- The STH-SOPR and one different indicator revealed that Bitcoin’s respite is coming.

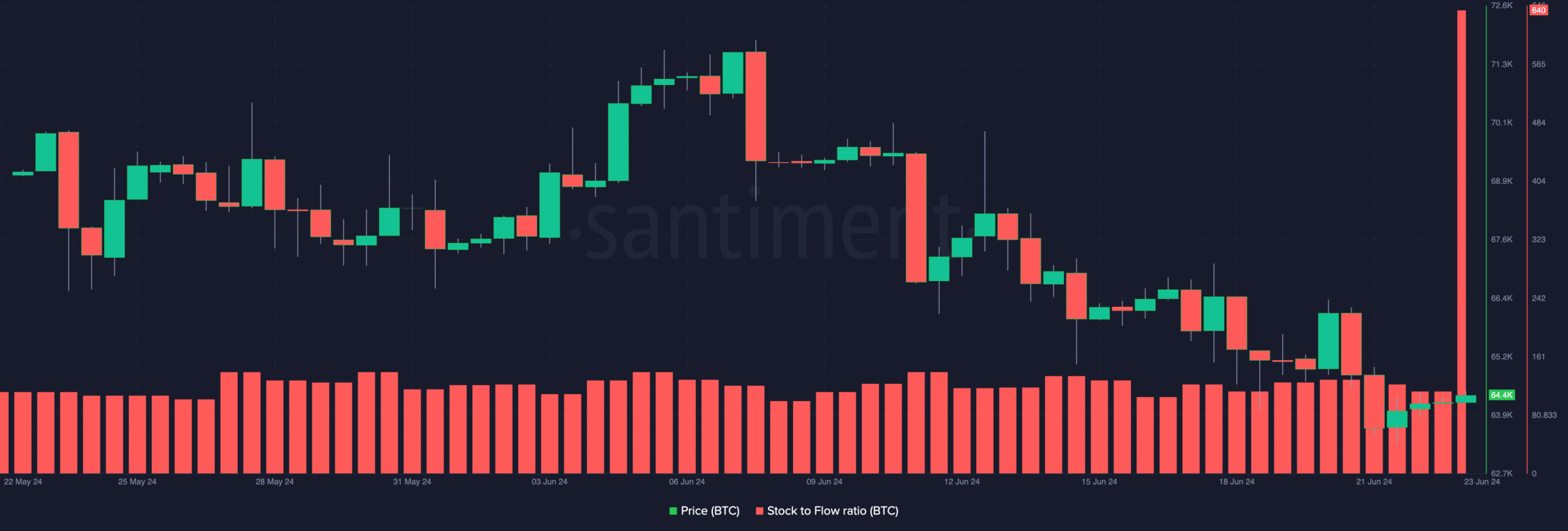

- The spike within the Inventory to Stream ratio backed the potential worth improve.

Historical past won’t repeat itself within the crypto market, however patterns usually rhyme. Because of this the worth of Bitcoin [BTC] could possibly be gearing up for a big turnaround from its correction.

The STH-SOPR is without doubt one of the causes for this prediction. STH stands for Quick-Time period Holder. SOPR is an acronym for Spent Output Revenue Ratio (SOPR).

When mixed, the metric exhibits if Bitcoin holders who purchased the coin inside a 155-day window are promoting at a loss or revenue.

Change is nearer than you assume

If the worth is beneath 1, it signifies the holders are promoting at a loss. Nonetheless, values above 1 recommend that they’re promoting at a loss.

At press time, AMBCrypto discovered, through knowledge from CryptoQuant, that the studying was precisely 0.99. This studying makes it a vital level for BTC, because it may go both methods.

In previous occasions, the studying beneath 1 marked the top of a downtrend. Subsequently, if the STH-SOPR stays beneath the edge for a while, Bitcoin’s worth could possibly be on the brink of erase a few of its current losses.

Supply: CryptoQuant

Nonetheless, that doesn’t indicate that Bitcoin’s prediction to $61,000 or $60,000 wouldn’t come to move. However it signifies that the worth of the coin won’t slip as low $54,000 earlier than a reversal to the upside begins.

