As an skilled insurance coverage agent with a wealth of expertise, you’re seemingly conscious that gaining clients’ belief isn’t simple, particularly within the extremely aggressive insurance coverage business.

To stand out, it’s essential to implement efficient methods; that is the place social media advertising and marketing comes into the image.

Social media has fully revolutionized how companies join with their viewers, and insurance coverage brokers (or insurance coverage businesses) are not any exception.

With the evolution of social media advertising and marketing, you now have the chance to achieve an unlimited viewers, construct relationships with them, and achieve extra clients.

While standard strategies of lead era, reminiscent of networking occasions and direct mails, are nonetheless efficient for insurance coverage businesses, social media platforms can considerably broaden your attain.

In this information, we’ll present ideas, concepts, and best practices on utilizing social media for insurance coverage brokers so as to achieve extra enterprise and speed up progress.

So, with out additional ado, let’s dive in.

Before we transfer on to the principle topic, let’s discover in depth why insurance coverage brokers ought to set up a strong presence on main social media platforms:

Establishing belief and credibility: Regularly posting beneficial content on social media permits insurance coverage brokers to showcase their experience and set up themselves as authoritative voices of their subject. By sharing informative and useful content that educates and addresses the ache factors of their audience, brokers can construct belief and credibility amongst their followers.

Harnessing buyer insights: Regular interplay together with your viewers on social media via related content can present a wealth of perception into their preferences and ideas. This deep understanding of your buyer’s wants and expectations lets you devise higher advertising and marketing methods and tailor your choices accordingly.

Tip: Actively take heed to conversations, monitor related hashtags, and observe the newest business traits to realize an in-depth understanding of your viewers.

Enhancing buyer expertise: Social media can also be a well-liked channel for customer support interactions. Therefore, one other compelling cause for insurance coverage brokers to make use of social media is to offer customized, immediate assist to their purchasers. Social media helps you ship glorious customer support by serving to you reply inquiries, handle policy-related questions, and resolve complaints.

Monitoring opponents: Social media permits insurance coverage brokers to trace their opponents’ actions, together with their content, methods, and buyer engagement techniques. And why observe your rivals? It can encourage you to strive new concepts and enable you determine any market gaps.

Building a robust skilled model: Social media presents a singular alternative for insurance coverage brokers to construct a private model and set up themselves as thought leaders within the business. But how will you develop a particular model id? Sharing your experience, success tales, and insights might help construct a singular model id. Ensure you keep knowledgeable voice whereas doing so.

Cost-effective promoting: Insurance brokers can cost-effectively attain their audience utilizing exact focusing on choices on platforms like Facebook, Instagram, and LinkedIn. These choices permit brokers to focus on particular demographics, pursuits, and areas, providing a extra reasonably priced different to conventional promoting strategies like print or tv.

Now that we’ve explored the advantages of social media for insurance coverage brokers, let’s focus on the best social media platforms for them.

Let’s get began.

Take a have a look at the important thing social media networks for insurance coverage brokers to ascertain an lively presence on:

1. Facebook for Insurance Agents

Given its demographics, Facebook is likely one of the best platforms for insurance coverage brokers to search out purchasers.

Why is that this so?

Facebook is residence to a various viewers, a lot of whom are on the peak of their insurance coverage wants, whether or not life and property or pet medical insurance coverage.

With this in thoughts, insurance coverage brokers can leverage Facebook to achieve extra individuals. They may run focused advert campaigns and even construct a group via Facebook Groups to realize extra clients.

Tip: Regularly posting informative posts, consumer testimonials, and business updates might help set up credibility and belief amongst your audience on Facebook.

