- Hyperliquid whales who management vital funds out there have opened extra quick positions

- Institutional buyers, alternatively, have continued to purchase Bitcoin

Bitcoin [BTC], after gaining by 1.59% final week, took a unique route over the past 24 hours. In reality, the aforementioned interval noticed the crypto lose nearly 3% of its worth.

That is value , particularly since AMBCrypto’s evaluation revealed that this decline might prolong itself as Hyperliquid whales took management of the derivatives market with a unfavourable internet BTC place. This raises an essential query although – Can institutional buyers regain floor and reverse the downturn?

Hyperliquid whales wager on a significant drop

In line with Coinglass, there was a surge in by-product positions on Hyperliquid – A platform that displays massive merchants’ positions – with figures for a similar climbing to $1.62 billion.

Curiously, quick positions appeared to account for 54.15% of those open positions, value $876 million. Usually, when market information reveals exercise skewed in favor of the bears, it’d trace at an absence of curiosity from high market members. This might doubtlessly result in a significant market decline on the charts.

Supply: Coinglass

Additional information revealed that merchants who positioned opposing bets—lengthy trades—are at a loss now. On the time of writing, lengthy revenue and loss (PnL) was down by $45.5 million, whereas quick merchants gained $125.75 million inside this era.

To place it merely, this steered that promoting has been extra worthwhile – One thing which will have influenced Bitcoin’s decline within the final 24 hours. AMBCrypto additionally discovered that institutional gamers are actively shopping for, seemingly for the long run.

Institutional buyers preserve accumulating

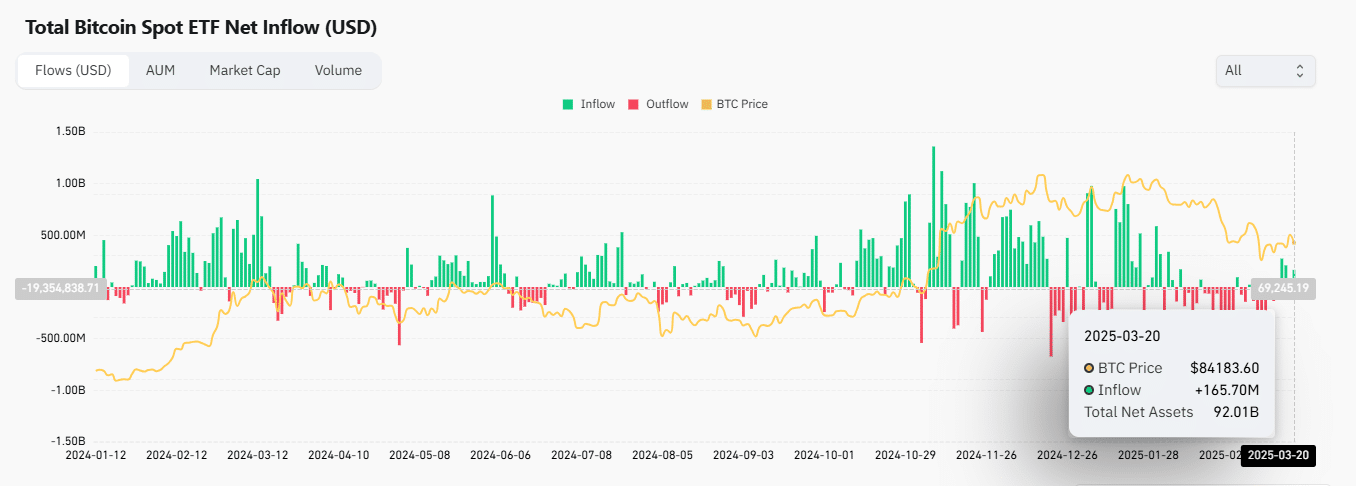

Whereas whales on Hyperliquid are predominantly promoting, institutional buyers have been actively buying Bitcoin. This may be evidenced by the netflows monitoring inflows and outflows.

In line with the identical, buyers bought a complete of $165.7 million value of BTC over the past 24 hours. Such a big quantity is an indication of excessive degree of curiosity in Bitcoin.

Supply: Coinglass

The Fund Market Premium, one other key metric evaluating Bitcoin costs on institutional funding platforms to the broader spot market, confirmed shopping for exercise from these platforms. On the time of writing, the metric sat above the impartial degree of 0.

AMBCrypto additionally discovered that this institutional shopping for sentiment gave the impression to be according to long-term holders’ choices to build up. The motion of their property prior to now seven days has notably declined, with a Binary CDD (Coin Days Destroyed) studying of 0.285.

