- Ethereum’s underperformance might delay the much-awaited altcoin season.

- Bitcoin’s rising dominance might derail altcoin efficiency post-Fed price cuts.

Ethereum’s [ETH] muted worth motion and the lackluster efficiency of US spot ETH ETFs might delay the much-awaited altcoin season. In reality, on thirtieth August, the US spot ETH ETFs report zero flows throughout the board.

One analyst referred to the zero flows as ‘sad’ and underscored a scarcity of curiosity.

‘I just realised that yesterday’s $ETH circulation was a literal zero. For some purpose, that’s much more unhappy than a adverse circulation. Nobody on this planet cares about ETH anymore lmao.’

Is ETH underperformance a threat to Alt Season?

General, the merchandise have seen cumulative outflows since inception, price $477 million per Farside Buyers knowledge.

In accordance with Quinn Thompson, founding father of crypto hedge fund Lekker Capital, the weak efficiency was ‘detrimental’ to the altcoin universe.

“The ETH ETFs’ lacklustre efficiency is a detrimental signal to the remainder of the altcoin universe…Bitcoin dominance will rise…ETHBTC is the alt barometer.’

For context, the ETHBTC ratio tracks ETH’s worth relative to BTC. The ratio has been in a downtrend for over two years and just lately hit a yearly low of 0.040.

Briefly, ETH’s underperformance relative to BTC reached a report low in 2024, primarily pushed by ETF purchaser curiosity.

Supply: ETH/BTC, TradingView

Thompson projected that ETHBTC would hit 0.033 by the top of 2024. Put in another way; the exec anticipated ETH underperformance to proceed till December earlier than ETF patrons present curiosity within the altcoin.

Though some altcoin watchers have been timing a breakout for the phase utilizing Solana’s [SOL] efficiency, the ETHBTC ratio stays a major take a look at for the sector’s well being per Thompson.

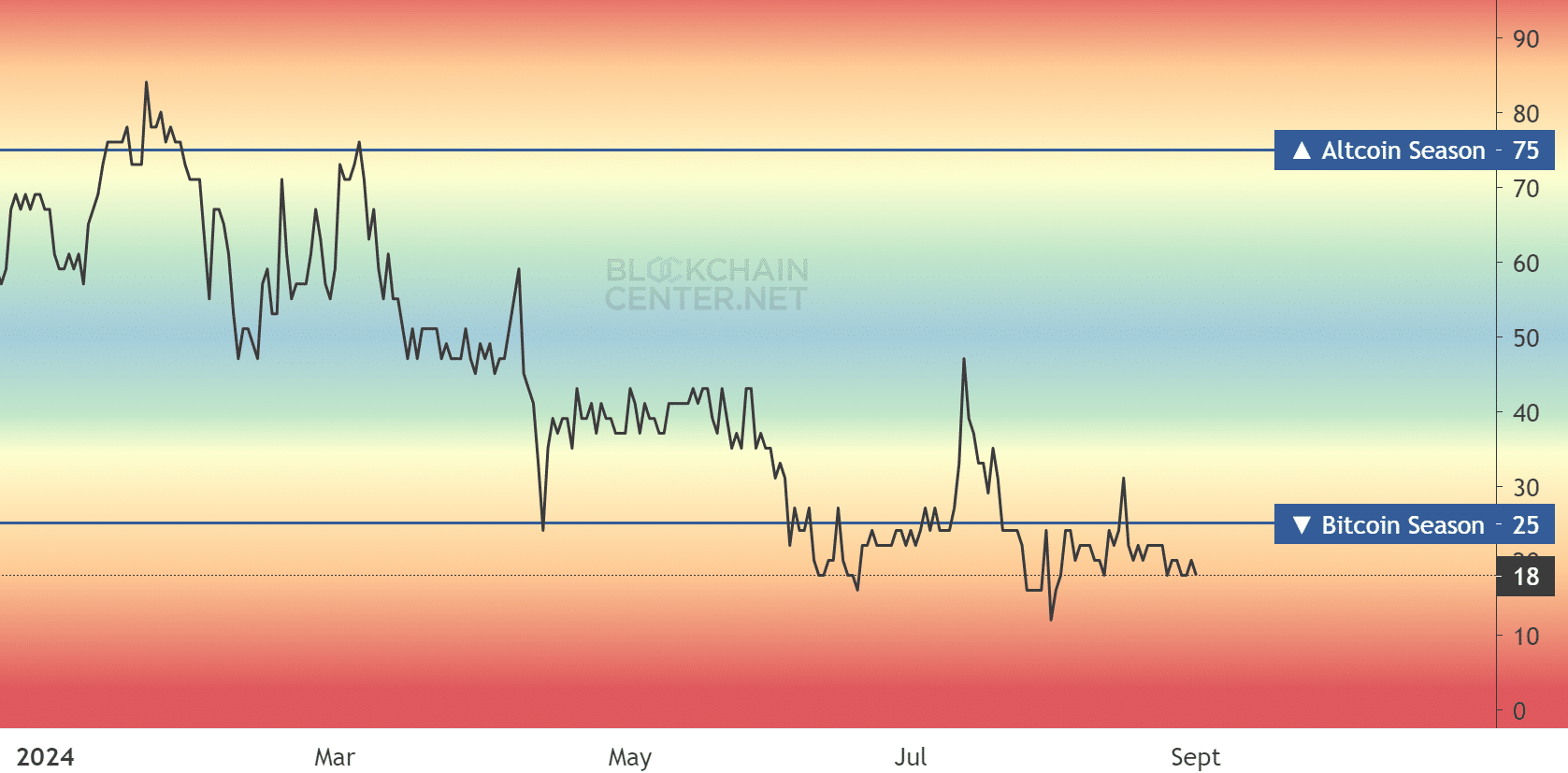

On the time of writing, the Altcoin Season Index studying was at 18, suggesting that it was nonetheless a agency BTC season.

Supply: Blockchain Heart

That mentioned, some market watchers have been speculating that the upcoming and certain Fed price lower might increase the altcoin phase. In accordance with crypto analyst Benjamin Cowen, the outlook was unsure as an identical state of affairs in 2019 led to altcoin capitulation.

‘#ALT / #BTC pairs monthly open in July 2019 when the Fed cut rates for the first time was 0.38. They capitulated to 0.29 that month. The monthly open in September 2024 for ALT/BTC pairs is 0.38. The Fed will cut this month. Maybe, just maybe, this time is not different.’

Supply: X/Cowen

On the time of writing, ETH traded at $2.4k, down practically 10% previously week after dropping from $2.7k.