- Some holders of the coin have been hit by one of many worst losses since 2022

- Lengthy-term holders stay worthwhile than short-term counterparts, indicating that BTC continues to be in a bull section

In accordance with a current report by Glassnode, Bitcoin’s [BTC] crash has been instrumental in driving one of many highest losses for the reason that bear market of 2022. Actually, over the past 30 days, BTC’s worth has declined by 14.45%.

Within the report, the on-chain analytics platform targeted on Brief Time period Holders (STH). These holders check with those that have held Bitcoin for lower than 155 days. Particularly, loads of STHs have fallen into losses for about 90 days resulting from Bitcoin’s crash.

Are weak fingers in hassle?

When in comparison with the final three years, this has been one of many largest monetary losses holders have had. Because of this, Glassnode noticed,

“If we make a comparison with the market conditions seen in Q2-Q3 2021, a much more significant Short-Term Holders experienced a much more significant duration of 70 consecutive days in acute financial stress. That period of time was severe enough to break investor sentiment, and gave way to the destructive 2022 bear market.”

Supply: Glassnode

Nonetheless, this doesn’t indicate that the Bitcoin’s crash has ultimately plunged the coin right into a bear section.

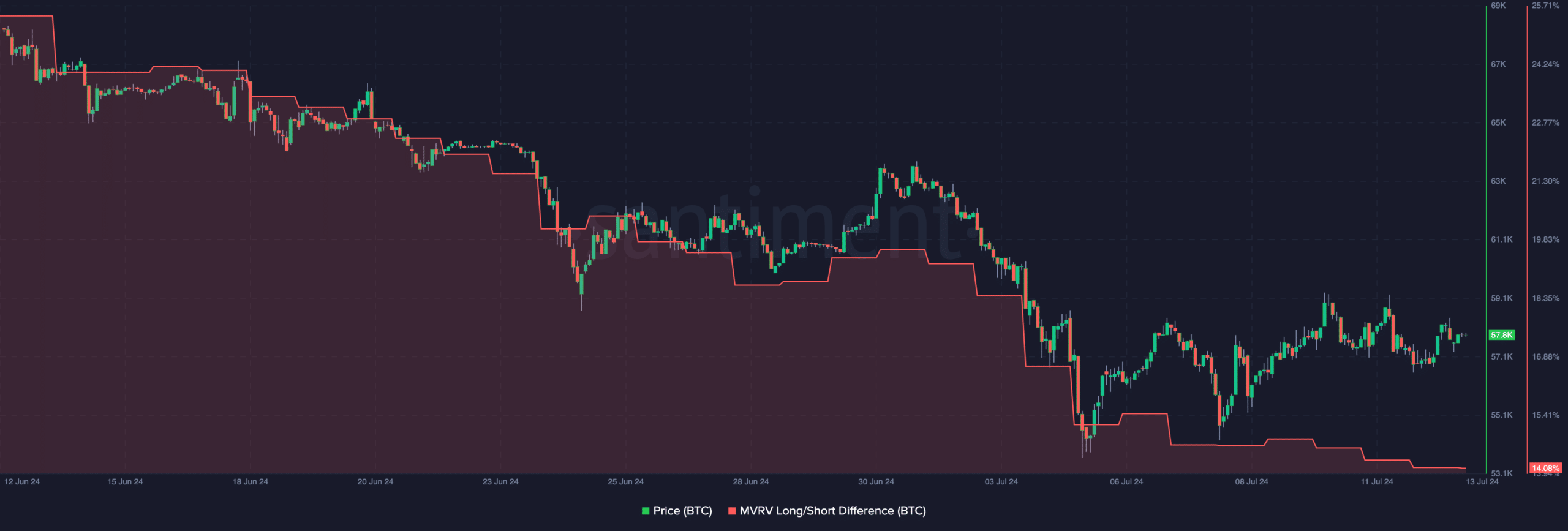

Proof of this sentiment may be highlighted by the MVRV Lengthy/Brief Distinction. Right here, MVRV stands for Market Worth to Realized Worth. This metric measures the profitability between long-term holders and short-term holders.

Bulls careworn by Bitcoin’s shenanigans

Detrimental values point out that short-term holders will understand larger income that long-term holders. If that is so, Bitcoin has fallen right into a bear market.

Nonetheless, if the distinction is constructive, it signifies that long-term holders will understand larger income than short-term holders in the event that they promote.

At press time, the MVRV Lengthy/Brief Distinction was 14.08%.

Regardless that it was low in comparison with earlier months, it doesn’t imply that Bitcoin’s crash has pressured the coin right into a bear section. As an alternative, the coin appears to be present process an unavoidable correction within the bull market.

Supply: Santiment

Moreover, hammering on the losses incurred, the report acknowledged,

“Zooming into Short-Term Holder losses specifically, we can see a total realized loss of ~ $595m was locked in by this cohort this week. This is the largest loss taking event since the 2022 cycle low.”

