- Bitcoin struggled to take care of the $65,000 degree amidst market volatility.

- Analysts offered conflicting views on whether or not Bitcoin has reached its lowest level.

Regardless of Bitcoin’s [BTC] persistent makes an attempt to stabilize its worth above the $64,000 threshold, the premier cryptocurrency has just lately recorded a decline.

Its worth fell by roughly 0.6% prior to now 24 hours to a present valuation of $65,619.

This ongoing downward pattern, which has seen Bitcoin lose practically 5% over the previous two weeks, is inflicting concern amongst traders and merchants alike.

What are the specialists saying?

Amid these fluctuations, notable crypto analysts are weighing in with diversified views.

CrediBULL Crypto, a famend determine within the digital forex house, shared a cautiously optimistic view on X (previously Twitter), suggesting that Bitcoin might need reached its low level. He elaborated,

“There’s a chance our $BTC bottom is in with this SFP…Yes, we can still technically go lower…but it would not surprise me to see that zone front run.”

He urged warning, emphasizing the necessity for a transparent bullish sign or ‘impulse’ earlier than making vital buying and selling selections.

Supply: CrediBULL Crypto/X

Conversely, Skew, one other revered dealer, highlighted the latest exercise on main exchanges as indicative of the market’s sentiment.

He identified that whereas there was some shopping for on Coinbase and Bitfinex, Binance continued to expertise promote stress. He famous,

“I think $66K – $67K is the key area to gauge if there’s ongoing absorption, else lower prices will come with price bleeding.”

He additionally talked about that the presence of spot premiums and low funding charges may very well be a optimistic signal, indicating potential for a market restoration.

Elementary outlook on Bitcoin

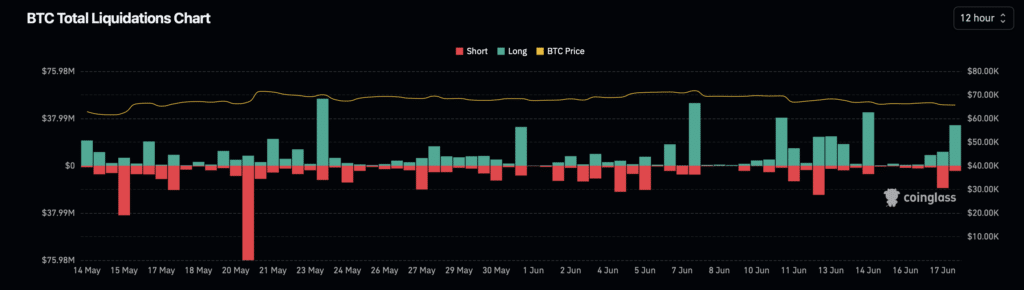

This era of uncertainty is mirrored within the substantial liquidations occurring inside the Bitcoin market.

Knowledge from Coinglass revealed that previously 24 hours alone, about 173,662 merchants have been liquidated, resulting in a complete of $456.43 million in liquidations, with Bitcoin merchants accounting for $70.24 million of this quantity.

Supply: Coinglass

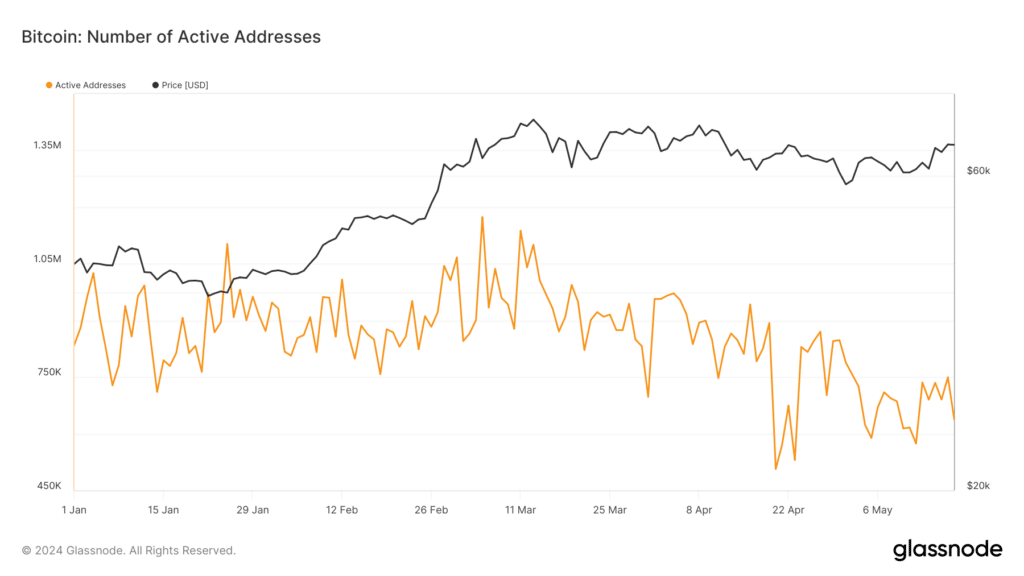

Regardless of these challenges, there was a silver lining within the type of elevated new consumer exercise on the Bitcoin community.

AMBCrypto’s evaluation of Glassnode’s information confirmed a surge within the variety of new Bitcoin addresses, climbing from beneath 550,000 in April to over 700,000 at press time.

Supply: Glassnode

This uptick in new addresses might signify a rising curiosity from new entrants or a return of dormant customers, probably stabilizing the market and fostering a restoration part.

Including to the cautiously optimistic outlook, AMBCrypto cited CryptoQuant analyst Ki Younger Ju, who remained bullish on Bitcoin’s long-term prospects.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

He believed that the typical entry worth for Bitcoin merchants remained round $47,000, suggesting that almost all are nonetheless in revenue regardless of the latest pullback from peak costs.

This resilience amongst Bitcoin holders, coupled with the potential accumulation at cheaper price ranges, might set the stage for a future rally, underscoring the advanced dynamics at play within the cryptocurrency market.