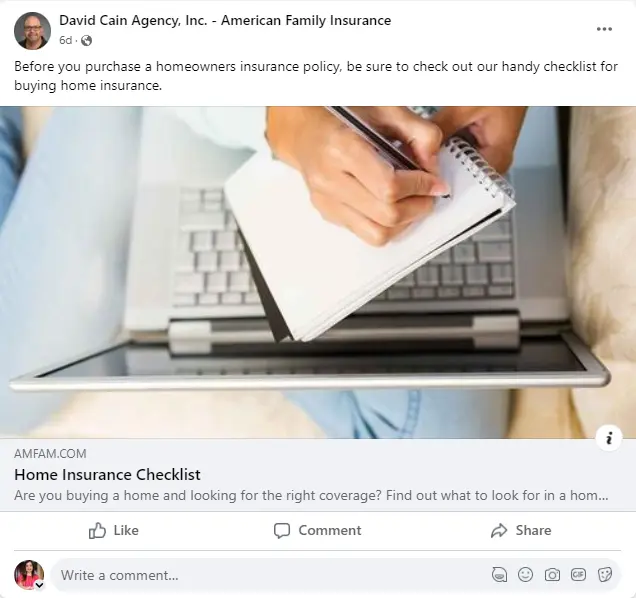

Look at how this insurance coverage agent has shared a useful residence insurance coverage guidelines with their viewers on Facebook | Source.

2. Twitter for Insurance Agents

Twitter is one other platform that insurance coverage brokers can use to have interaction with their audience.

The platform’s concise, to-the-point dialog model lets customers join successfully with their followers.

Now, how will you use Twitter as an insurance coverage agent?

Twitter is an efficient platform for sharing business information, posting essential updates, answering buyer queries, and showcasing your experience.

Moreover, Twitter is a superb instrument for social listening, which might help you perceive your viewers higher and shut gross sales extra rapidly!

Check how GEICO shared an essential replace on Twitter stating how their response group helps a group recuperate from Hurricane Ian and the way they’ve put in place pop-up websites to assist settle claims rapidly | Source

3. YouTube for Insurance Agents

YouTube is a platform the place companies can constantly share participating video content. Some social media content concepts for insurance coverage brokers for YouTube embrace subjects that simplify insurance policies or ideas for choosing the proper protection.

In all, insurance coverage brokers can place themselves as trusted advisors on YouTube and appeal to potential purchasers looking out for insurance-related info.

4. Instagram for Insurance Agents

Instagram is a extremely visible platform the place you may simply construct your place as an issue knowledgeable. However, make sure you’re discovering the fitting steadiness. Don’t solely submit visually interesting content; supply precise worth to your followers.

Some efficient social media content concepts for insurance coverage brokers for Instagram embrace:

Showcasing your organization tradition, group involvement, behind-the-scenes glimpses, and consumer success tales.

What’s extra?

Instagram is a wonderful platform for leveraging influencer collaborations and using related hashtags to broaden attain and engagement. So, think about incorporating these methods into your marketing strategy.

5. TikTookay for Insurance Agents

TikTookay is yet one more social media platform for insurance coverage brokers to think about.

This extremely in style social platform, with 15.54 million every day lively customers, is thought for its quick and entertaining movies. If your purpose is to teach and interact a youthful demographic, TikTookay is the place you have to be. The platform comes built-in with video-editing instruments, and also you don’t have to be a tech guru to make use of the platform.

What sorts of content must you share on TikTookay?

Some examples embrace: movies that simplify insurance coverage ideas, debunk frequent misconceptions, and supply ideas for saving cash on insurance policies.

6. Alignable for Insurance Agents

Alignable is a social media platform particularly designed for native companies and professionals to attach and collaborate.

Insurance brokers are turning to Alignable as a result of it supplies an internet area to satisfy and join with the enterprise homeowners that match their consumer base.

Alignable permits insurance coverage brokers to showcase their experience, take part in group discussions, and achieve native visibility.

Therefore, insurance coverage brokers ought to think about using Alignable to draw extra purchasers.

Looking for a bunch of extremely efficient social media advertising and marketing ideas for insurance coverage brokers to maximise their social media efforts?

Take a have a look at the picture under:

Let’s put these social media advertising and marketing ideas for insurance coverage brokers to good use by discussing the varied social media submit concepts.

Keep studying.

Here are some nice social media submit concepts for insurance coverage brokers that you need to use to have interaction your social viewers efficiently:

1. Create Video Content

In this digital age, video content is king. As per the newest statistics, an estimated 3.37 billion web customers watched video content in 2022. It’s a recognized incontrovertible fact that movies can convey messages extra impactfully than pictures. As an insurance coverage agent, you may create informational movies on subjects related to your area of interest.

