- Marathon {Digital} declares an bold plan to additional Bitcoin funding.

- Bitcoin provide reserve in all exchanges hits the bottom stage since 2018.

Marathon {Digital}, a number one Bitcoin [BTC] mining agency, plans to lift $250 million to purchase extra Bitcoin.

After buying $100 million value in July, Marathon now holds 20,000 BTC. Current knowledge reveals that giant traders, referred to as whales, have been steadily growing their BTC holdings over the previous few months, signaling sturdy market confidence.

This institutional involvement has been evident within the regular rise of accumulation indicators which have been supported by totally different metrics together with provide reserves.

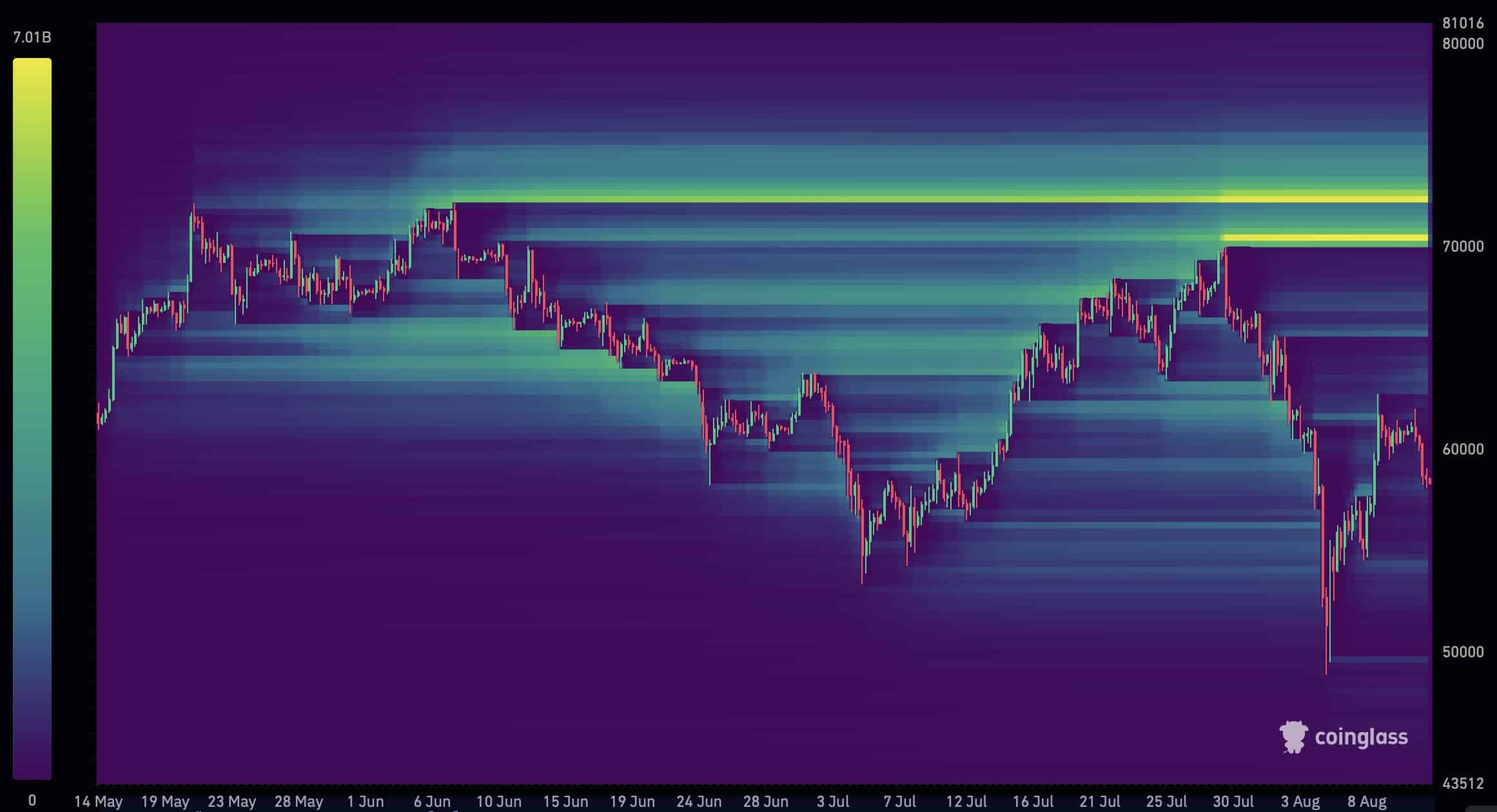

Supply: CryptoQuant

BTC reserves on all exchanges have additionally dropped to their lowest stage since 2018, with a major decline noticed for the reason that begin of this 12 months.

This implies that establishments are steadily accumulating Bitcoin, possible as a result of they anticipate a optimistic market pattern.

Such a decline in out there provide is a powerful bullish sign, indicating rising investor confidence in Bitcoin’s future.

For that reason, that is the time to think about a bullish stance on BTC because the market shifts.

