Picture supply: Getty Photographs

UK shares have loved some spectacular positive factors because the begin of 2024. The FTSE 100’s risen 6% in worth. Nevertheless, these robust upward actions are fuelling fears of a possible inventory market crash.

These dire warnings aren’t simply coming from fringe commentators both. None aside from the Financial institution of England has warned of a possible storm for monetary markets.

On Thursday (27 June), the central financial institution warned costs of many property similar to shares and bonds stay excessive relative to historic norms, and a few have continued to rise. This means traders in monetary markets are persevering with to count on the financial system to get well and inflation to fall.

They’re inserting much less weight on dangers, similar to geopolitical developments or continued excessive inflation, which may trigger weaker progress or rates of interest to remain larger than anticipated.

These dangers make it extra possible that there could possibly be a pointy correction in asset costs.

What ought to I do now?

Traders can take steps to guard themselves. They will do that by scouring the marketplace for low cost shares.

Corporations that commerce at a low worth — whether or not that be relative to their earnings, property, dividends or future money flows (generally known as intrinsic worth) — have a built-in cushion in opposition to losses.

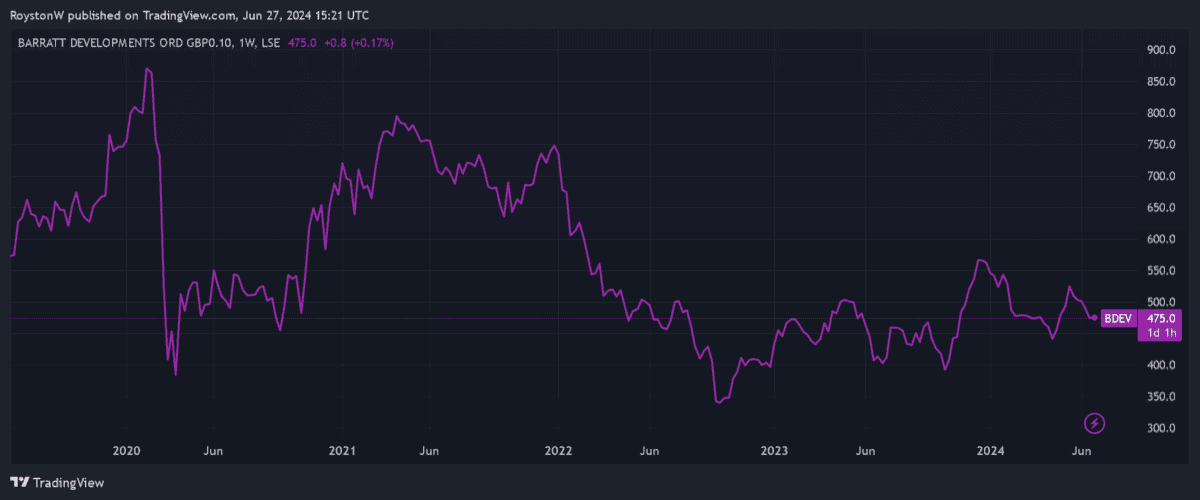

Barratt Developments (LSE:BDEV) is one such inventory I’d take into account shopping for immediately. It at present trades on a ahead price-to-earnings progress (PEG) ratio of 0.7, under the worth watermark of 1.

In the meantime, its dividend yield for this 12 months stands at a market-beating 4.1% for this 12 months. This surpasses the ahead common of three.5% for FTSE 100 shares.

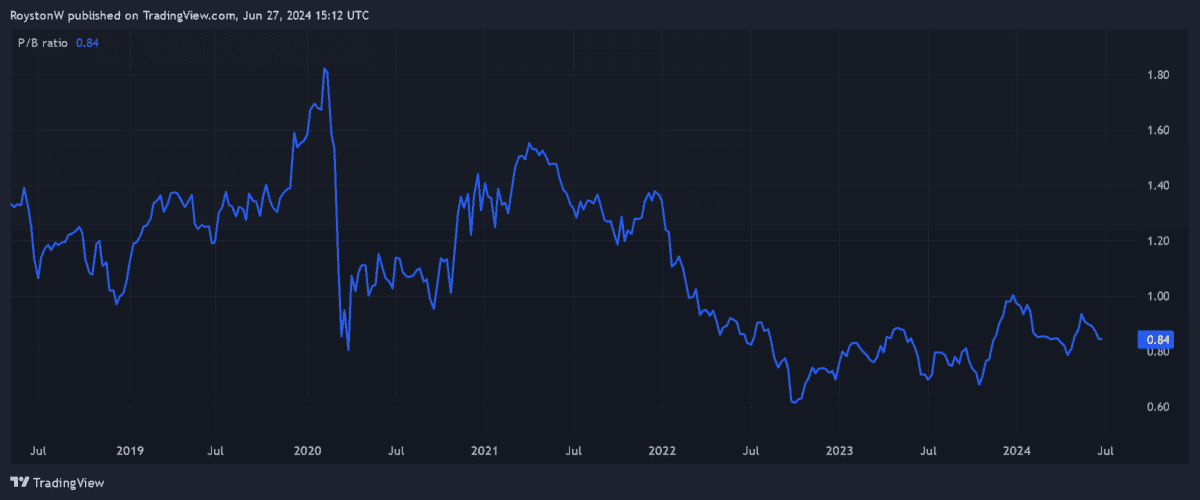

And eventually, Barratt appears low cost relative to its price-to-book (P/B) ratio (see under). Just like the PEG a number of, a sub-1 P/B ratio signifies {that a} inventory is undervalued.

Brilliant future

Barratt might nonetheless expertise some near-term turmoil if the inventory market corrects. However over the long run, I consider the corporate has the potential to ship distinctive returns.

However there’s danger right here. Lloyds Financial institution chief Charlie Nunn instructed Sky Information this week that mortgage charges of between 3.5% and 4.5% would be the “new normal” going ahead. That is above 1.5-2.5% within the final decade.

An atmosphere of upper mortgage charges would, in flip, hurt newbuild gross sales and residential costs. But, on steadiness, I nonetheless consider housebuilders like Barratt have monumental funding potential.

Demand for brand new properties is ready to steadily develop because the inhabitants expands. That is illustrated by Labour’s pledge to construct 1.5m new properties in 5 years.

What’s extra, housebuilders’ revenue margins ought to rise sharply as value inflation steadily eases.

Protecting the religion

Sudden share market corrections are a relentless danger. However talking as an investor, the specter of contemporary volatility isn’t sufficient to discourage me from shopping for UK shares.

Previous efficiency isn’t any assure of the long run. However historical past exhibits that share costs all the time get well strongly from durations of maximum weak point.

The Footsie has endured a number of financial crises since its inception in 1984. And final month, it printed new closing highs of 8,445.80 factors.

As a long-term investor, I’m ready to simply accept some near-term ache to make important eventual returns. So I’ll preserve shopping for British shares regardless of the Financial institution of England’s warning.