- The Bitcoin rainbow chart confirmed intense bullishness for BTC over the subsequent 12–18 months

- Market sentiment was lukewarm and public frenzy hasn’t gotten rolling, although costs have been slightly below ATH.

The Bitcoin [BTC] Rainbow Chart is a enjoyable, uncomplicated manner for traders to get an thought of the place BTC is in its cycle.

Developed in 2014, it takes the previous efficiency of the king of crypto and tasks it ahead utilizing a logarithmic chart.

This smooths out a number of the intense volatility Bitcoin has seen up to now decade, and the distinct coloration bands give traders an thought of market sentiment at a look.

Nonetheless, that is just for multi-year holders and never for day merchants.

What does the Bitcoin rainbow chart mission for 2024, and when ought to holders search to take income?

Bitcoin continues to be low cost!

Supply: Blockchain Heart

Trying again on the previous two halvings, we are able to see that costs take a number of months to get the bull run going after the halving occasion. This cycle was totally different from the others thus far.

The value quickly elevated earlier than the halving, and set a brand new all-time excessive only a month after it.

Regardless of these beneficial properties, the value was nonetheless inside the accumulation zone. This was immensely encouraging for holders and long-term traders.

As this outstanding crypto dealer factors out, FUD occasions like Mt. Gox, the German authorities, or the U.S. authorities’s seized BTC promoting have been all behind us.

Public sentiment is lukewarm and costs are sitting a stone’s throw away from ATH. Issues can warmth up rapidly and get extra bullish a 12 months into the longer term.

Prior to now cycle, the cycle high got here 546 days after the halving. If historical past repeats itself, Bitcoin might kind this cycle’s high in October 2025.

This might put costs within the $144k-$184k window, assuming the “sell, seriously, SELL” zone isn’t reached.

Insights from on-chain metrics

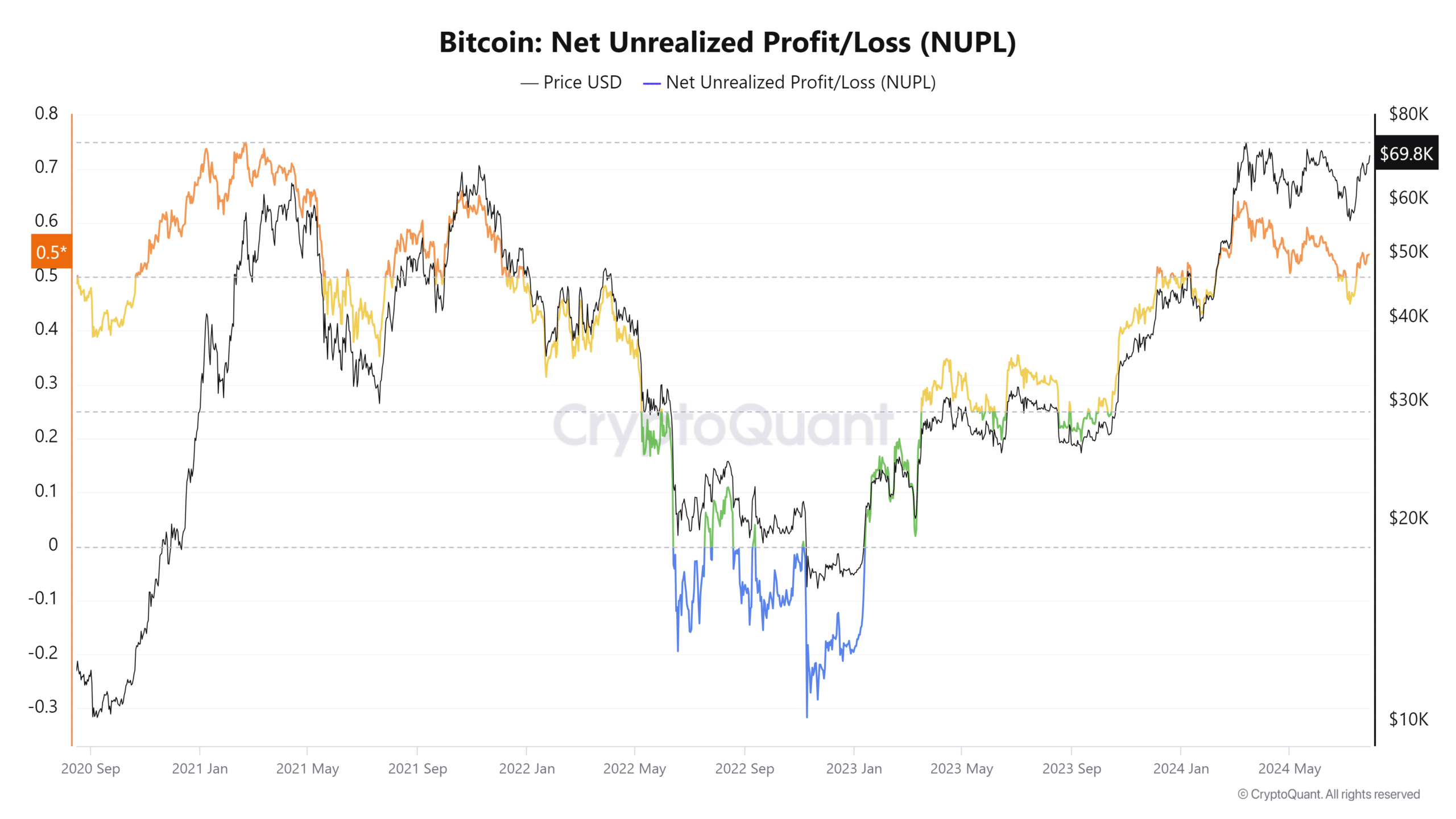

Supply: CryptoQuant

AMBCrypto appeared on the Internet Unrealized Revenue/Loss metric. This metric signifies the entire quantity of revenue/loss in all of the cash, represented as a ratio. Values above 0.7 usually point out a market high.

In March 2024, the NUPL metric reached 0.62, representing overheated situations and elevated promoting stress from profit-taking. Nonetheless, it has steadily trended downward since then.

This confirmed a lower in promoting.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Therefore, there’s extra room for costs to broaden upward. Moreover, the NUPL can stay within the space above 0.5 for months at a time. The latter half of 2020 is a outstanding instance, and the identical might repeat in 2024.

General, long-term traders can select to build up extra BTC or just HODL their baggage. Continued value beneficial properties are more likely to arrive, however it might take a number of extra months.