Picture supply: Getty Photographs

Incomes a second earnings doesn’t all the time imply sitting up till midnight engaged on a facet hustle. Certain, placing within the effort and time is one option to earn additional money. However one other means is by saving and investing.

With little effort, most individuals may save £7 of spare change every day. It wouldn’t be tough — however it might add as much as an honest £200 a month.

Placing that cash to work may go a great distance. However the place to place it? A financial savings account is safe however barely beats inflation and few index-tracking funds return over 5%. What a couple of rigorously picked portfolio of high-yield dividend shares?

Now there’s an fascinating choice.

Purpose for a yield of seven%

The common yield on the FTSE is round 3.6%. That is introduced down by many shares that pay lower than 1%. However many pay 7%, or above. The highest payers change ceaselessly however some appear to all the time be close to the highest 10. These are the shares to intention for.

However to take care of a yield of seven% requires cautious planning. The portfolio will want a mixture of dependable shares with yields which might be prone to stay between 6% and eight% for the long run. That is unattainable to ensure however there are methods to enhance the probabilities.

Checking a inventory’s observe report

Take Aviva for instance. It has a 7% yield at the moment however look again 10 years. The yield is in all places, spending a lot of the previous decade under 5%. Taylor Wimpey additionally appears to be like good with a 6.3% yield however earlier than 2022, it was principally under 5%. Phoenix Group appears to be like strong with a yield above 6% since 2011, often going as excessive as 9%. However wait a second – the share value is down 24% in 5 years. That’s much less promising.

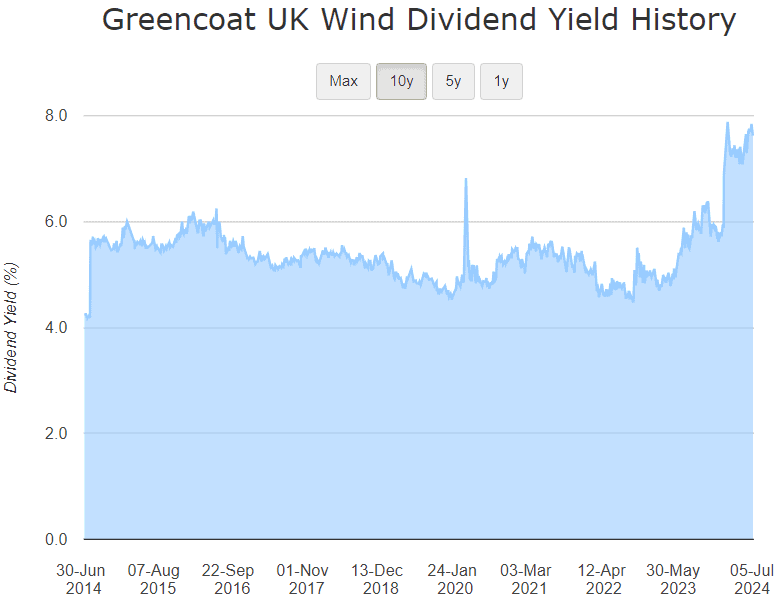

What concerning the lesser-known FTSE 250 actual property funding belief (REIT) Greencoat UK Wind (LSE: UKW)? It at present sports activities a tasty 7.6% yield and it’s held strong above 5% for the previous decade so may very well be one to contemplate.

Please be aware that tax therapy is determined by the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for info functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation.

It has a wholesome steadiness sheet with an appropriate debt degree and respectable money flows. Admittedly, the share value hasn’t carried out properly lately however is up 30% since July 2014. If the worth and yield proceed on this style, it might make a very good addition to a 7% dividend portfolio.

Dangers

The renewables vitality sector is predicted to develop significantly over the following decade and I, for one, am obsessed with it. That stated, it’s not with out threat. UK Wind’s earnings depend on promoting wind energy to the native grid, the worth of which is about by the regulator Ofgem. This limits the management it has over its personal success.

Wind energy will be costly and unreliable, whereas oil and fuel are extra predictable. In a troublesome economic system, even essentially the most eco-friendly customers could also be delay by rising prices. If sentiment shifts towards renewables it may damage the UK Wind share value.

These dangers will be offset by together with a mixture of high-yield dividend shares from totally different industries. A month-to-month funding of £200 right into a 7% yielding portfolio may develop to £157,000 in 20 years, paying annual dividends of £12,000 – or £1,000 a month.