For occasion, you may discuss related business information, share money-saving recommendations on a selected insurance coverage coverage, or just spotlight the advantages of a particular coverage. In the top, make sure you create content that solves the issues and questions of your viewers in a fascinating, impactful method.

You may even use the reside streaming capabilities of a social platform to have interaction together with your audience as properly.

One of the simplest social media advertising and marketing methods for insurance coverage brokers is sharing buyer testimonials.

Testimonials function free promoting for your enterprise and are an ideal type of social proof that encourages potential purchasers to work with you. When you share testimonials on social media, your clients really feel heard and appreciated, strengthening your relationship with them.

Tip: Frame your testimonials in line with the platform you might be posting on. Create a visually interesting graphic that includes a constructive consumer ranking if it’s an image-centric platform. If it’s a text-centric platform, submit the testimonial textual content and share it together with your followers.

3. Engage With Infographics

Chances are, you’ll have shared FAQs in your web site weblog. Now, see when you can flip a few of your solutions into participating infographics for your social media viewers.

But, why infographics?

Infographics are charts, illustrations, diagrams, and different graphics that assist put essential info ahead with the least quantity of phrases. Owing to their easy, colourful, and informative nature, they hook consideration immediately.

So, whereas looking out for social media content concepts for insurance coverage brokers, make sure you share some beneficial infographics together with your viewers.

Apart from taking info out of your FAQs, you may as well share infographics that specify processes, statistics, lists, comparisons, and timelines engagingly.

Some subject concepts that insurance coverage brokers can clarify via infographics embrace:

- How entire and time period life insurance coverage are completely different

- The claims fee course of

- The fee course of to a beneficiary

- Do’s and don’ts if you’re in an accident

- What steps to observe to avoid wasting up on home insurance coverage prices

Tip: Tools reminiscent of Canva, Visme, and Venngage mean you can make interesting infographics.

Did a brand new worker be a part of you? Are you providing a brand new coverage or partnering with a brand new provider? Share all the newest information in your social media channels!

Why?

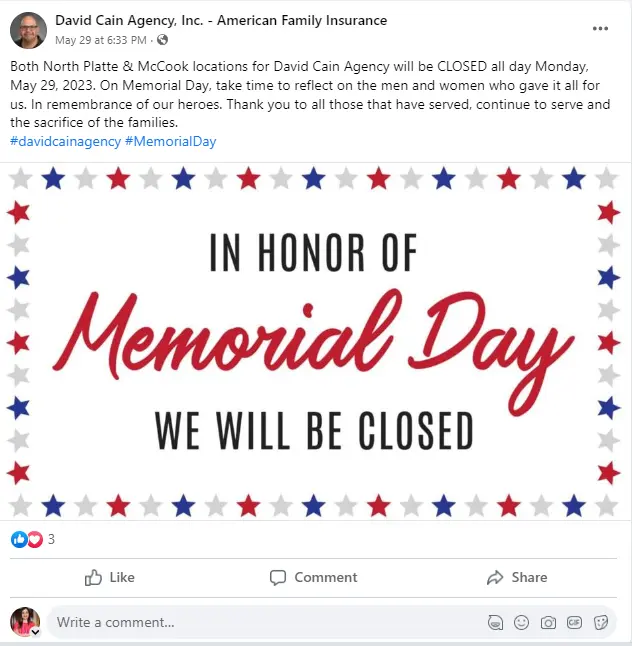

Sharing essential updates about your enterprise helps your enterprise come off as genuine, instilling belief and confidence within the minds of your potential purchasers. For occasion, try this submit of an insurance coverage agent who shared an essential workplace replace stating that they’ll stay closed on Memorial Day.

Source

Social media is, in any case, a social discussion board. While it’s fully nice that you simply share posts about your enterprise, make sure you submit Reels, Tweets, photographs, and Stories about your private life as properly (if you’re an unbiased insurance coverage agent).

Think about it…

People favor to do enterprise with individuals they know relatively than with strangers. Hence, you will need to share private content together with your followers every so often.

While it’s essential to know social media advertising and marketing concepts for insurance coverage brokers, we additionally want to speak about some vital challenges that insurance coverage brokers face and the way to overcome them.

Keep studying to know extra.

