- Drop in long-term holder lively gross sales meant sellers is perhaps exhausted

- Enhance within the largest whales’ holdings whereas costs plummeted could also be seen as an indication of confidence

Bitcoin [BTC] fell again quickly from the $69k-$70k resistance zone. The weekly timeframe developed a bearish construction, and the FOMC assembly slashed bullish hopes of a Fed fee lower in September.

On prime of this, the Sahm Rule appeared to substantiate financial weak point and opened up the potential for a recession. This despatched the markets right into a panic and BTC tumbled decrease.

The $60k area is a major assist zone, however there are not any ensures that the bulls would efficiently defend it. AMBCrypto regarded nearer at on-chain metrics to higher perceive the long-term holder sentiment.

Lengthy-term holder promote strain has fallen

Supply: Axel Adler on X

In a publish on X (previously Twitter) crypto-analyst Axel Adler noticed that long-term holder lively gross sales had diminished. In comparison with early June, the promoting strain from this band of holders was “minimal.”

The long-term provide additionally fell dramatically. This urged intense profit-taking exercise when BTC was buying and selling across the $68k-$70k ranges. It pointed to a scarcity of conviction of a breakout previous $70k.

Alternatively, this may also be optimistic information as a result of this meant the promoting strain is probably going exhausted.

Whale cohort’s habits is thrilling information

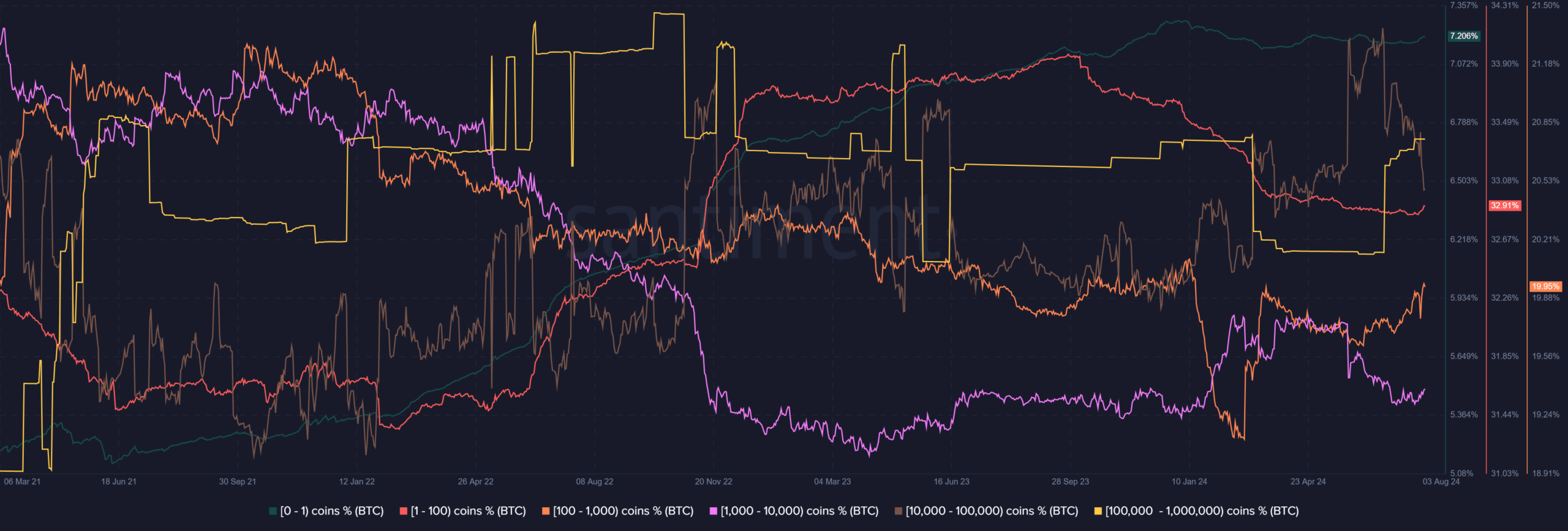

Supply: Santiment

The cohort of wallets with 100k-1M BTC of their wallets climbed greater as a proportion of the whole. The final time it jumped this quickly was in Could 2023, when Bitcoin started to poke its head above the $26k resistance.

Whereas this whale accumulation is encouraging, different whale cohorts have been promoting. The 1k-100k division noticed a pointy drop of their holdings over the previous two weeks, exhibiting promoting strain from whales.

