- Bitcoin’s worth dropped by 2% within the final 7 days

- Market indicators hinted at a couple of slow-moving days forward

Bitcoin [BTC] started June on a sluggish observe because the coin’s worth motion remained bearish on the charts. Nevertheless, the slow-moving worth motion won’t be a bearish factor, as this simply may be a prelude for an enormous rally within the coming days.

Bitcoin to show bullish?

Bitcoin’s worth motion has remained sluggish for fairly a while now, which could have made a number of traders skeptical. In actual fact, in response to CoinMarketCap, BTC has misplaced 2% of its worth within the final seven days. On the time of writing, BTC was buying and selling at $67,735.81 with a market capitalization of over $1.33 trillion.

Nevertheless, issues may change quickly. Mags, a preferred crypto analyst, just lately shared a tweet highlighting an attention-grabbing growth. In accordance with him, BTC’s worth, after breaking out above the final month-to-month resistance again in March, has now turned the extent right into a assist. For the previous few months, the worth has been going sideways above the earlier ATH.

Throughout a market uptrend, it’s regular for the worth to maneuver sideways earlier than a giant transfer. In 2023, from March to September, the worth stayed flat for 7 months earlier than it broke out and surged by 178% on the charts.

In accordance with the analyst,

“So, even though it might seem boring, this kind of sideways movement usually comes before a massive move. If we see a similar 178% surge on the current range breakout, we are looking at $188,00.”

Is there any proof right here?

For the reason that aforementioned evaluation predicted BTC to the touch $188K, AMBCrypto then analyzed the king of cryptos’ metrics to higher perceive whether or not it’s all set to check its ATH within the coming days. We discovered that BTC’s internet deposit on exchanges was excessive at press time, in comparison with the final seven-day common.

This prompt that promoting strain on the coin has been excessive. Moreover, the aSORP was additionally purple, which means that extra traders have been promoting at a revenue. In the midst of a bull market, it could actually point out a market prime.

Nonetheless, Bitcoin’s binary CDD revealed that long-term holders’ actions within the final 7 days had been decrease than common. They’ve a motive to carry their cash.

Supply: CryptoQuant

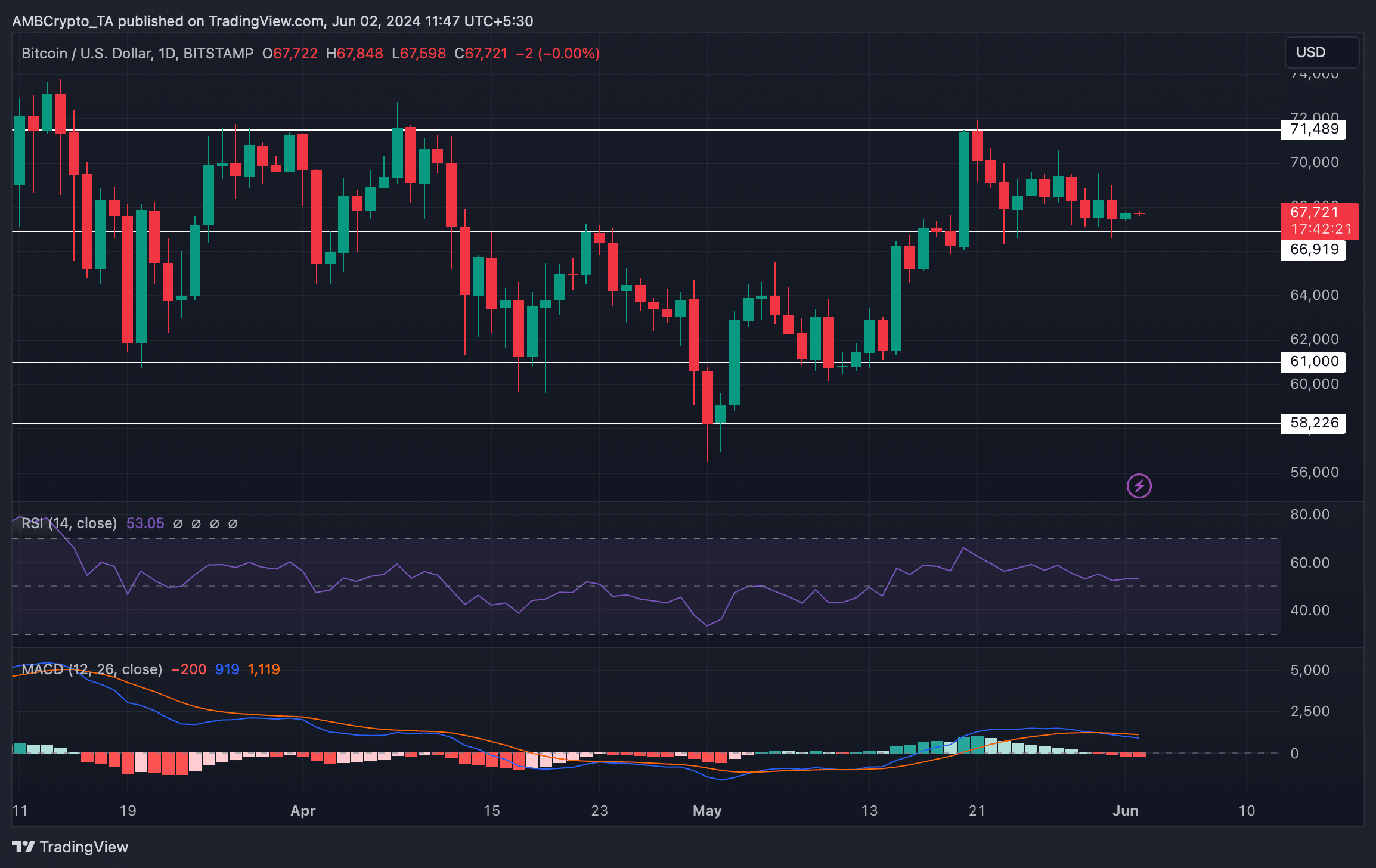

AMBCrypto then analyzed BTC’s each day chart to higher perceive whether or not it might check its ATH anytime quickly.

Learn Bitcoin (BTC) Worth Prediction 2024-25

As per our evaluation, the MACD flashed a bearish crossover. Its Relative Power Index (RSI) additionally moved sideways, hinting at a couple of extra slow-moving days.

Nevertheless, BTC continued to commerce above its assist at $66.9k, hinting at a doable worth hike within the coming days.

Supply: TradingView