Picture supply: Getty Photographs

Lloyds Banking Group‘s (LSE:LLOY) shares have gone completely gangbusters up to now three months.

At 54.4p per share, the inventory has risen round a fifth because the remaining days of February. Just like the FTSE 100‘s different main banks, Lloyds has leapt as hopes of growth-boosting rate of interest cuts have risen.

There’s a few necessary questions I have to ask proper now. Do the corporate’s shares nonetheless supply strong worth at present costs? And is the financial institution actually a sexy inventory to purchase at present?

All-round worth

Dealer forecasts can usually miss their goal. However utilizing projections from seasoned Metropolis analysts is an effective technique to gauge a inventory’s funding attraction.

Based mostly on present estimates, it appears at first look that there’s nonetheless loads of worth available with Lloyds shares.

At this time, the Black Horse Financial institution trades on a ahead price-to-earnings (P/E) ratio of 9.5 instances. It additionally carries an enormous 5.4% dividend yield.

By comparability, the typical readings for FTSE 100 shares are 11 instances and three.5%, respectively.

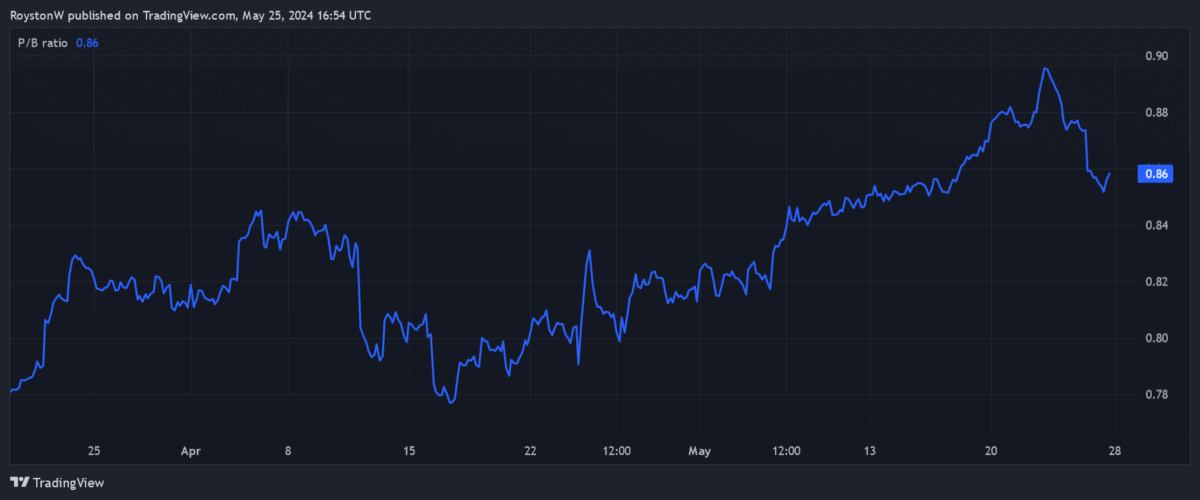

This isn’t all. Lloyds additionally appears to be like low cost when you think about the worth of its belongings utilizing the price-to-book (P/B) ratio.

Because the chart above exhibits, the shares commerce on a sub-1 a number of, indicating that Lloyds is at a reduction to its ebook worth (whole belongings minus whole liabilities).

Discount or basket case?

As an investor, I’ve to contemplate whether or not a inventory’s low valuation is merited or not.

Some shares are genuinely underpriced by the market, and have the potential to rise strongly as traders clever as much as this truth.

Nevertheless, some companies commerce cheaply for good purpose. They’ve poor progress prospects, expose traders’ money to vital threat, or each.

It’s my perception that Lloyds falls into the ultimate class.

Danger vs reward

It’s not all dangerous for the banking large. A (seemingly) fall in rates of interest may enhance revenues and scale back mortgage impairments. Indicators of restoration within the housing market are one other good omen as Lloyds is by far the nation’s largest residence mortgage supplier.

But I consider the dangers of proudly owning Lloyds shares outweigh the potential advantages. For one, whereas reversing rates of interest can enhance banks’ earnings not directly, additionally they squeeze internet curiosity margins (NIMs), a key gauge of profitability.

The outlook for the UK financial system additionally appears to be like bleak even when rates of interest drop as predicted. Labour market issues, post-Brexit turbulence, low productiveness, and excessive public debt are only a few challenges to progress within the quick time period and past.

Big problem

Lloyds additionally has an almighty combat to cease challenger banks consuming into its income.

These new entrants will not be solely providing market-leading merchandise. The likes of Monzo and Starling are additionally profitable with regards to their web platforms, because the graphic from Fairer Finance above exhibits. You’ll see that the challengers are higher trusted than Lloyds and the opposite established banks.

Given the rising recognition of on-line banking, and the significance of belief with regards to cash issues, that is extraordinarily worrying knowledge. And it explains why the challengers are gaining market share.

As I say, Lloyds shares are low cost, however I consider they’re low cost for a purpose. I’d a lot reasonably purchase different UK worth shares at present.