Here are some frequent challenges and techniques to beat them:

Increasing lead era: One of the numerous challenges within the insurance coverage sector is lead era. Key social media platforms could be instrumental in overcoming this hurdle. Insurance brokers going through the hurdle of buying leads can flip to social networks reminiscent of Facebook, Twitter, TikTookay, and Instagram and use focused adverts or interactive content polls or quizzes to generate leads.

Even by constantly posting useful and fascinating content, you enhance your possibilities of gaining leads.

Bridging the hole between clients and insurance coverage suppliers: Often, there’s a communication hole or lack of know-how between insurers and their purchasers. Social media might help bridge this hole by fostering two-way communication, offering academic content, and answering real-time consumer queries.

Building belief within the insurance coverage business: Trust has all the time been a priority within the insurance coverage business. Thanks to social media, insurance coverage brokers can now construct belief amongst their purchasers by posting related content reminiscent of testimonials and behind-the-scenes insights. Showcasing their experience and dedication to consumer service on social media channels can instill confidence in purchasers when buying insurance coverage choices.

Responding to financial fluctuations: Economic downturns can considerably affect the insurance coverage business. During such instances, insurance coverage brokers can use social media to share informative content with their clients on the way to handle their insurance coverage successfully.

Are you conscious that there are instruments accessible to help you in managing the social media presence of your enterprise?

A social media administration instrument helps companies streamline their social media actions. These instruments assist plan, schedule, submit, and monitor content throughout varied social media platforms.

Take a have a look at a few of the top social media administration instruments:

