- IBIT noticed report quantity whereas BTC’s value declined.

- BTC, nevertheless, noticed a report quantity of over $100 billion.

The cryptocurrency market, together with Bitcoin [BTC], has skilled a big downturn just lately, culminating in a pointy decline on fifth August.

Regardless of this widespread market pullback, there was an intriguing distinction within the exercise noticed with the Blackrock Bitcoin ETF, which recorded considered one of its highest day by day buying and selling volumes on the identical day.

Blackrock logs report quantity

The latest buying and selling information from Coinglass highlights a exceptional surge in quantity exercise.

The BlackRock Bitcoin ETF (IBIT) recorded the very best quantity on fifth August. Evaluation confirmed that this ETF’s buying and selling quantity soared all through the day.

It started with a formidable $1.5 billion within the early buying and selling hours and closed the day at almost $3 billion. This degree of exercise was considerably increased than some other ETF in the identical class for the day.

Supply: Coinglass

This surge in buying and selling quantity throughout a broader market downturn is especially notable. It means that whereas the overall cryptocurrency market was declining, many buyers actively engaged with the BlackRock Bitcoin ETF.

This might point out a spread of strategic behaviors amongst buyers. Some could have seen the downturn as a shopping for alternative, buying extra shares at a cheaper price in anticipation of future positive factors.

Conversely, others may need been promoting their holdings to attenuate losses amidst falling costs.

Furthermore, the distinctive quantity within the ETF may replicate a broader shift in investor sentiment or technique. Notably throughout heightened market volatility and uncertainty, buyers typically hunt down what they understand as safer or extra steady funding choices.