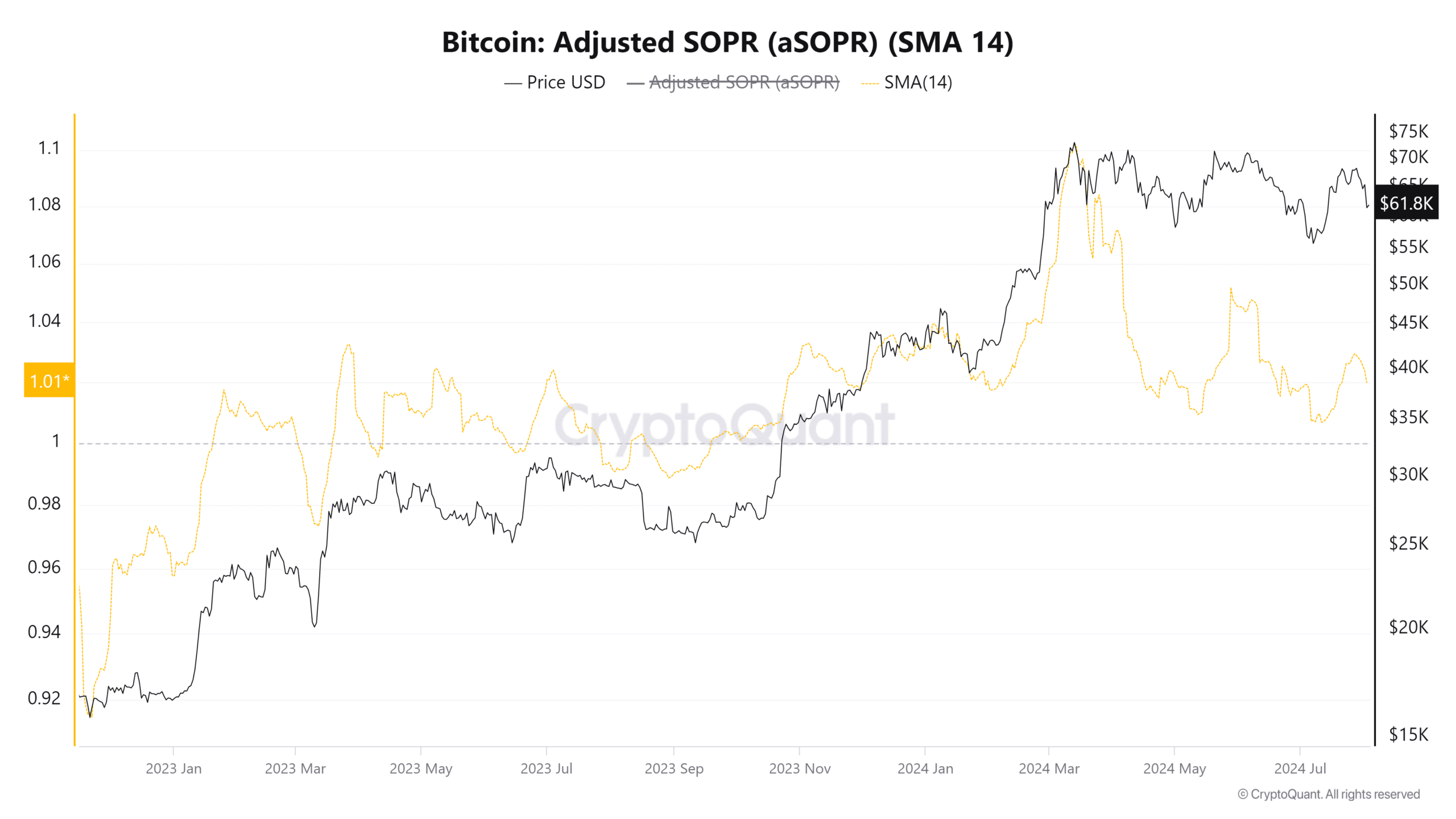

Supply: CryptoQuant

Proof for bearish sentiment over the previous few months was additionally seen within the adjusted SOPR. The worth was above 1 to indicate that on common, cash have been offered at a revenue.

Alas, the falling aSOPR pattern since March has been a bearish sign.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

General, the drop in LTH lively gross sales, mixed with accumulation from bigger whales, is encouraging. Regardless of these positives, nonetheless, Bitcoin would possibly battle to get better in August because of the bearish market-wide sentiment.