Right here, Binary CDD tracks long-term holders’ exercise based mostly on a scale from 1 to 0. The nearer it’s to 0, like within the current case, the extra shopping for and holding actions are happening. It is a signal that these buyers are regaining a bullish outlook throughout the market.

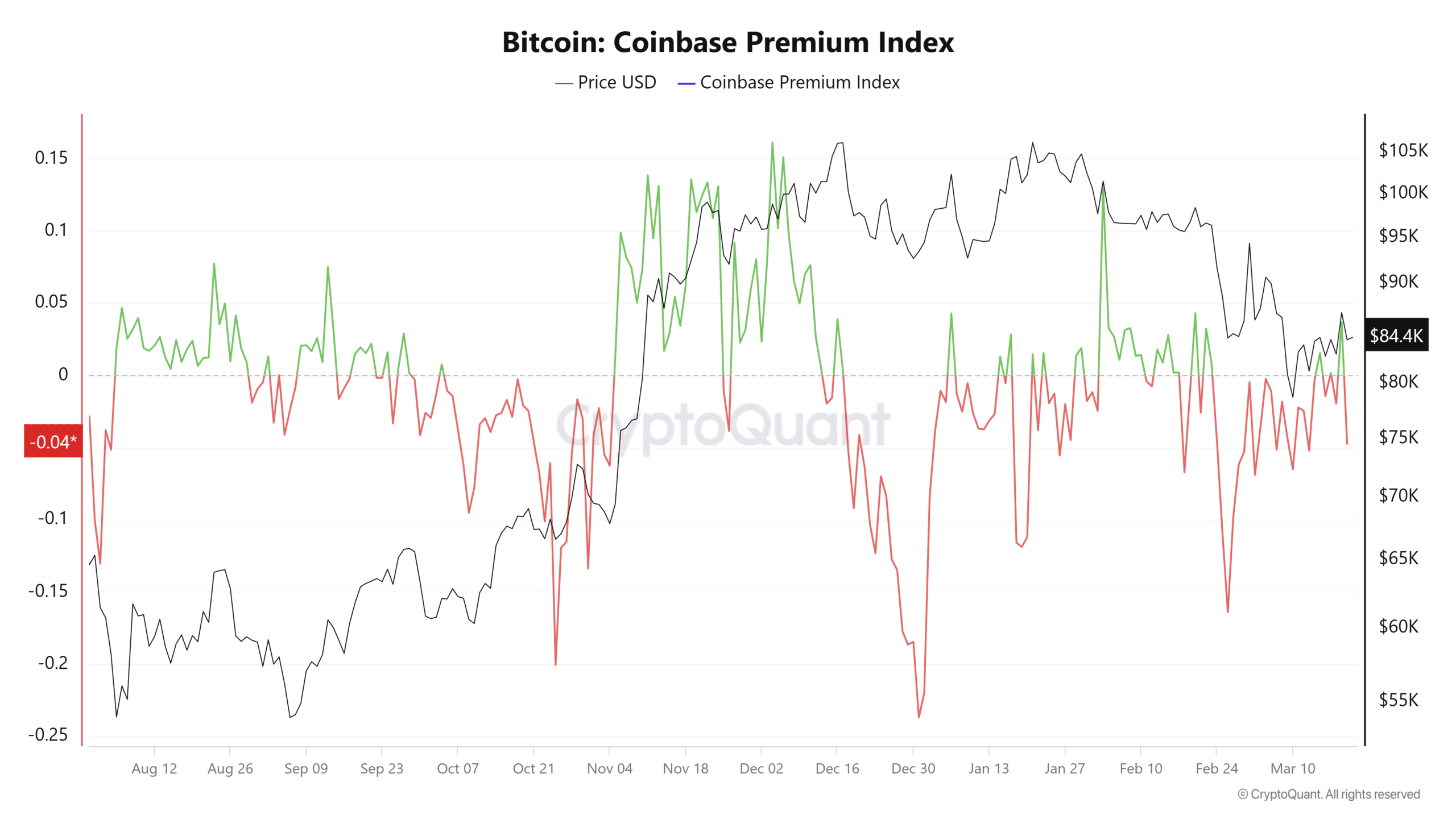

U.S buyers are promoting

Lastly, American buyers are following the identical path as Hyperliquid whales, at the moment promoting, as mirrored by the Coinbase premium dropping to -0.04. When this premium enters unfavourable territory, it alludes to vital promoting stress.

Supply: CryptoQuant

Usually, U.S buyers affect Bitcoin’s long-term motion, which means that if their promoting stress continues to climb, Bitcoin might fall additional. Nonetheless, if promoting eases, Bitcoin might rebound according to the institutional buyers’ bullish wave.

General, a key shift in both path—bullish or bearish—will lend us extra readability on Bitcoin’s subsequent few weeks and months.