- Marathon {Digital} purchased an additional $100 million as a part of a brand new HODL method.

- MARA plans to carry all its mined BTC and purchase extra from open markets

Standard Bitcoin [BTC] miner Marathon {Digital} is within the information right this moment after it added $100 million price of BTC as a part of a brand new technique. Mara {Digital} CEO Fred Thiel acknowledged that the agency added the stash over the previous month to “strengthen” its treasury technique.

“Today Marathon is proud to announce that to strengthen our strategy of holding #Bitcoin as our strategic treasury reserve asset…We will now go full HODL.”

The agency added that its new full HODL method means it will preserve all mined BTC and strategically accumulate much more from open markets. That’s a bullish cue from one of many largest BTC miners, reiterating the digital asset’s ‘long-term value’ in the long term.

Marathon {Digital}’s transfer: Is BTC miner disaster over?

A current Bernstein report additionally illustrated MARA’s accumulation spree and HODL method. The report famous that MARA’s portion of BTC bought as a proportion of manufacturing declined from 56% in 2023 to 31% in 2024.

Supply: Bernstein

The HODL pattern has additionally been seen throughout different BTC miners, like Riot platforms and CleanSpark.

In actual fact, MARA’s CEO and Chairman Fred Thiel is now encouraging others to comply with their HODL method and embody BTC as a strategic treasury reserve.

“We believe Bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold bitcoin as a reserve asset.”

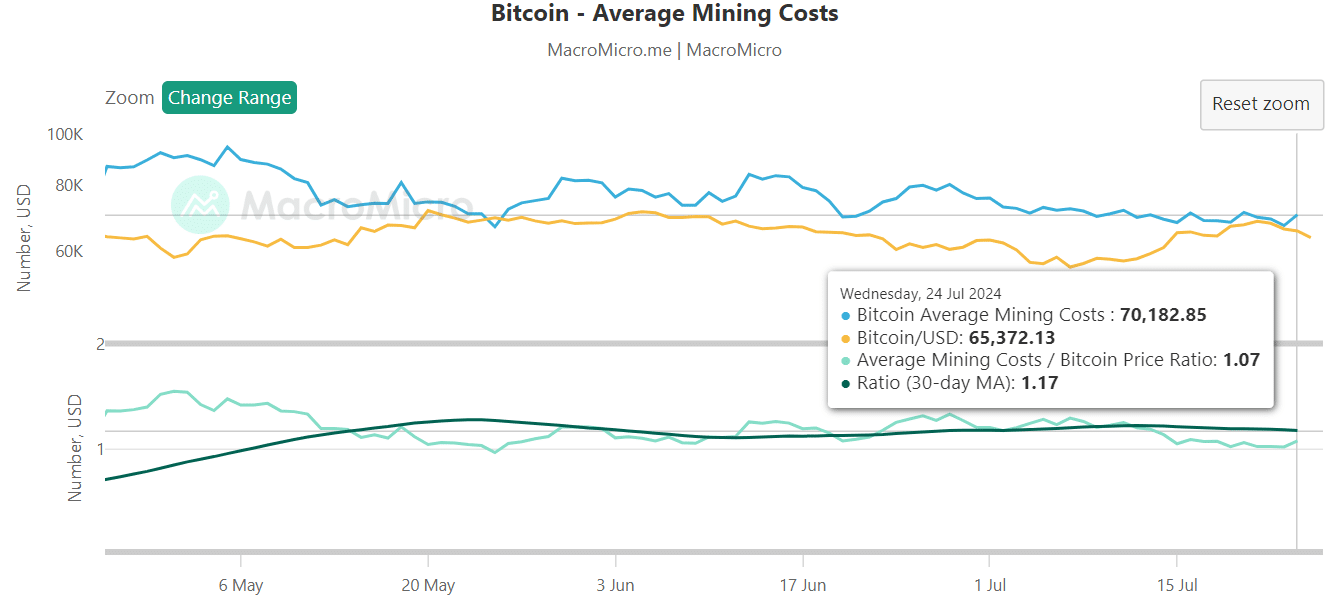

Regardless of the holding technique of some giant publicly-traded BTC miners, common mining prices stay means above the crypto’s current worth although. At press time, the typical mining value stood at $70K, towards a press time worth of $65K.

Supply: MacroMicro

Which means that BTC miners’ profitability continues to be an issue, particularly for small-scale personal corporations.

Nevertheless, in accordance with BTC analyst Willy Woo, this might quickly change when miner capitulation ends. The analyst added that the tip of the miners’ disaster might rally BTC miner shares, together with MARA.