- At press time, Bitcoin was buying and selling above $60,000 regardless of declines.

- Nonetheless, the BTC value pattern remained bearish.

Over the previous few weeks, Bitcoin [BTC] has skilled vital volatility, characterised by speedy value actions.

Regardless of this turbulence, there have been encouraging indicators out there dynamics, significantly relating to buying and selling exercise and new addresses.

Just lately, this heightened exercise coincided with a value rebound, which helped BTC surge again to the $60,000 vary.

Bitcoin units document volumes

Throughout a current downturn in Bitcoin’s value, which noticed it drop to round $50,000, there was a big surge in market actions.

Information confirmed that each spinoff and spot buying and selling volumes reached near-historic ranges.

In response to knowledge from CryptoQuant, on the day of the value drop, the futures buying and selling quantity soared to an all-time excessive (ATH) of $154 billion.

This spike in Futures quantity indicated a heightened stage of buying and selling exercise, probably pushed by merchants capitalizing on the volatility to position giant bets on the value course of Bitcoin.

Supply: CryptoQuant

Concurrently, the spot buying and selling quantity noticed an enormous improve, reaching $83 billion. This determine represented the second-highest quantity in Bitcoin’s buying and selling historical past.

Such a big quantity stage throughout a pointy value decline usually suggests a mixture of sell-off and shopping for strain.

Present holders are both making an attempt to chop losses, or new or current traders want to accumulate at decrease costs.

Bitcoin addresses see a slight improve

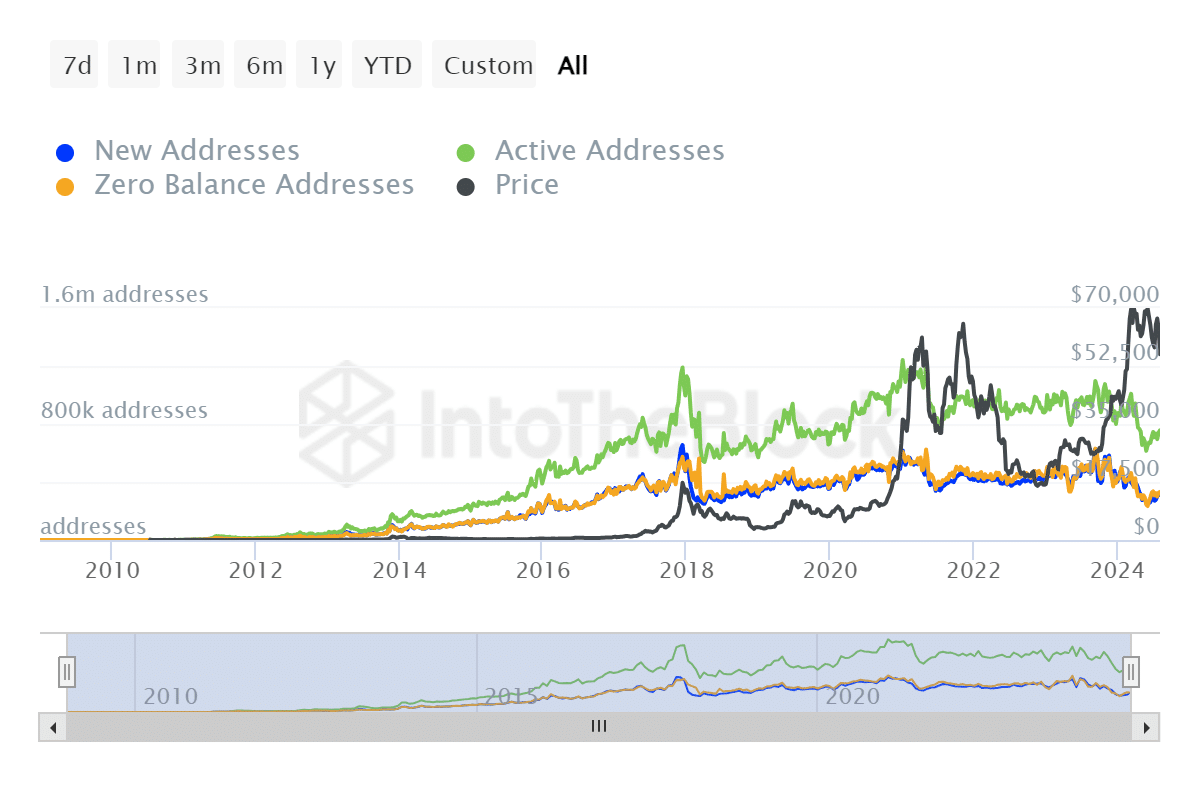

Current knowledge from IntoTheBlock highlighted a notable shift in Bitcoin exercise, particularly relating to new addresses.