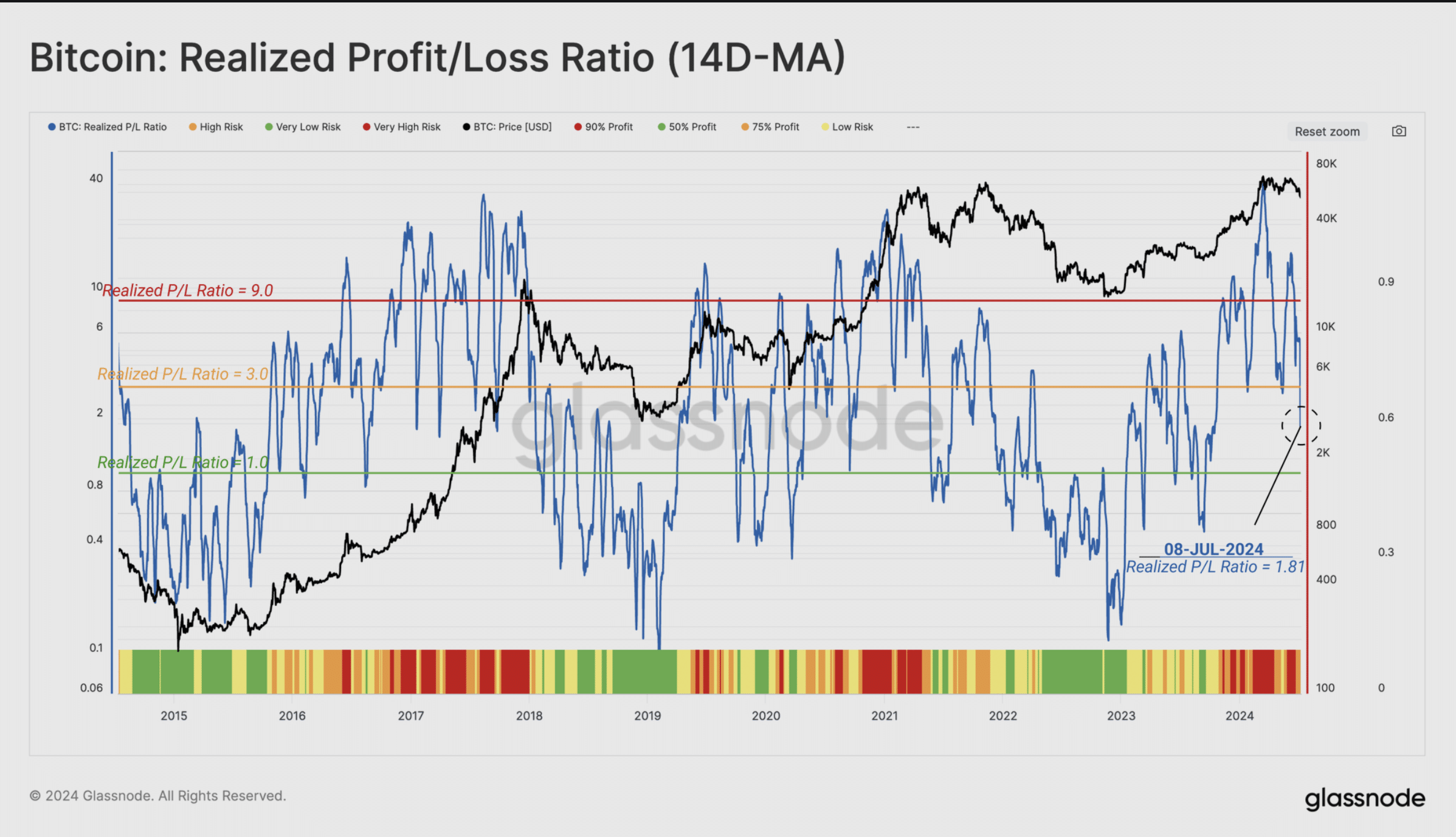

Moreover, whereas admitting that bulls had been underneath stress, the Realized Revenue/Loss Ratio revealed that profitability has been nearly non-existent. Sometimes, if the ratio is between 0.50 to 0.75, it signifies that Bitcoin is in a correction section of the bull market.

Alas, as of 8 July, the metric had fallen to 1.81, implying that buyers have been largely skeptical in regards to the crypto’s potential. If unchecked or worth fails to bounce, this might drive BTC right into a bear section.

Supply: Glassnode

At press time, Bitcoin was valued at $57,848, following a really insignificant hike over the past 24 hours.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

If the worth information a much bigger hike, Bitcoin’s crash may quickly change into a factor of the previous. If it doesn’t, nevertheless, BTC holders will danger getting weaker.