- Metaplanet’s elevated Bitcoin holdings mirror MicroStrategy’s profitable institutional adoption technique.

- Regardless of volatility, Metaplanet’s inventory rises in sync with Bitcoin’s upward trajectory in 2024.

As Bitcoin [BTC] and the broader crypto market bled crimson for days, Metaplanet, a publicly-listed funding and consulting agency primarily based in Japan, has determined to extend its BTC holdings.

This transfer underscores the technique referred to as “buying the dip,” the place traders buy belongings at decreased costs with the expectation of future worth appreciation.

For these unfamiliar with the time period, “buying the dip” displays a perception within the asset’s long-term potential regardless of short-term market fluctuations.

Metaplanet’s Bitcoin holdings

Based on the assertion launched by Metaplanet Inc.,

“We hereby announce that we have purchased an additional 400 million Yen worth of Bitcoin.”

The assertion additional elaborated,

Supply: Metaplanet Inc.

This transfer by Metaplanet aligns intently with Michael Saylor’s MicroStrategy BTC holdings. As of twentieth June, Saylor emphasised,

“$MSTR hodls 226,331 $BTC acquired for ~$8.33B at average price of $36,798 per bitcoin.”

Following the steps of MicroStrategy

In reality, MicroStrategy’s BTC holdings have contributed to a 380% improve in MSTR inventory value. Based on CCData’s current report titled ‘2024 H2 Outlook’,

“MicroStrategy led with a 380% rise in stock price, driven by its 214,000 Bitcoin holdings now worth $13.3bn, purchased at an average cost of $35,158. These holdings have earned the company approximately $6.54bn since 2020.”

Following within the footsteps of MicroStrategy, Metaplanet is usually hailed as “Asia’s MicroStrategy,” highlighting the rising adoption of BTC amongst establishments.

Evidently, the launch of Bitcoin ETFs have been a catalyst that shifted the angle of tens of millions, together with Wall Avenue, from viewing BTC as a menace to now seeing it as a chance.

Furthermore, there was a notable shift in political curiosity, notably from former President Donald Trump, who as soon as mocked cryptocurrencies, however now sees crypto and Bitcoin as doubtlessly pivotal in profitable upcoming elections.

Affect of Bitcoin on Metaplanet’s inventory value

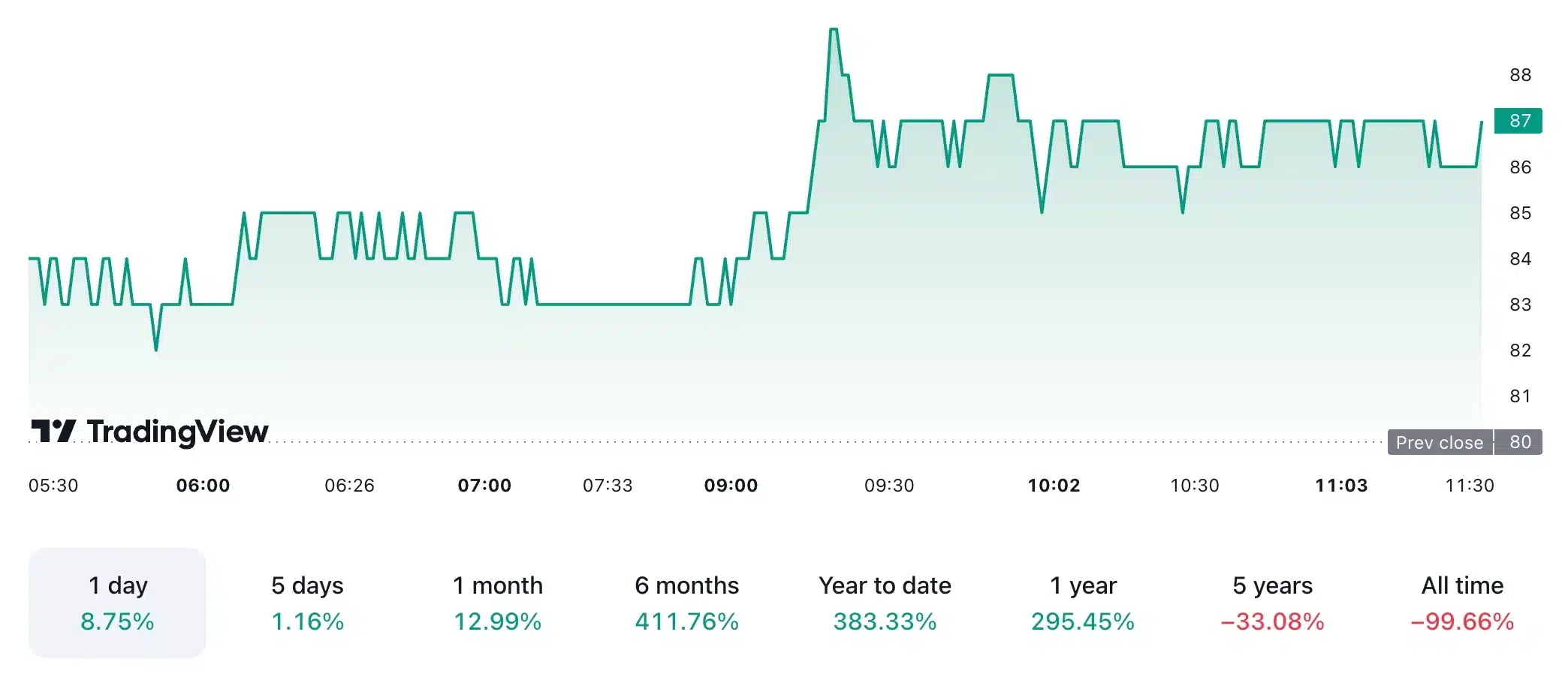

Nonetheless, just like the current downturn in Bitcoin, there was a direct detrimental influence on Metaplanet’s inventory value.

After reaching a peak of 107 yen on eleventh June, Metaplanet inventory declined by 25% as BTC dropped from round $70,000 to under $60,000.

Nonetheless, as of the most recent replace, the inventory was buying and selling at 87 yen, reflecting an 8.75% improve prior to now 24 hours, with the inventory’s year-to-date value rising by 383.33%.

Supply: TradingView

In the meantime, Bitcoin was buying and selling at $57,705 at press time, having seen a 2.29% improve prior to now 24 hours, and boasting a year-to-date acquire of 36.55%.