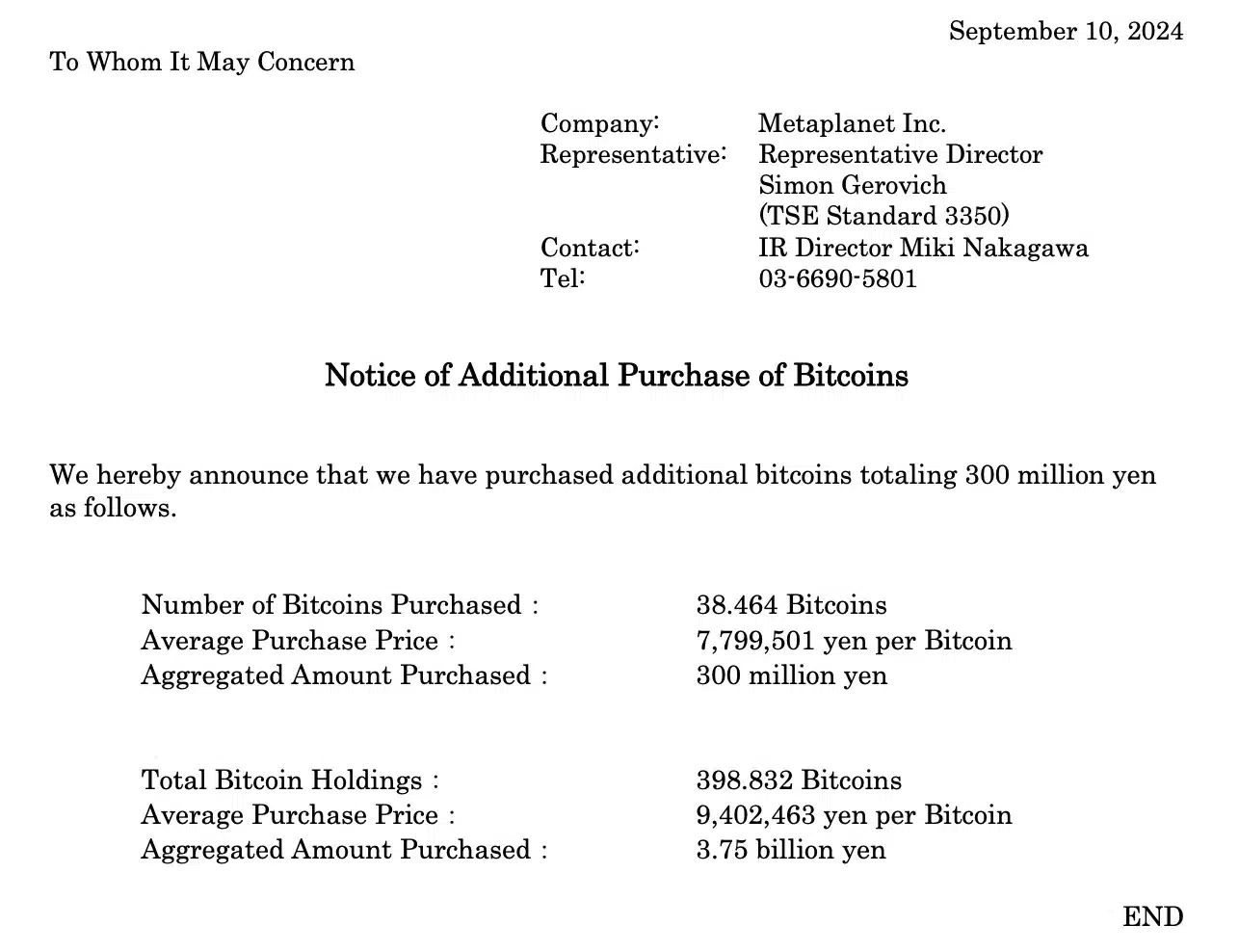

In response to the newest report launched on the tenth of September, Metaplanet acquired 38.46 Bitcoin for $2.1 million (300 million Japanese Yen).

This buy elevated their whole holdings to 398.8 BTC, valued at roughly $23 million.

Supply: metaplanet.jp

Moreover, in keeping with Bitcoin Treasuries information, Metaplanet started its BTC acquisition on the twenty third of April and made its tenth buy on the tenth of September.

Supply: bitcointreasuries.web

Because of this, Metaplanet now holds the Twenty seventh-largest company Bitcoin reserve globally and ranks third in Asia.

