- Bitcoin’s “Cup & Handle” sample pointed to a bullish run, carefully following the S&P500 and Gold

- A possible BTC rebound to $69,785 may liquidate $91.32 million in shorts

Bitcoin (BTC), at press time, gave the impression to be mapping out a “Cup and Handle” sample, one fairly acquainted to each the S&P500 and Gold, based on an analyst’s current tweet. Based mostly on the setup, a bullish breakout may see the worth of Bitcoin climb as excessive as $230k over the approaching months.

Therefore, the million-dollar query that traders are desperate to see answered is whether or not or not this cryptocurrency market will comply with different conventional property in its surge to this goal.

Shorts could fall…

Bitcoin’s potential rebound may set off an especially intense liquidation occasion if its worth bounces again to $69,785.

At present, $91.32 million value of quick positions are in danger, ought to the crypto head north. With momentum constructing throughout the market, important volatility must be anticipated.

Supply: Coinglass

Bitcoin addresses surge on the verge

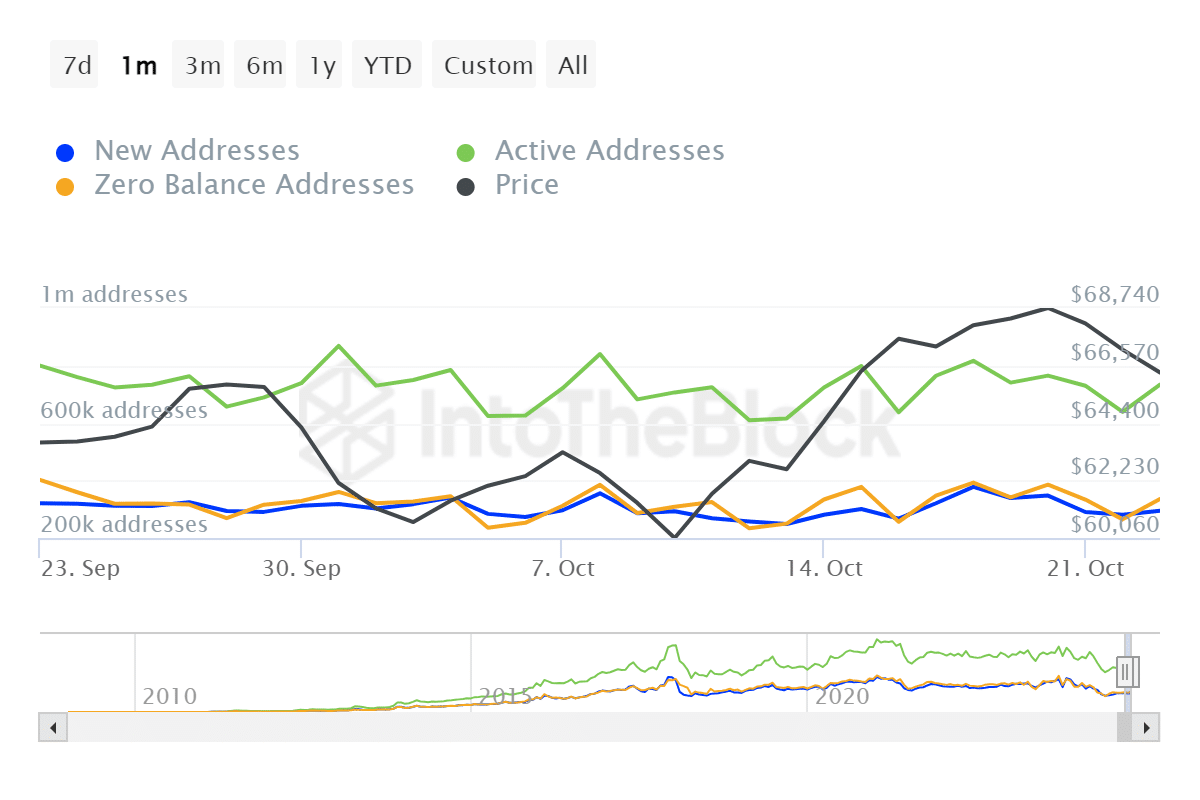

AMBCrypto additional analysed IntoTheBlock’s information, with the identical indicating a surge within the variety of energetic addresses over the past 24 hours.

Bitcoin’s community has grow to be significantly extra energetic recently. In actual fact, its variety of energetic addresses went flying 14% greater to 733k addresses. This hike in participation is an indication of larger curiosity and engagement, lending extra gas to the king coin’s worth momentum.

