- Bitcoin reveals a slight restoration after a big drop, influencing correlated altcoins like Cardano.

- Analysts recommend monitoring the optimistic correlation between Bitcoin and altcoins for potential market shifts.

Bitcoin [BTC], after experiencing a pointy decline earlier this week because it dropped by greater than 10% inside simply two days, has proven a slight rebound over the previous 24 hours. Throughout this era, Bitcoin’s worth has elevated by 0.5%, approaching the $60,000 mark.

Regardless of this minor restoration, the asset stays down by 2.3% over the previous week, reflecting a market nonetheless in flux. This worth motion has sparked discussions amongst analysts, with explicit deal with the correlation between Bitcoin and varied altcoins.

Correlation between Bitcoin and altcoins

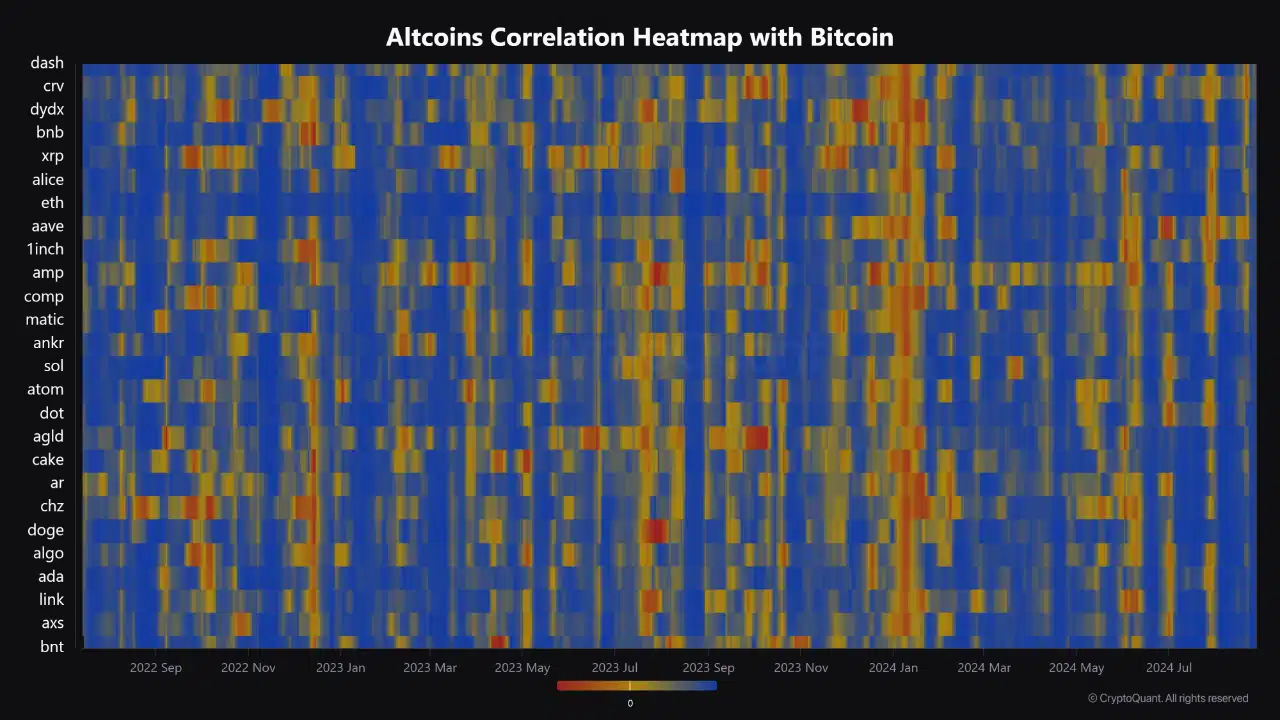

Amidst Bitcoin’s fluctuating efficiency, a report from CryptoQuant analyst Joao Wedson highlighted the numerous correlation between Bitcoin and altcoins.

In response to Wedson, the present optimistic correlation means that altcoins are intently following Bitcoin’s worth actions, indicating an alignment within the broader crypto market.