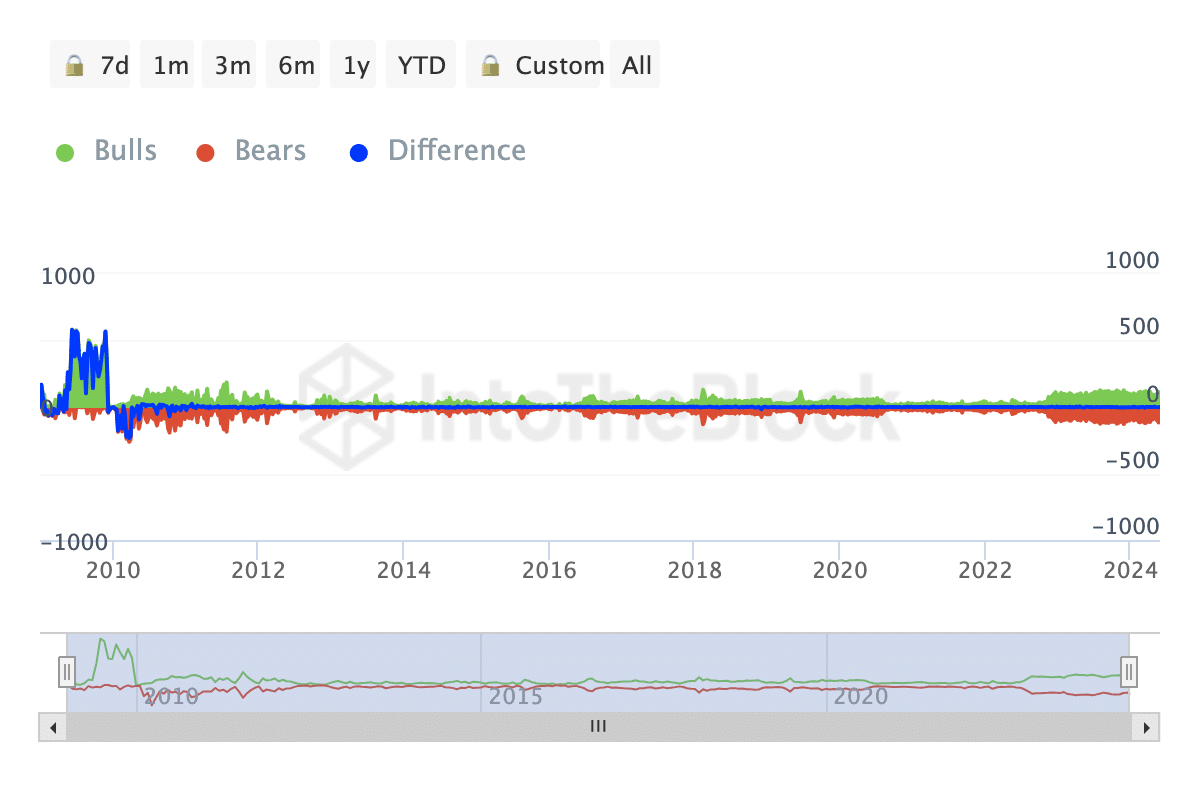

One other indicator fueling the forecast is the Bulls And Bears supplied by IntoTheBlock.

This metric compares the addresses that purchased greater than 1% of the 24-hour buying and selling quantity, and people who offered greater than 1% inside the identical interval.

Bulls set for low inflation

If the addresses that purchased outweighed the addresses that offered, then it’s a bullish signal. Nonetheless, if the addresses that offered are extra, it’s a bearish outlook.

As of this writing, the Bulls And Bears indicator was +2 in favor of bulls. Whereas this won’t have a right away impact on BTC, sustaining the place over the approaching days to weeks may assist Bitcoin correction finish.

Supply: IntoTheBlock

Ought to this be the case, Bitcoin’s worth can start a transfer that takes it again to $66,000. Final on the record of metrics supporting a worth improve within the Inventory to Stream ratio which spiked to 640 on the twenty third of June.

The Inventory to Stream ratio measures an asset’s vulnerability to inflation and its shortage. If the studying is low, it means that there’s excessive inflation price. As such, it could possibly be troublesome for the worth to extend within the mid to long-term.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2024

Nonetheless, the excessive studying recommend that Bitcoin has a low inflation price. Additionally, it means the worth would possibly retain a excessive stage of worth improve as time goes one.

Supply: Santiment

Contemplating the state of the info talked about, BTC would possibly get better inside a brief interval. Nonetheless, the prediction could possibly be invalidated if massive traders in BTC proceed to promote a few of their holdings.