Liquidation ranges

Over $15 billion in BTC quick positions shall be liquidated when the value hits $72K, based on Coinglass.

Vital liquidity lies between $70K and $72K, suggesting a market shift as large establishments accumulate BTC for long-term good points.

Supply: Coinglass

Bitcoin opens one other CME hole

This week, Bitcoin has created one other CME hole, including to the 2 large gaps it closed not too long ago, with the most recent shut at $63K marking a neighborhood prime.

A brand new hole now sits above the $61K worth mark. Whereas gaps don’t at all times shut, they typically do, signaling worth rallies in the direction of the hole.

Supply: TradingView

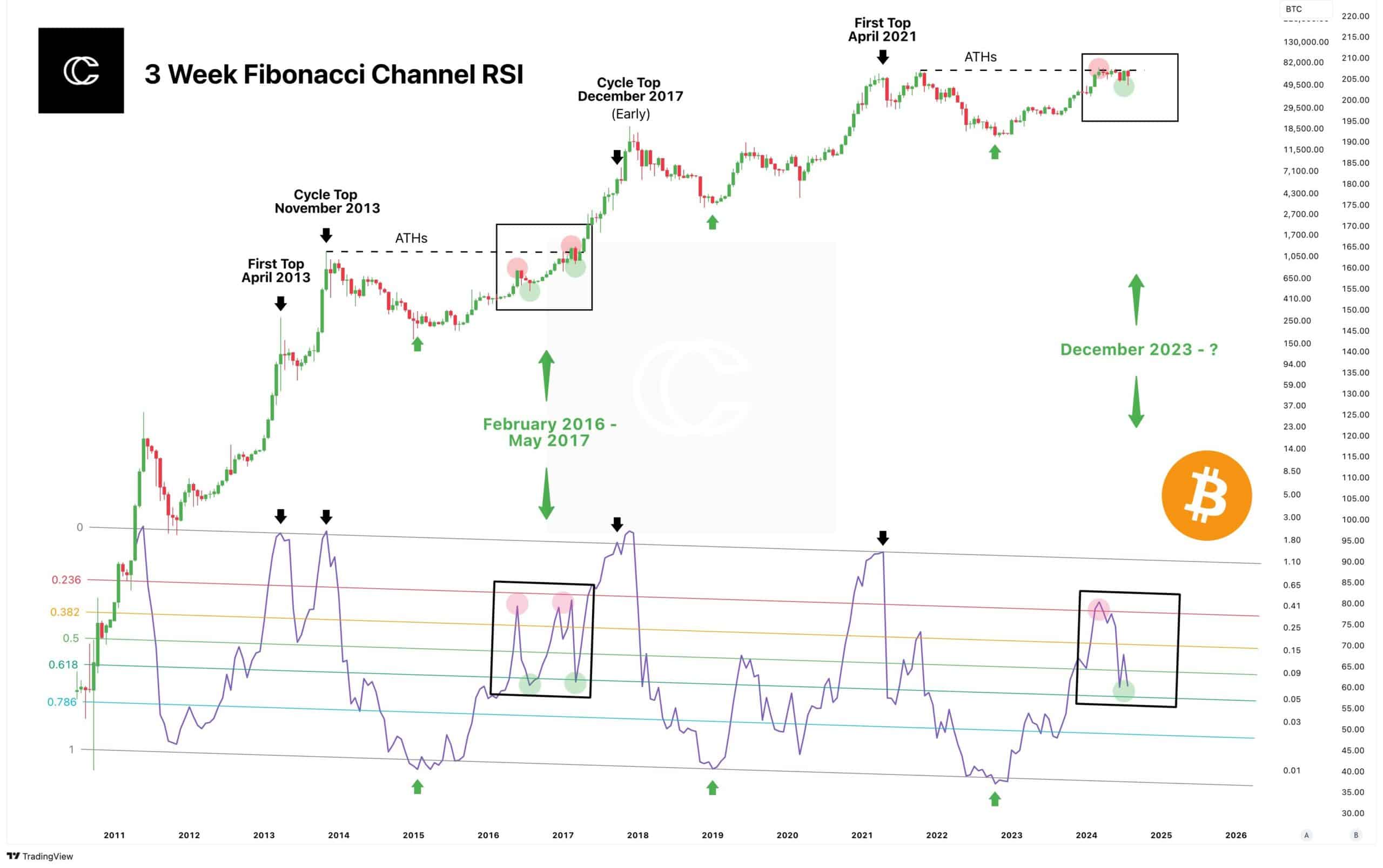

Bitcoin RSI on Fibonacci ranges evaluation

The AMBCrypto evaluation staff famous the 2-week Bitcoin RSI hit the cycle tops, however the 3-week RSI supplied a clearer view of the market sentiment.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

BTC’s RSI sample now mirrors the 2016-2017 interval when it aimed for brand new highs.

Not like earlier cycle peaks, this implies that the March 2024 transfer was vital, however the perception is that the bull market might proceed for over a 12 months as soon as establishments end accumulating.

Supply: TradingView