Bitcoin regains consciousness amidst BlackRock’s quantity

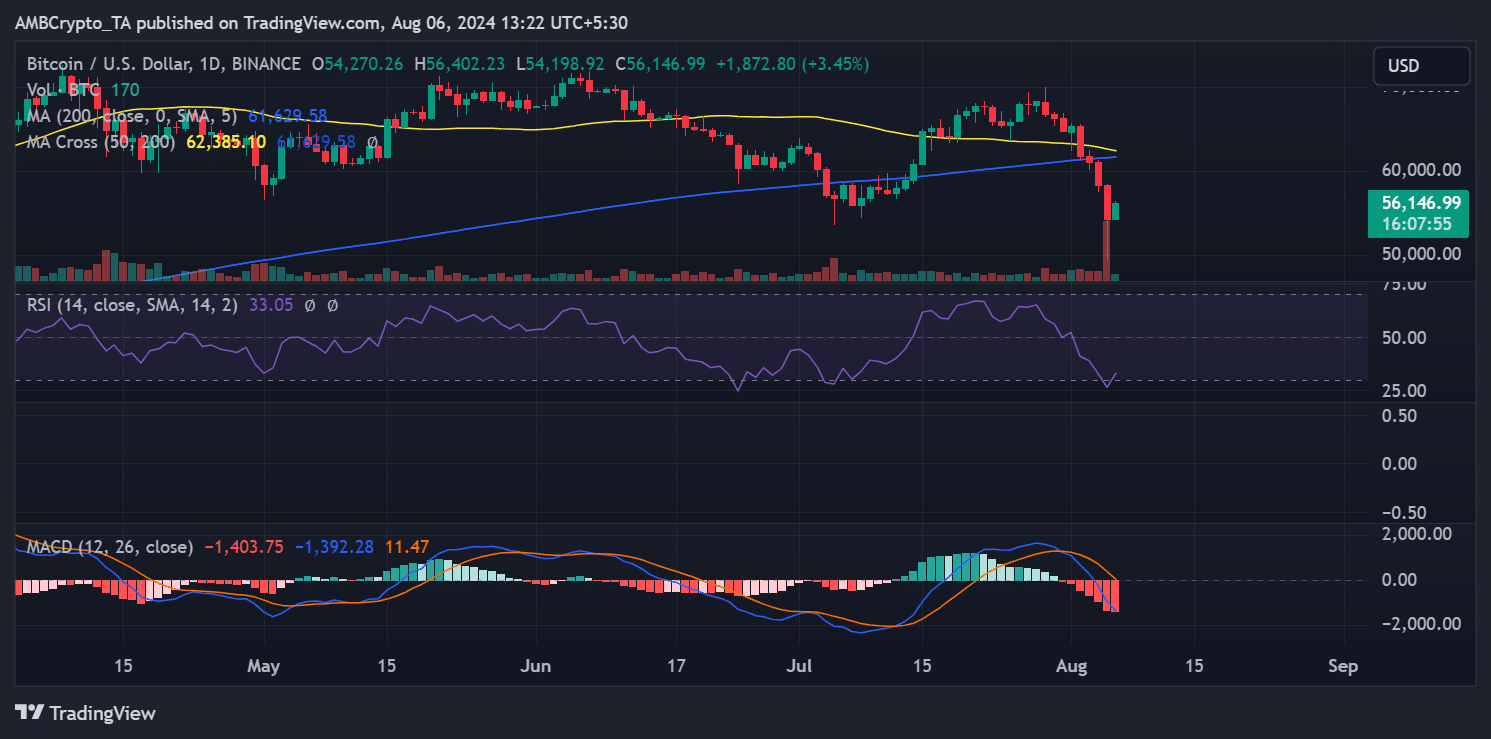

The latest evaluation of Bitcoin’s value actions highlighted a contrasting situation. Regardless of a spike in buying and selling volumes for the BlackRock Bitcoin ETF, BTC confronted vital value struggles.

In response to AMBCrypto’s evaluation on a day by day timeframe chart, BTC’s value skilled a pointy fall, falling to as little as $49,360.

Though it recovered considerably by the top of the session, it closed at roughly $54,274—down from a gap value above $58,000, marking an total decline of over 6%.

Supply: TradingView

This decline pushed Bitcoin’s Relative Power Index (RSI) additional into the oversold territory, crossing beneath the important threshold of 30.

At the moment, Bitcoin reveals indicators of a modest restoration, buying and selling at over $56,000 with an over 3% enhance. Correspondingly, its RSI has improved barely, rising simply above 30.

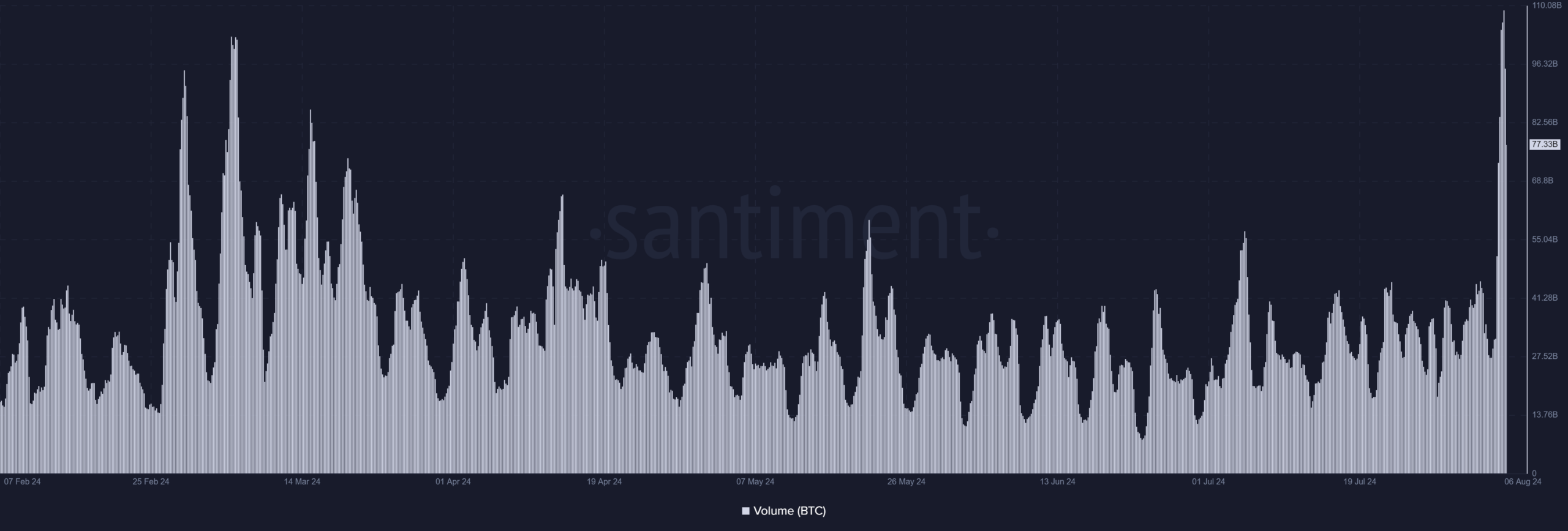

BTC sees a quantity spike of its personal

Evaluation of the Bitcoin quantity confirmed that it skilled a spike of its personal, identical to BlackRock. Knowledge from Santiment revealed a big surge, with volumes reaching over $104 billion on fifth August.

Supply: Santiment

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

This spike in buying and selling quantity is especially noteworthy because it marked the primary event in additional than 5 months that it surpassed the $100 billion threshold.

The final occasion of such excessive quantity was recorded on sixth March, when it briefly touched $102 billion.