- BTC is near retesting its all-time excessive because it rises to the $70,000 value degree.

- Indicators are displaying {that a} bull run could be on the horizon.

As Bitcoin [BTC] holds sturdy above the $70,000 degree, traders are more and more optimistic in regards to the potential for a Bitcoin bull run. By analyzing key indicators, such because the NVT (Community Worth to Transactions) ratio, lively handle knowledge, and present value momentum, we are able to perceive whether or not Bitcoin is setting the stage for a long-term bullish part or if warning could be wanted.

NVT Ratio indicators stability for Bitcoin bull run

The NVT ratio, typically in comparison with Bitcoin’s “price-to-earnings” ratio, supplies perception into whether or not the asset is overvalued or undervalued based mostly on community exercise.

At present, the NVT ratio displays a balanced and wholesome market, displaying that Bitcoin’s community is dealing with the heightened demand with out indicators of overheating.

Supply: CryptoQuant

Traditionally, a gradual or low NVT ratio throughout value development has laid the groundwork for a Bitcoin bull run, because it suggests the rally has a powerful basis.

This favorable NVT studying hints that the present value momentum might need the resilience wanted to maintain an extended bullish development.

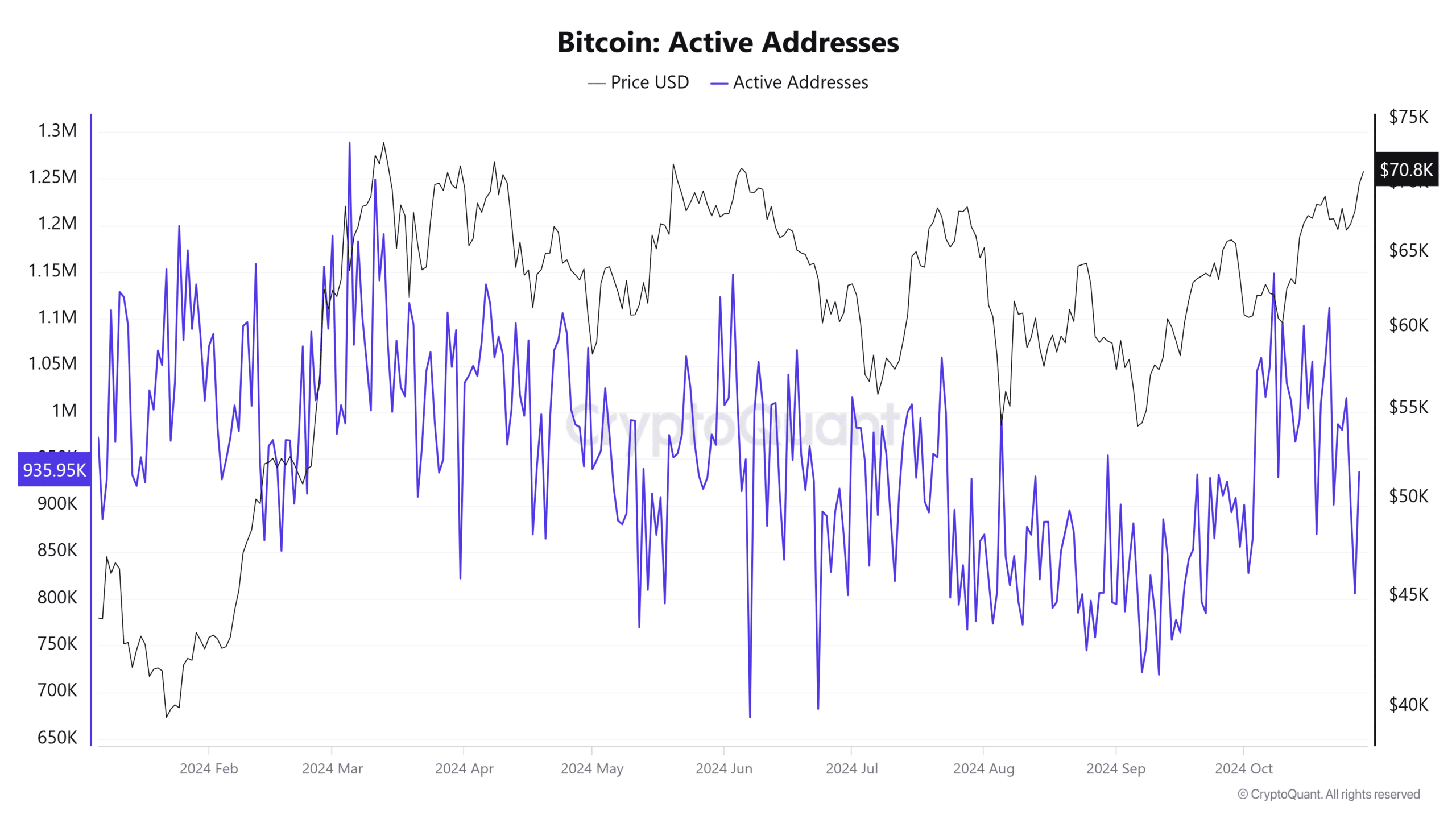

Rise in lively addresses provides gasoline to bullish sentiment

A latest uptick in lively Bitcoin addresses additionally helps the case for a Bitcoin bull run. With lively addresses now constantly above 935,000, community exercise exhibits wholesome development.