Supply: CryptoQuant

This habits displays investor confidence, because the synchronized motion suggests a stage of stability available in the market. Nonetheless, the report warns {that a} shift to a destructive correlation may function a crimson flag for Bitcoin and the market at massive.

Traditionally, a destructive correlation happens when altcoins considerably outperform Bitcoin, usually resulting in a subsequent drop in BTC’s worth.

This sample was evident in January, June, and July of 2024, the place altcoins outpaced Bitcoin, just for the market to expertise a big downturn shortly afterward.

At present, altcoins equivalent to Bancor (BNT), Axie Infinity (AXS), Chainlink (LINK), Algorand (ALGO), and Cardano (ADA) exhibit the best correlation with Bitcoin, that means their costs are transferring in tandem with BTC.

In distinction, altcoins like Sprint (DASH), Curve (CRV), dYdX (DYDX), Binance Coin (BNB), and MyNeighborAlice (ALICE) present decrease correlation ranges, indicating a extra impartial worth motion.

Supply: CryptoQuant

Regardless of these variations, the general optimistic correlation throughout altcoins suggests a market transferring in unison with Bitcoin, signaling potential short-term stability. Nonetheless, steady monitoring is important to detect any deviations that may sign elevated danger.

Cardano: A case examine in correlation and market developments

Taking Cardano [ADA] as a case examine, we observe that ADA’s worth has mirrored Bitcoin’s trajectory, experiencing a big drop earlier this week to as little as $0.34.

Nonetheless, up to now 24 hours, ADA has proven indicators of restoration, with its worth rising by 2.8%. This restoration aligns with the broader market’s development of slight rebounds following preliminary sharp declines.