Supply: IntoTheBlock

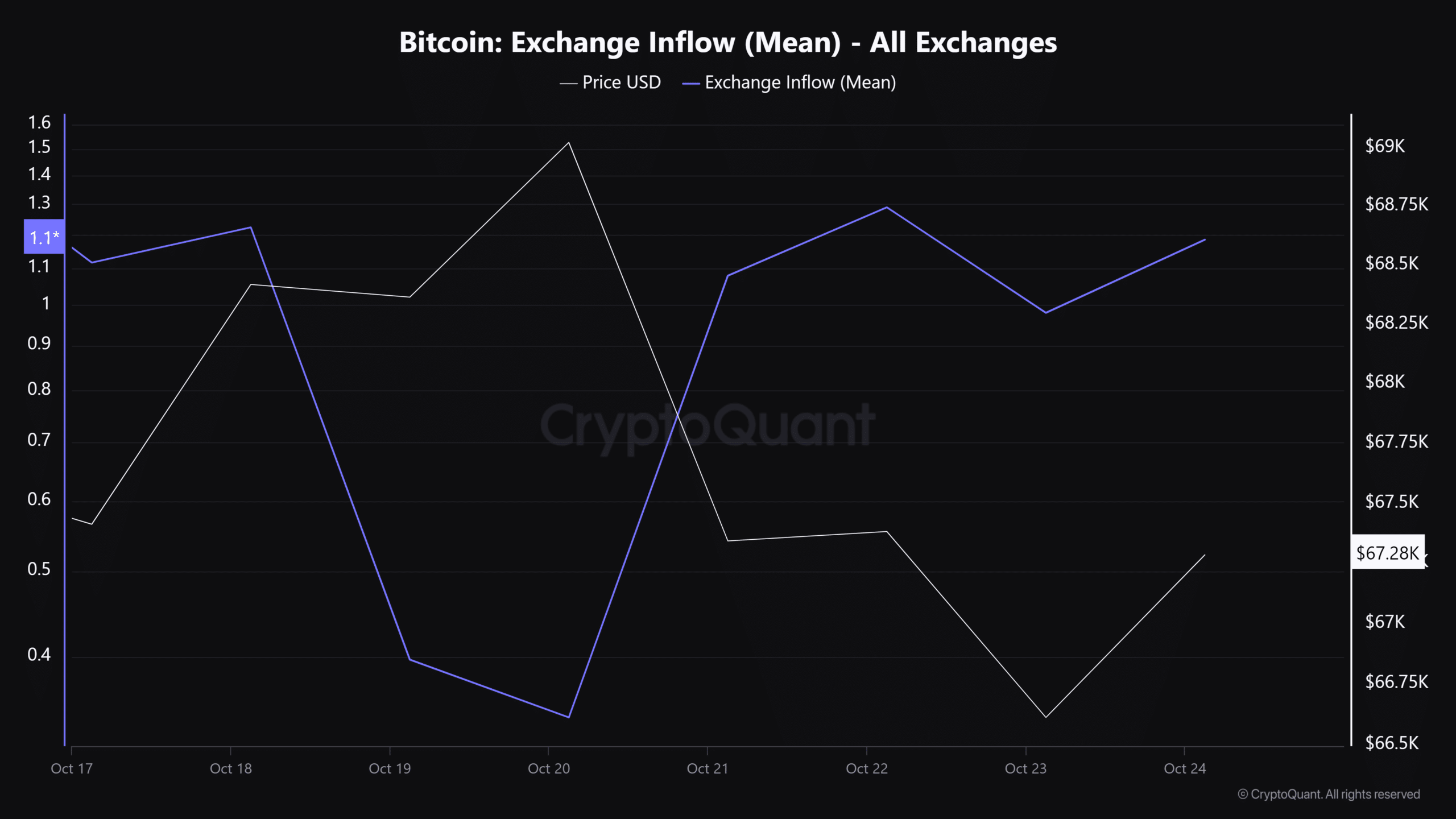

Trade inflows add to a possible bullish rally

With most analysts now anticipating BTC to rally bullishly, it’s value noting that the asset has been recording important inflows of late. The identical was evidenced by the newest findings on CryptoQuant.

This may be interpreted to be an indication of excessive Open Curiosity and demand for Bitcoin, with all metrics alluding to the crypto probably heading to the moon too.

Supply: CryptoQuant

With Bitcoin following within the footsteps of main property like Gold and the S&P500, the subsequent few months might be essential for its future.

If the asset manages to succeed in its projected top, many potential ripple results on the bigger economic system might be on playing cards.