Picture supply: Getty Pictures

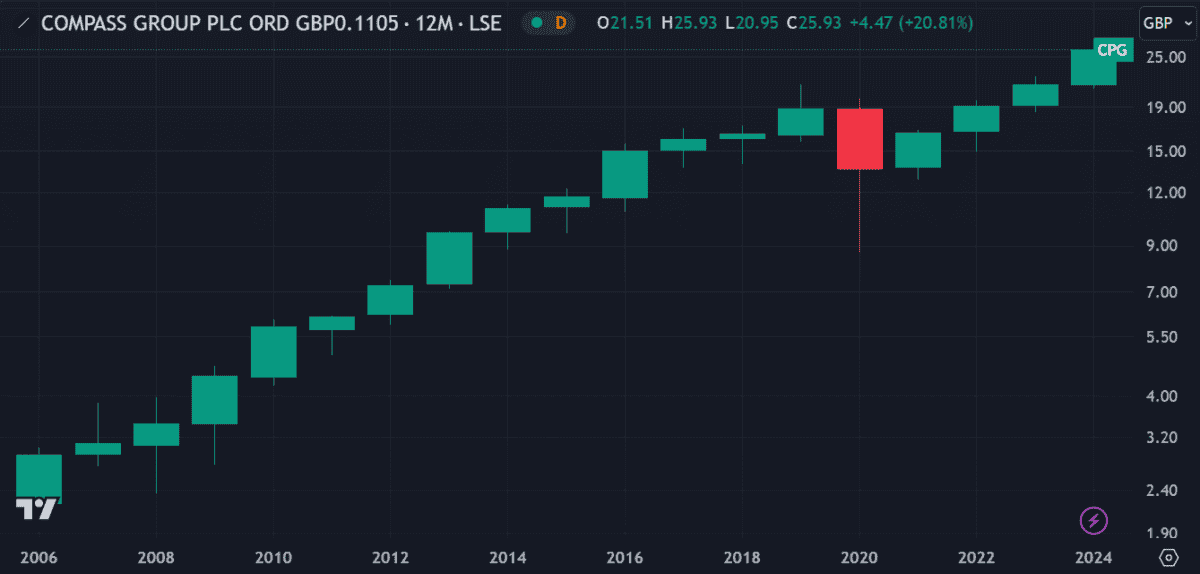

As one of the vital constant gainers on the FTSE 100, Compass Group (LSE: CPG), is a worth investor’s dream.

Between 2006 and 2019, it closed increased yearly and elevated dividend funds yearly with out fail.

Then, in 2020, the Covid pandemic put an finish to its successful streak. The inventory tumbled 27% that 12 months and the corporate was compelled to chop dividends.

Restoration was swift although. It reinstated dividends the next 12 months and shortly began climbing once more. Right this moment, the inventory’s buying and selling round £26 — a 145% enhance from its November 2020 low of just about £10. That’s an annualised return of 25% a 12 months!

The dividend yield’s returned a mean of 1.5% in that point. Utilizing these averages, a £5,000 funding might have grown to £12,800 right now, with dividends reinvested.

Ought to that sort of progress proceed, an identical funding right now might exceed £50,000 in 10 years. However is {that a} real looking expectation? I made a decision to take a more in-depth look.

Sturdy defensive credentials

As the biggest contract meals service firm in Europe, Compass Group’s the type of enterprise that enjoys constant demand. Not solely does it serve meals in colleges, places of work and hospitals but in addition areas as distant as offshore oil platforms. Since 1941, it’s acquired 35 meals service firms worldwide, using over 500,000 workers.

Mainly, if meals’s being served, chances are high Compass is concerned. That alone suggests it’s a reasonably dependable funding.

So what’s the catch?

Nevertheless, Compass is delicate to financial downturns and inflationary pressures, as witnessed in 2020. Rising meals and labour prices mixed with potential provide chain disruptions might eat into earnings. What’s extra, its world attain makes it susceptible to foreign money fluctuations and regulatory adjustments.

Not too long ago, this affected income, main the agency to stabilise operations by exiting sure markets. These market dynamics could proceed to create worth volatility, which potential traders ought to consider.

Stable outcomes

Compass posted strong Q3 2024 outcomes final week, with progress pushed by excessive consumer retention and new enterprise throughout key areas — notably in healthcare and training. This progress helped elevate income, assembly the corporate’s forecasts for the 12 months and strengthening its world management in meals providers.

Web revenue grew to $31.5m in comparison with a internet lack of $3.8m in Q3 2023, with gross sales up 11.8% to $582.6m.

With earnings forecast to develop, its price-to-earnings (P/E) is anticipated to drop from 32 to 27. This might convey it extra consistent with rivals, enhancing the inventory’s worth proposition. Future return on fairness (ROE) is forecast to be above 30% in three years, which might be the strongest indicator of the corporate’s efficiency.

My verdict

It’s true that some shares benefitted from measures put in to spice up the financial system post-Covid. Nevertheless, Compass’ current efficiency isn’t unprecedented. Between 2006 and 2016, it loved comparable progress, delivering annualised returns of 17% a 12 months.

Barring one other pandemic, I see little cause to counsel it could possibly’t do the identical once more. It could not flip £5k into £50k within the subsequent decade but it surely ought to do pretty properly. Does that imply I’m planning to purchase the inventory? You possibly can guess your Christmas pudding I’m!