Supply: CryptoQuant

Elevated lively addresses typically sign higher consumer engagement, translating to greater demand for Bitcoin. This development, typically related to value appreciation, may point out renewed curiosity within the asset.

Due to this fact, the sustained rise in lively addresses is a key indicator that would bolster the continuing rally, feeding into the broader narrative of a attainable bull market.

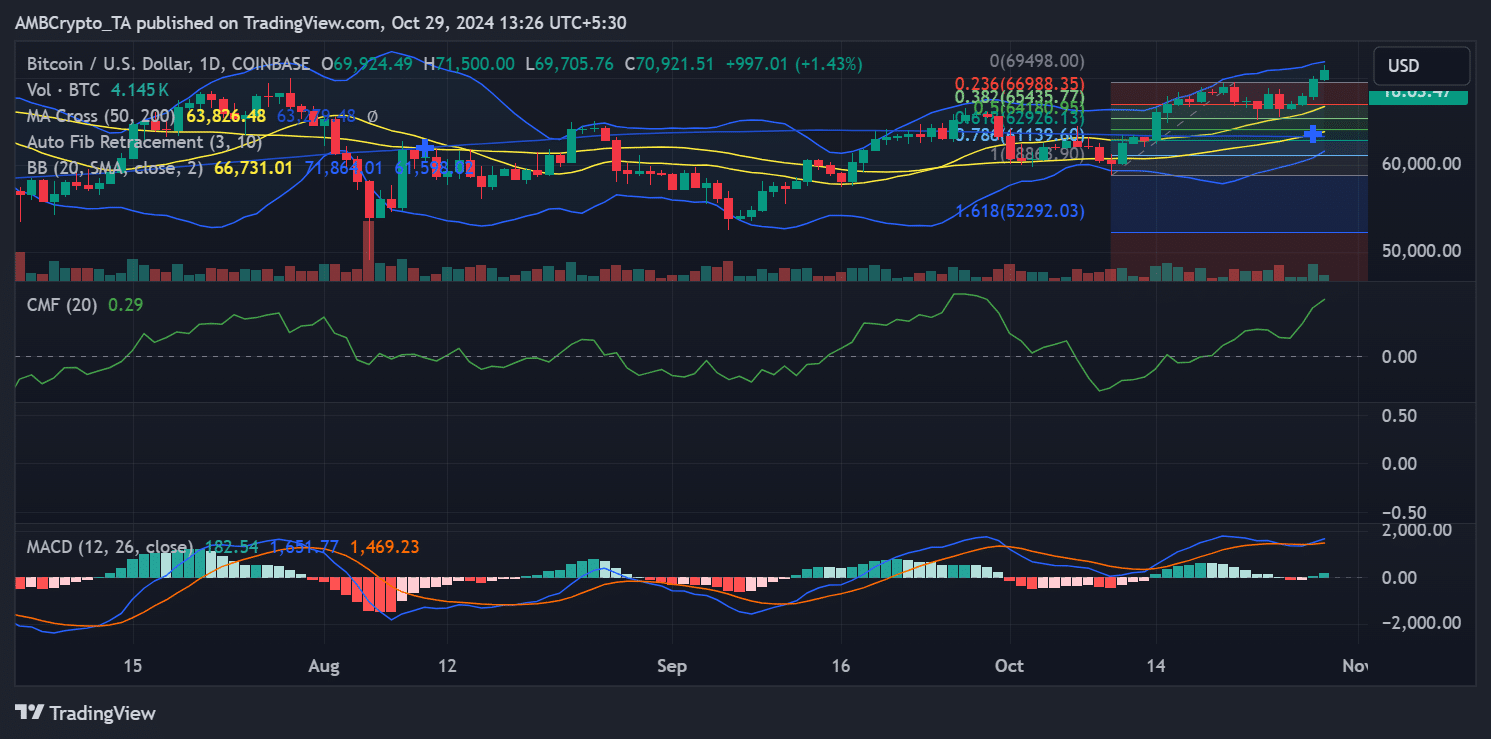

Technical indicators help Bitcoin Bull Run potential

Bitcoin’s value chart reveals a number of bullish indicators reinforcing the potential for sustained upward momentum. Bitcoin not too long ago broke via main resistance ranges and has proven stable help across the 50-day transferring common.

This indicator has typically served as a basis for bullish momentum.

Supply: TradingView

Moreover, the Chaikin Cash Move (CMF) presently reads a constructive 0.29, indicating sturdy shopping for curiosity. On the identical time, a latest bullish MACD crossover enhances this momentum.

Collectively, these technical indicators align nicely with Bitcoin’s elementary energy, constructing a convincing case for a Bitcoin bull run.

In abstract, Bitcoin’s elementary metrics and technical indicators point out a good atmosphere for a possible bull run.

A balanced NVT ratio, rising lively addresses, and supportive technical energy all trace that Bitcoin’s upward momentum may persist.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Buyers monitoring the marketplace for indicators of a Bitcoin bull run could discover encouragement in these metrics.

Nevertheless, shut monitoring of key indicators will stay important to gauge the sustainability of this rally, as Bitcoin may very well be on the verge of setting new all-time highs within the months to return.