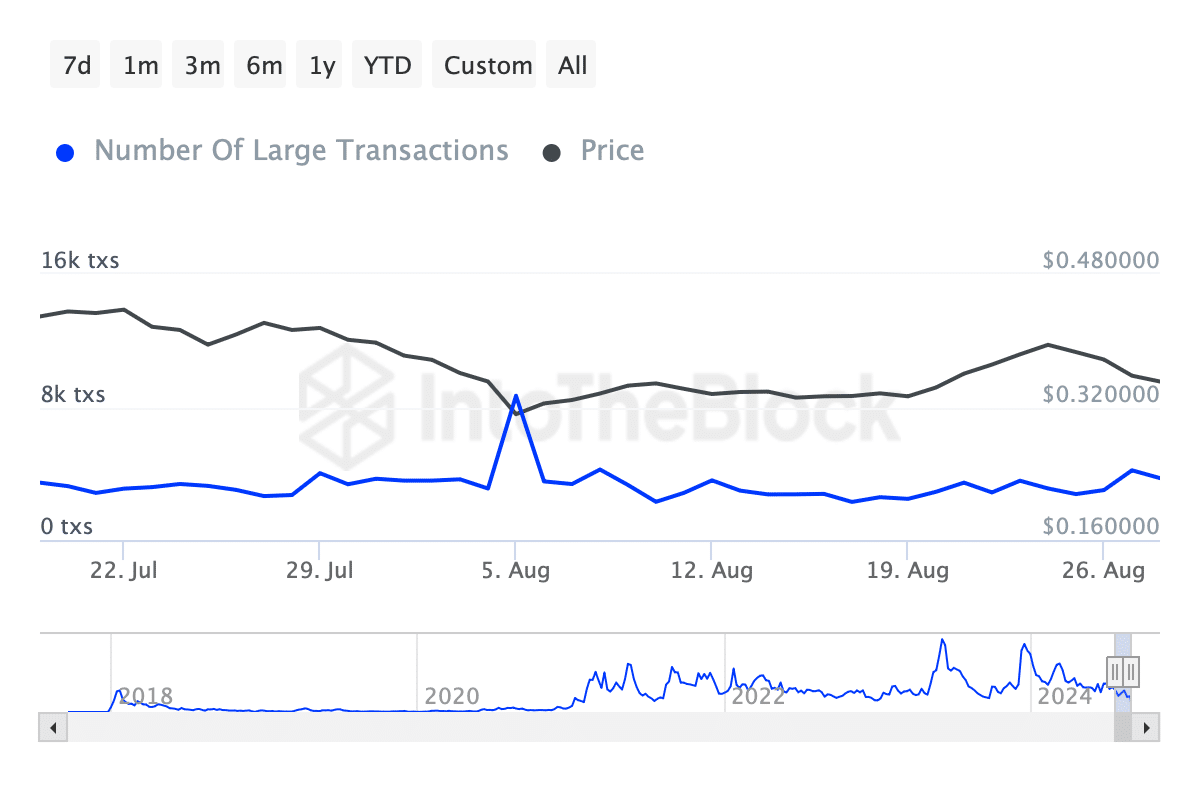

Apparently, regardless of ADA’s worth drop, its fundamentals point out rising whale curiosity.

Knowledge from IntoTheBlock reveals a surge in massive transactions—these better than $100k—reaching almost 4,000 as of at the moment, a pointy enhance from under 3k transactions recorded final week.

This implies that bigger buyers are making the most of the decrease costs to build up ADA.

Supply: IntoTheBlock

Learn Cardano’s [ADA] Worth Prediction 2024-25

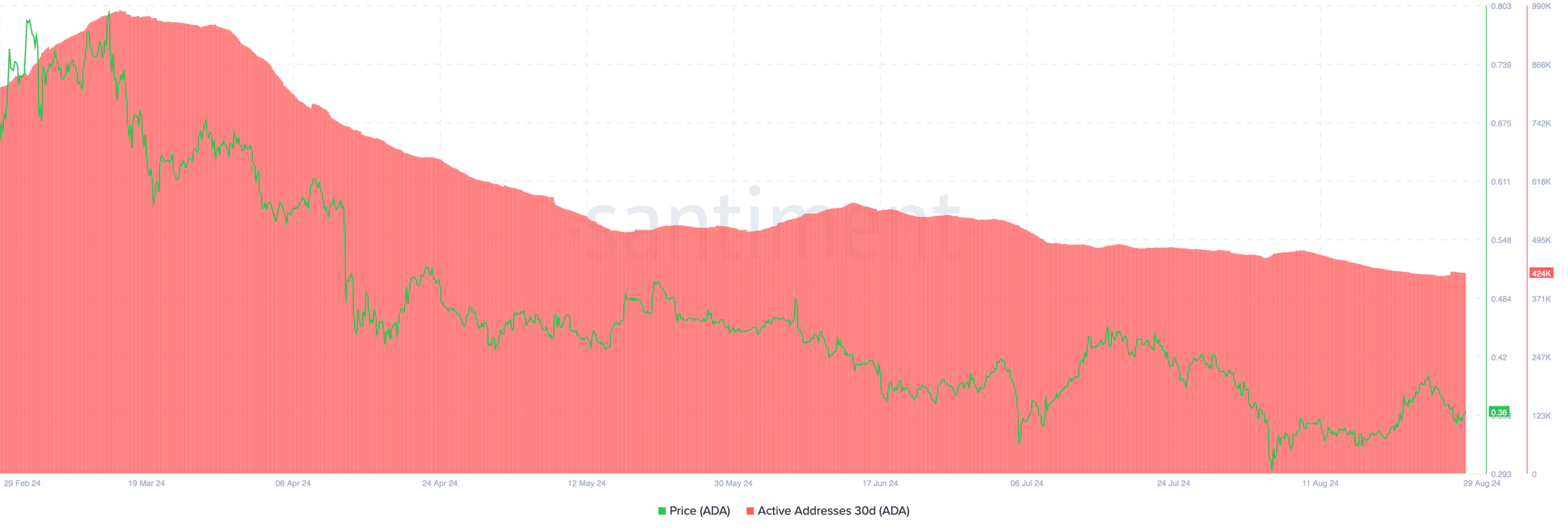

Alternatively, information from Santiment reveals a decline in ADA’s variety of lively addresses over the previous month, dropping to under 500k—a big lower from almost 1 million addresses in March.

This decline in lively addresses may replicate lowered retail investor exercise, at the same time as whales proceed to have interaction with the asset.

Supply: Santiment