- Senator Cynthia Lummis reveals BTC as a strategic reserve asset.

- Bitcoin will enhance USD, and eradicate nationwide debt.

Bitcoin and Crypto have taken middle stage as america prepares for the upcoming presidential elections. Over the previous months, Donald Trump has grow to be a pro-crypto presidential candidate, as reported earlier by AMBCrypto.

The rise of political discourse about BTC and Crypto is shaping the longer term trajectory. In the course of the Bitcoin convention, Senator Cynthia Lummis introduced a invoice proposing that BTC be a U.S. strategic reserve asset.

Senator Cynthia proclaims BTC strategic reserve Invoice.

In the course of the Bitcoin 2024 convention, U.S. Senator Cynthia Lummis introduced a proposal to bolster the USD.

The senator proposed the institution of a strategic Bitcoin reserve to assist the greenback in opposition to rising inflation and cement the U.S. place in a altering monetary system.

By means of her proposal, she famous that,

“Establishing a strategic Bitcoin reserve would firmly secure the dollar’s position as the world’s reserve currency into the 21st century and ensure we remain the world leader in financial innovation,”

She argued that the present financial circumstances are troublesome with rising inflation charges. Subsequently, with the rising inflation, it’s essential to diversify into BTC and defend America’s financial future.

She added that the laws will ask the U.S. authorities to buy 1 million Bitcoins over 5 years. By means of her assertion, she added that,

“Implement a 1-million-unit Bitcoin purchase program over a set period to acquire a total stake of approximately 5% of total Bitcoin supply, mirroring the size and scope of gold reserves held by the United States.”

BTC holding for U.S. debt administration

Supply: Statista

The U.S. debt has skyrocketed to a document excessive of $35 trillion within the final decade. In her speech, Senator Cynthia argued that if the federal government invests $3.3 million in BTC reserve, the federal government will eradicate the debt.

Based on the Senator, the federal government can use BTC to eradicate debt for the reason that worth of BTC will rise over time. Subsequently, BTC was created to anticipate the looming fiscal and financial disaster in america and globally.

BTC aimed to handle the fixed devaluation of the fiat forex by way of authorities spending and borrowing, dealing with the U.S. right this moment.

Thus, by way of BTC reserve property, the federal government can cut back borrowing whereas particular person holders keep away from fiat devaluation.

What would the BTC reserve imply for the USD?

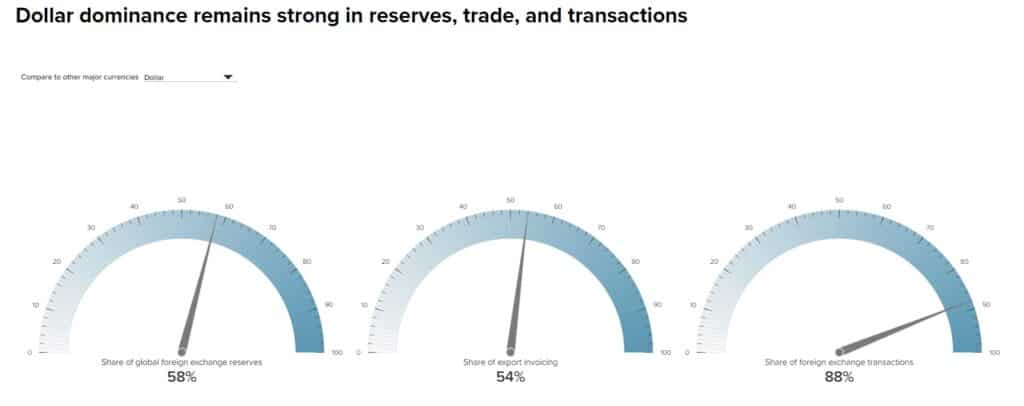

Supply: Atlantic Council

For years, USD has defied the prediction of its collapse because it stays probably the most dominant forex. Virtually 60% of worldwide overseas trade reserves are in {dollars}.

Nonetheless, the share has step by step declined over current years. The decline arises from the monetary market evolution, particularly by way of the rise of cryptocurrencies and altering geopolitics.

With cryptocurrencies taking middle stage within the digital monetary revolution, having a BTC reserve asset will enhance the greenback.

Though BTC costs expertise volatility, their worth rises yearly, not like USD, which loses worth by way of devaluation.