- Bitcoin speculators had been reluctant to bid, based mostly on the Open Curiosity stagnation.

- Funding charges had been solely barely optimistic, and BTC may not be able to rally.

Bitcoin [BTC] held on to the $67k help stage, defending the earlier week’s good points and the bulls had been trying to construct on it. At press time, the value was at $68.9k, and the $71.4k-$71.6k is the following resistance zone.

The buying and selling quantity hunch posed a menace to the bulls. Quick-term holder profitability additionally grew. The coin days destroyed metric soared just lately, which may spark Bitcoin volatility.

Assessing the speculator sentiment

Supply: Axel Adler on X

In a put up on X (previously Twitter) crypto analyst Axel Adler noticed that the weekly change in Open Curiosity was impartial at -1%. This got here although BTC had flipped the $67k stage to help and was aiming to push greater.

The shortage of speculative curiosity over the previous week indicated that the majority market members had been sidelined. They had been unwilling to guess on worth actions and lacked bullish conviction. This might see BTC type a short-term vary between $67k and $71.5k.

The analyst additionally mirrored that this would want to vary for Bitcoin to embark on its subsequent development.

The shortage of bull dominance pointed towards a torpid market

Supply: Axel Adler on X

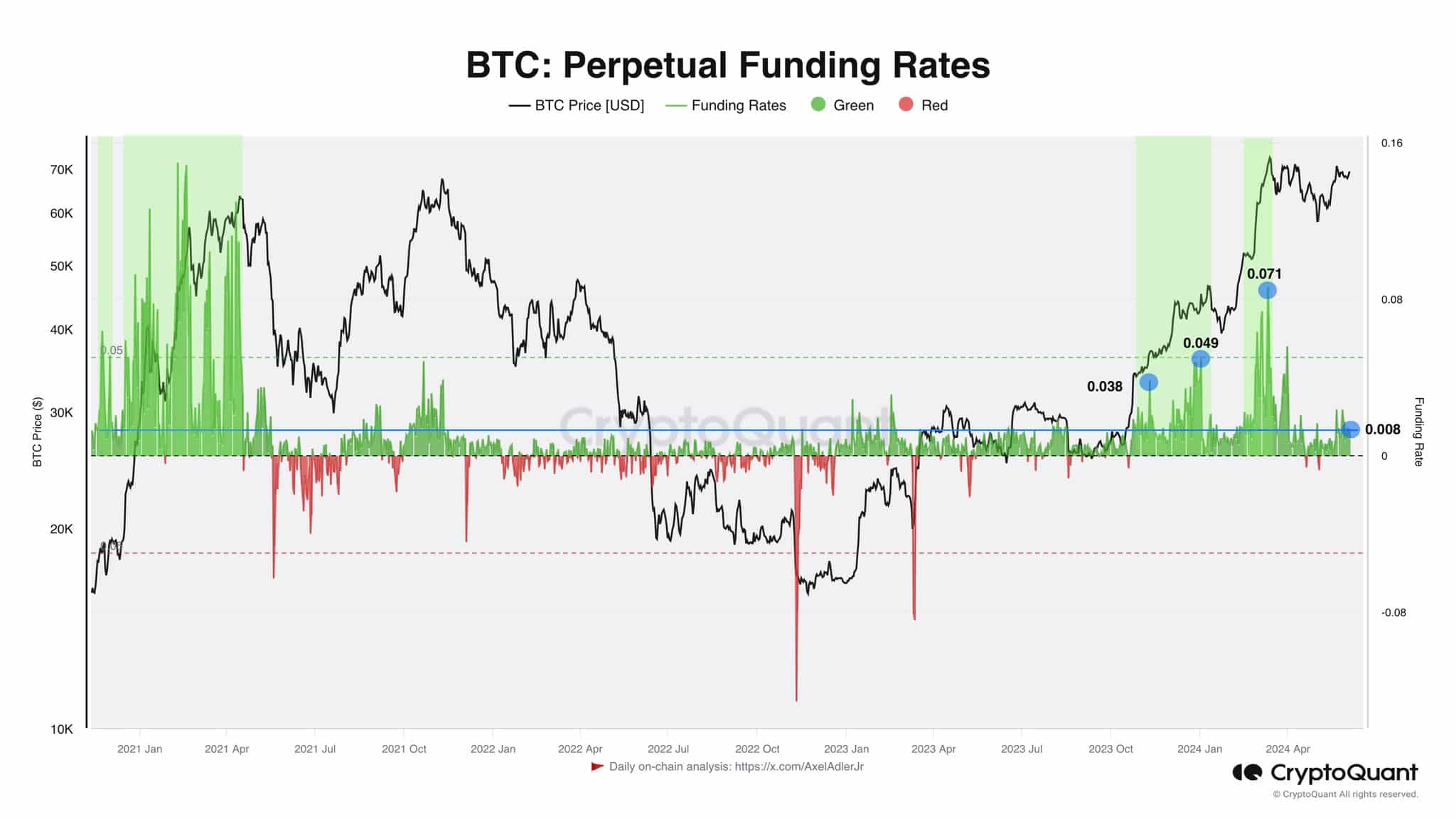

In one other put up, the analyst additionally confirmed that dramatic worth surges have been accompanied by spikes in funding charges. In late 2020 and early 2021, the huge rally from $20k was accompanied by durations of excessive funding charges that reached +0.15.

The rally since 2023 October additionally noticed the funding fee spike above the +0.03 mark. Nevertheless, at press time, it was at +0.008.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

This confirmed an absence of bullish conviction. Mixed with the hunch within the weekly buying and selling quantity, the proof strongly hinted that Bitcoin is just not able to breakout previous the $72k space but.

Buyers and merchants must be ready for extra rangebound worth motion within the coming weeks.