Though the pattern for brand spanking new day by day addresses has been on a decline since November 2023, there was a current uptick.

This improve within the formation of latest addresses over the previous few weeks recommended a renewed curiosity from retail traders.

Supply: IntoTheBlock

The uptrend in new addresses is a constructive signal, usually interpreted as a bullish indicator, because it factors to a rising variety of new contributors coming into the market, significantly from the retail sector.

This modification may sign a broader engagement with Bitcoin, probably driving additional market exercise and funding.

BTC sees a pleasant rebound

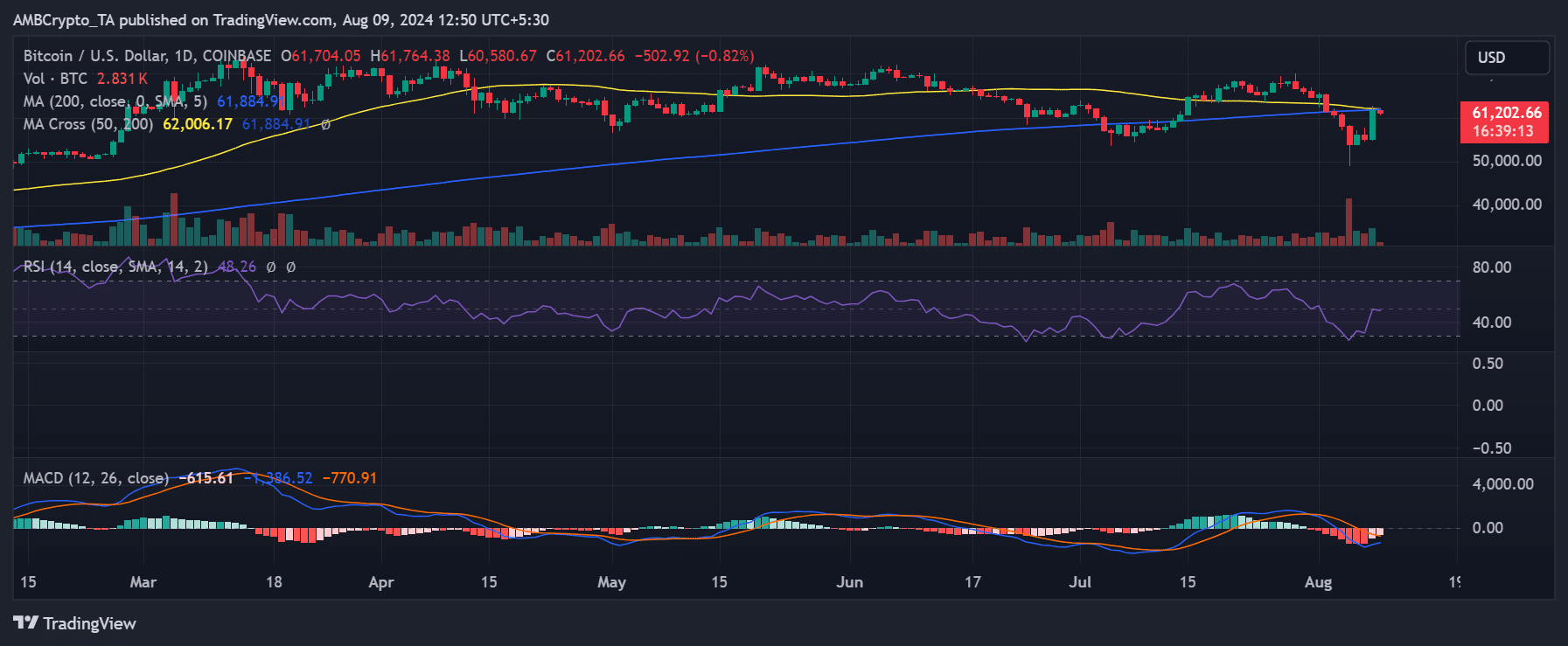

AMBCrypto’s evaluation of Bitcoin on a day by day timeframe has captured a big rebound over the past buying and selling session.

The king coin skilled an 11.89% spike, which boosted its value from round $55,000 to a peak of over $62,000. The session finally closed with Bitcoin at $61,705 at press time.

Supply: Buying and selling View

Regardless of this notable improve, the surge was not robust sufficient to shift Bitcoin absolutely right into a bull pattern. The Relative Power Index (RSI) remained beneath the impartial 50 mark, indicating that it was nonetheless in a bearish section.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This implies that whereas the value spike represents a big constructive motion, it has not but been adequate to change the broader market sentiment definitively.

As of this writing, the value has seen a slight decline of over 1%, adjusting to roughly $60,900.