The Affect

Regardless of this vital buildup, the agency’s inventory value noticed a minor decline of 0.45%, buying and selling at 1,096 JPY, and Bitcoin additionally skilled a downturn.

Supply: Buying and selling View

Nonetheless, Metaplanet’s share value has surged by 480% because the firm first introduced its Bitcoin funding technique in early April, in keeping with MarketWatch.

In Might, Metaplanet revealed its technique to boost its BTC reserves by adopting a complete vary of capital market devices, mirroring the method taken by MicroStrategy.

MicroStrategy accumulates BTC

As anticipated, MicroStrategy, the biggest company holder of Bitcoin, not too long ago printed its second quarter 2024 monetary outcomes.

The discharge highlighted MicroStrategy’s ongoing dedication to increasing its BTC holdings.

“After yet another successful quarter for our bitcoin strategy, MicroStrategy today holds 226,500 bitcoins reflecting a current market value 70% higher than our cost basis. We remain laser focused on our Bitcoin development strategy and intend to continue to achieve positive “BTC Yield.”

This pattern underscores how institutional traders are rising their BTC holdings regardless of short-term value fluctuations, suggesting a possible bullish flip for BTC quickly.

What lies forward for Bitcoin?

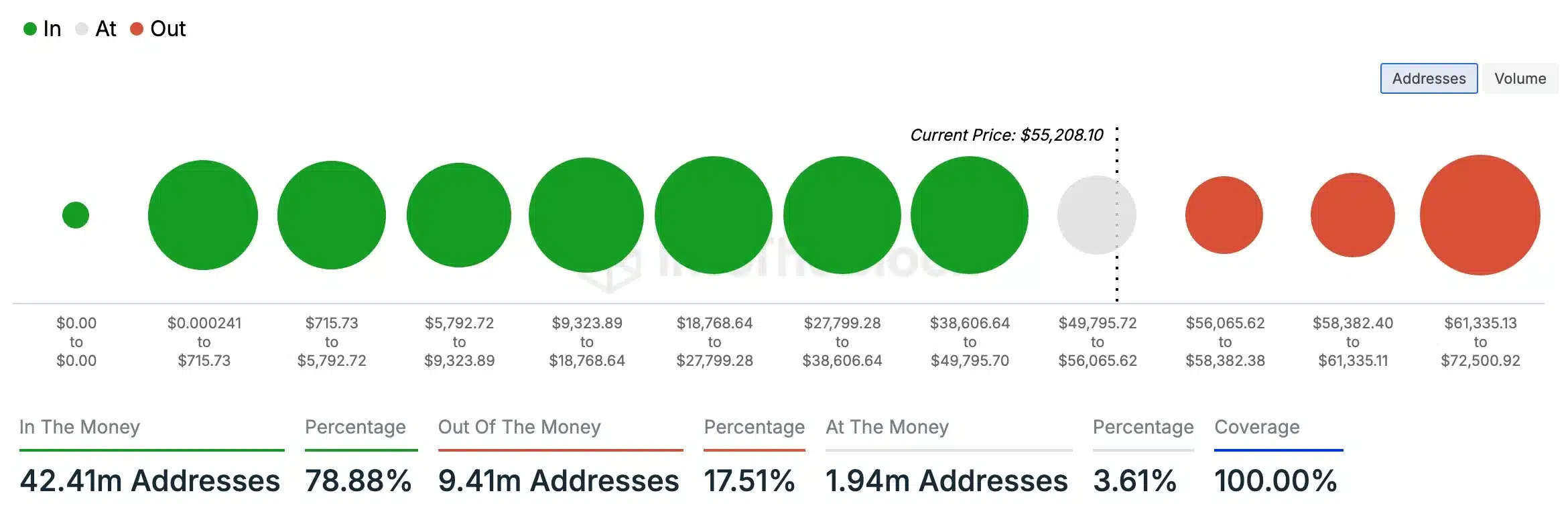

Evaluation by AMBCrypto, utilizing information from IntoTheBlock, reveals {that a} substantial majority (78.88%) of Bitcoin holders are presently “in the money,” holding tokens valued above their buy value.

Conversely, solely 17.51% of holders are “out of the money,” with tokens price lower than their preliminary funding.

Supply: IntoTheBlock

This information additional reinforces the expectation that Bitcoin could expertise a constructive shift in worth quickly.