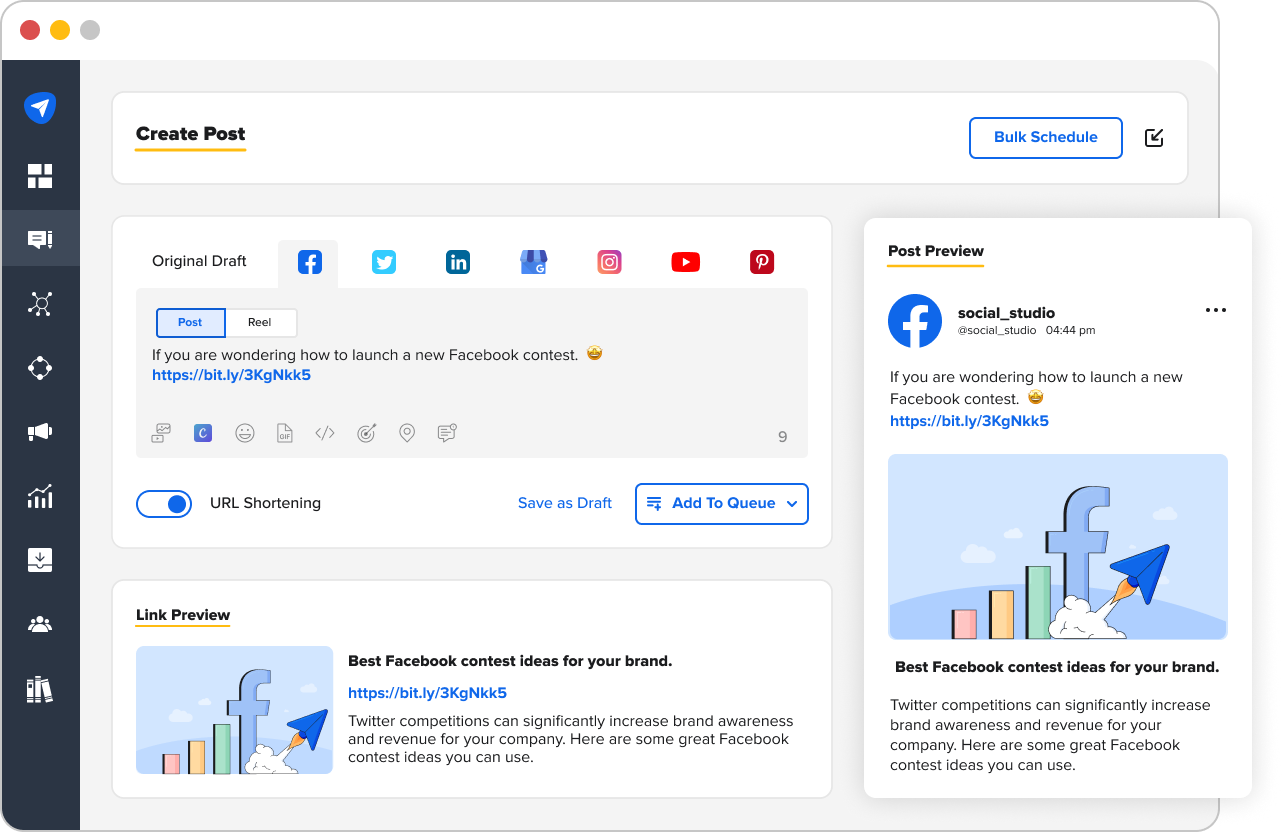

SocialPilot is the go-to instrument for efficient social media administration for insurance coverage brokers and advertising and marketing businesses dealing with a number of insurance coverage company accounts.

Here are a few of the options you may anticipate from this instrument:

- Scheduling and publishing: SocialPilot permits efficient scheduling and publishing of your social media content throughout varied platforms. This means you get to broaden your enterprise’s attain and appeal to potential clients rapidly and effectively. You can personalize your posts within the instrument by incorporating movies, pictures, emojis, GIFs, mentions, and hashtags.

- Analytics: SocialPilot offers you insights into the efficiency of your social media accounts. How does this enable you? This info assists you in analyzing the outcomes and making any mandatory changes.

- Social Inbox: This instrument features a easy and efficient Social Inbox, facilitating real-time engagement together with your social media viewers.

- Collaboration: SocialPilot enhances your group’s effectivity by enabling you to ask group members and purchasers to collaborate on particular accounts.

2. Hootsuite

Hootsuite is a sturdy social media administration instrument permitting insurance coverage brokers to submit constantly with the assistance of its scheduling function. The instrument additionally affords monitoring capabilities, which assist monitor mentions, business traits, and keywords.

With the assistance of Hootsuite’s group collaboration function, you may assign duties, handle approvals, and keep a unified social media technique. The platform additionally affords detailed analytics and reporting options to trace the efficiency of social media campaigns, measure engagement, and perceive viewers habits.

3. Buffer

Buffer is a dependable social media administration instrument for scheduling posts upfront. With this instrument, you may create tailor-made posting schedules based mostly in your viewers’s habits and engagement patterns.

Buffer additionally supplies a content library to prepare and retailer pictures, movies, and different media property for easy accessibility and reuse. Apart from this, the instrument affords detailed analytics to measure the efficiency of posts and monitor engagement.

Sprout Social boasts many helpful options that may profit insurance coverage brokers. Features like scheduling, content calendars, and collaborative planning assist streamline the content creation and publishing course of.

The instrument additionally has a unified social inbox that mixes messages and feedback from a number of social media platforms making it simpler to streamline communication and guarantee well timed responses.

Apart from this, when you resolve to make use of the instrument, you may monitor model mentions, business traits, and competitor exercise. Lastly, the platform supplies complete analytics and reporting to trace efficiency, measure marketing campaign success, and generate customized reviews.

5. Later

Later makes a speciality of visible platforms like Instagram, permitting insurance coverage brokers to plan and schedule posts with pictures and movies. The devoted media library makes storing and organizing visible property simple, simplifying content creation and curation.

When you discuss of Instagram particularly, Later affords hashtag ideas, analytics for Stories, and the power to preview the visible grid earlier than publishing.

Conclusion

In conclusion, social media serves as a robust instrument for insurance coverage brokers aiming to broaden their attain, interact extra successfully with their viewers, and develop their companies. By harnessing the potential of platforms like Facebook, Twitter, YouTube, Instagram, Alignable, and TikTookay, insurance coverage brokers can entry an unlimited pool of potential purchasers and solidify their place as trusted authorities within the insurance coverage business.

Remember, the important thing to profitable social media advertising and marketing lies in understanding your viewers, delivering beneficial content, and fostering real connections. By implementing the guidelines, concepts, and best practices outlined on this complete information, you’re not simply setting your self up for success in social media advertising and marketing but in addition paving the way in which for a thriving insurance coverage enterprise within the digital age.

Perfect Your Strategy – SEO Tips, Tricks and Myths Debunked

Perfect Your Strategy – SEO Tips, Tricks and Myths Debunked