Picture supply: Getty Pictures

As a long-term investor, it’s unsurprising that I see a Shares and Shares ISA as a long-term funding car.

Shopping for into nice firms at a pretty value then letting them exhibit their value over time might hopefully assist me enhance my very own value too.

Right here is how I might do this.

Profiting from my ISA allowance

Even when I didn’t have any cash in my ISA, my first transfer can be to place some in to speculate. In actual fact, I might attempt to benefit from my annual allowance.

Doing that is dependent upon one’s private monetary circumstances, but when I might put in £20K I might.

Please notice that tax remedy is dependent upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Constructing long-term wealth

I might then make investments that over a diversified group of firms I hoped might ship robust development over time. That would come from share value acquire, dividends or a mixture of each.

If I might compound my ISA’s worth at a 5% charge yearly, after 15 years it ought to be value round £42,000.

Fifteen years could sound like some time to attend, however I can simply think about being glad 15 years from now for the monetary strikes I make immediately.

Choosing the proper shares

Is a 5% compound annual development charge possible?

I believe it’s, however would need to put the chances in my favour by ruthlessly specializing in nice firms with enticing share costs. For example of the kind of low cost share I might fortunately purchase this August if I had spare money to speculate, contemplate Diageo (LSE: DGE).

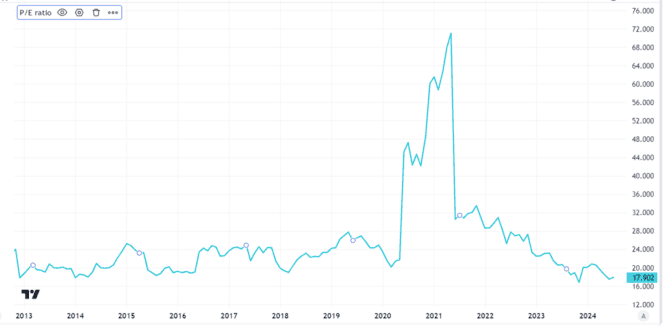

The FTSE 100 drinks large’s price-to-earnings (P/E) ratio this 12 months has hit a decade low. At a P/E of 17, it nonetheless could not appear low cost. However I believe that’s a pretty value for an organization like Diageo.

Created utilizing TradingView

The marketplace for alcoholic drinks is powerful and demand will doubtless stay excessive. Diageo has what Warren Buffett (a former investor within the firm when it was a lot smaller than immediately) calls a moat. Its iconic premium manufacturers and distinctive manufacturing amenities imply it could possibly cost a value that enables for a excessive revenue margin.

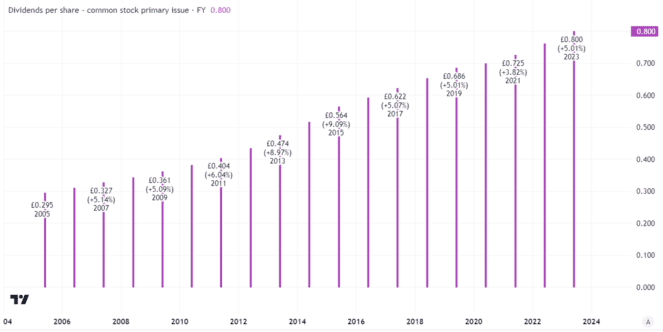

That in flip can fund a dividend. Diageo is a Dividend Aristocrat, having grown its payout per share annually for over three a long time.

Created utilizing TradingView

Aiming for long-term wealth creation

The present yield is 3.6%. I anticipate Diageo to continue to grow its well-covered dividend yearly, though that’s by no means assured. Spending on premium items has been falling markedly in massive markets. In its preliminary outcomes immediately (30 July), Diageo reported gross sales volumes 5% decrease than a 12 months in the past.

Even when the dividend does continue to grow although, might Diageo assist me hit a 5% goal? In any case, its share value has fallen 34% prior to now 5 years.

In actual fact, that partly explains why I believe the share might do very nicely in coming years – and lately purchased some myself.

I imagine the present value overemphasises short-term enterprise challenges. However over the long run, I believe it seems to be low cost for a share in such an excellent enterprise. With massive long-term development alternatives in creating markets and the prospect to trip the following financial upturn, I believe Diageo’s share value might transfer nearer to its historic P/E ratio, shifting upwards.

If I’m proper, I anticipate the share value might develop handily over the approaching 15 years.