- EigenLayer’s newest partnership has introduced the liquid BTC restaking function.

- Its TVL was over $10 billion, at press time.

EigenLayer, Ethereum’s [ETH] largest restaking platform, just lately introduced its newest Bitcoin[BTC] restaking choices.

The choice gives yield alternatives for wrapped Bitcoin (WBTC) holders.

The platform introduced new options, together with yield payouts from node operator P2P.org. Additionally, it introduced staking choices for uniBTC, a wrapped BTC variant.

These developments align with a broader development of accelerating demand for Bitcoin yield-generating options as BTC holders search diversification by means of staking.

Demand for Bitcoin restaking on EigenLayer rises

On the 4th of November, EigenLayer introduced that ARPA Community would quickly start rewarding uniBTC depositors on its platform.

The event permits BTC holders to earn yields whereas contributing to Ethereum’s decentralized ecosystem.

This transfer represents a part of a broader development, as over 15% of all WBTC is now actively staked throughout platforms.

This development highlights the rising need for Bitcoin staking choices as DeFi continues to develop, with BTC holders wanting to leverage decentralized protocols for asset maximization.

Supply: IntoTheBlock

Current charts underscore this shift, with a marked enhance in restaked BTC transaction volumes since early August.

The rising weekly transaction figures for WBTC and different wrapped Bitcoin property mirror the rising enchantment of yield-generating alternatives for BTC. This identified that staking and yield options are more and more considered as viable choices for Bitcoin holders.

EigenLayer’s TVL maintains respectable momentum

EigenLayer’s Whole Worth Locked (TVL) has proven regular development, as reported by DefiLlama.

This climb mirrors the heightened adoption of Bitcoin staking options, enabling BTC holders to have interaction in staking actions with out liquidating their property.

Supply: DefiLlama

EigenLayer bridges a niche for these seeking to earn returns on Bitcoin holdings. This technique helps the platform’s upward trajectory in complete property locked.

Value evaluation: EIGEN token outlook

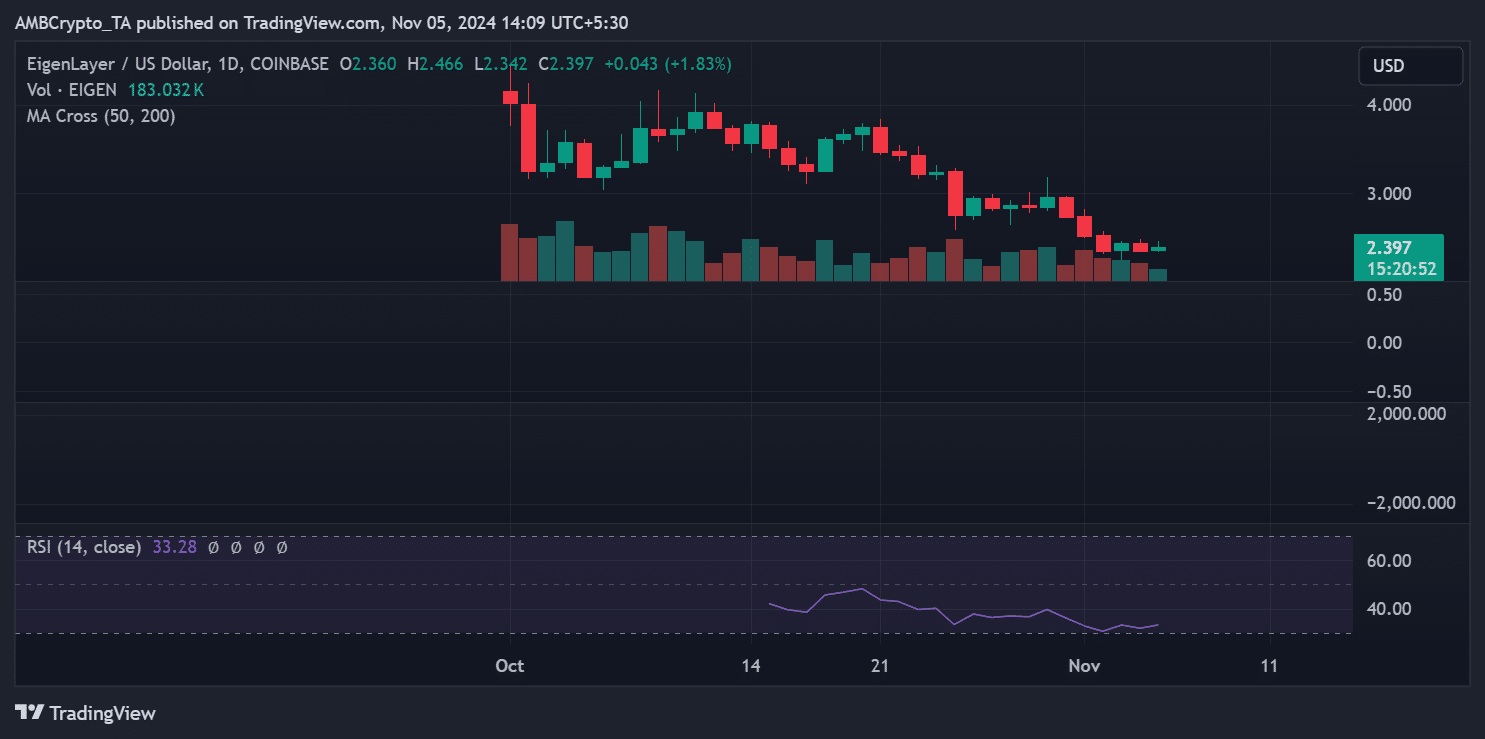

Relating to EigenLayer’s native token, EIGEN, current exercise has indicated worth consolidation.

At press time, the coin was buying and selling round $2.39, EIGEN’s worth actions mirror each market sentiment and platform-specific development.

On the time of writing, the Relative Power Index (RSI) for EIGEN was close to 33, suggesting that it’s near oversold ranges.

This might probably current a shopping for alternative if the downward stress stabilizes.

Supply: TradingView

The buying and selling quantity for EIGEN has seen modest fluctuations however stays secure total.

If EigenLayer’s expanded Bitcoin restaking choices appeal to extra BTC holders, EIGEN’s worth might expertise upward stress.

This might probably surpass its resistance degree close to the $2.50 mark.

Is your portfolio inexperienced? Try the EigenLayer Revenue Calculator

The platform’s current updates supply Bitcoin holders new methods to discover yield-generating choices with out parting with their holdings. With potential additional adoption, the approaching months might decide if these enhancements will translate into sustained development for EIGEN.

This might solidify EigenLayer’s position as a key participant in Bitcoin staking throughout the DeFi ecosystem.